Get the free Self-Direct Your IRA. Invest In What You ... - Directed IRA

Show details

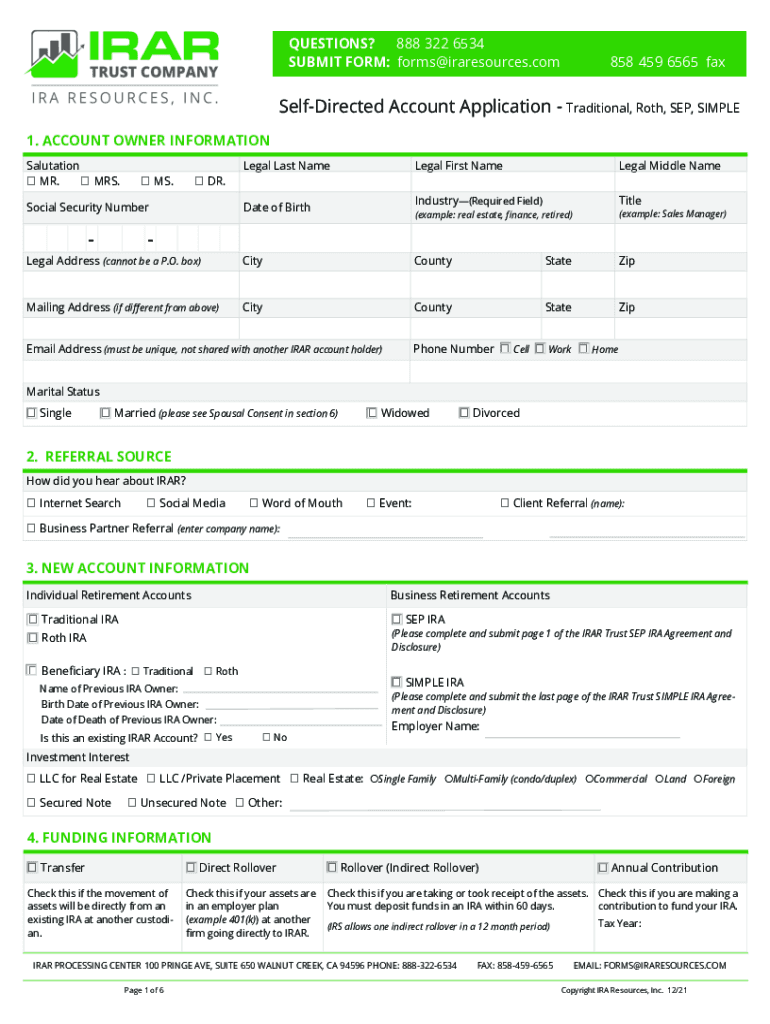

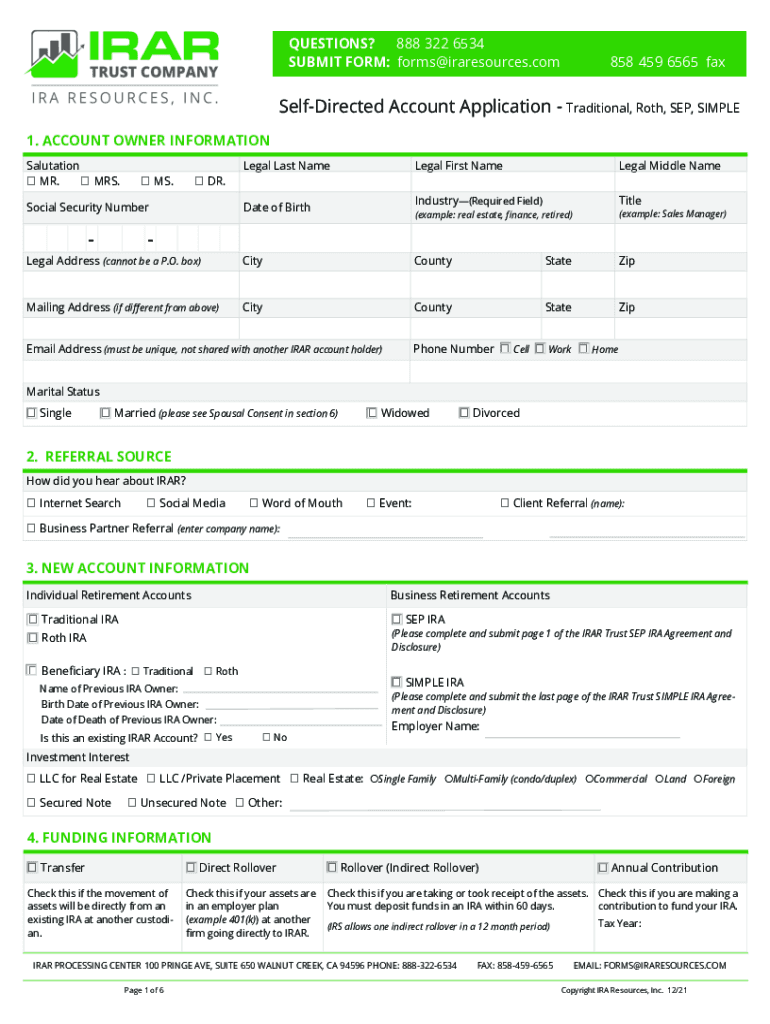

(888) 3226534 www.IRAResources.comNew Account Application Instructions Traditional IRA Form UseInstructionsComplete this form to establish a self-directed new account. Complete the Account Application,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self-direct your ira invest

Edit your self-direct your ira invest form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self-direct your ira invest form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit self-direct your ira invest online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit self-direct your ira invest. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self-direct your ira invest

How to fill out self-direct your ira invest

01

Determine if you are eligible for a self-directed IRA. Certain qualifications must be met, such as having earned income or having a traditional IRA or former employer's retirement plan.

02

Choose a self-directed IRA custodian. Research and select a reputable custodian that specializes in self-directed IRAs. They will help you set up and manage your account according to IRS rules.

03

Fund your self-directed IRA. Transfer funds from your existing retirement account or make contributions directly to your self-directed IRA. Follow the custodian's instructions for funding.

04

Educate yourself on investment options. With a self-directed IRA, you have the freedom to invest in a wide range of assets, such as real estate, private loans, precious metals, and more. Learn about different investment opportunities and assess the risks involved.

05

Conduct thorough due diligence. Before making any investment, thoroughly research and evaluate the investment opportunity. Consider factors like potential returns, liquidity, and the credibility of the investment provider.

06

Make investment decisions. Once you have sufficient knowledge and have evaluated different options, make informed investment choices that align with your financial goals and risk tolerance.

07

Monitor and manage your investments. Regularly review the performance of your investments and adjust your portfolio as needed. Stay updated with tax regulations and reporting requirements for self-directed IRAs.

08

Consult professionals if needed. Self-directed IRAs can have complex rules and require specialized knowledge. Consider seeking guidance from tax advisors, financial planners, or attorneys for assistance.

