Get the free Syndication Back Leverage Loan Term Sheet Form .docx

Show details