Who needs self-direct your ira invest?

01

Individuals who want more control over their investment decisions.

02

People who have knowledge or interest in alternative investments beyond traditional stocks and bonds.

03

Those who believe they can achieve better returns by investing in non-traditional assets.

04

Investors who are comfortable conducting research and due diligence on investment opportunities.

05

Individuals who are willing to take on the risks associated with self-directed IRA investments.

06

Those with a retirement account or retirement savings looking to diversify their portfolio.

07

People who want the flexibility to invest in assets like real estate, private equity, cryptocurrency, or precious metals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit self-direct your ira invest online?

With pdfFiller, it's easy to make changes. Open your self-direct your ira invest in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out self-direct your ira invest using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign self-direct your ira invest and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit self-direct your ira invest on an Android device?

You can edit, sign, and distribute self-direct your ira invest on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is self-direct your ira invest?

Self-direct your IRA invest allows individuals to make investment decisions on behalf of their IRA, instead of leaving it up to a broker or financial institution.

Who is required to file self-direct your ira invest?

Individuals who have a self-directed IRA account are required to file self-direct your IRA invest.

How to fill out self-direct your ira invest?

To fill out self-direct your IRA invest, individuals need to provide information about the investments made through their self-directed IRA account.

What is the purpose of self-direct your ira invest?

The purpose of self-direct your IRA invest is to give individuals more control over their investment decisions and potentially earn higher returns.

What information must be reported on self-direct your ira invest?

Information such as investment transactions, income generated, expenses incurred, and any changes to the account holdings must be reported on self-direct your IRA invest.

Fill out your self-direct your ira invest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self-Direct Your Ira Invest is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.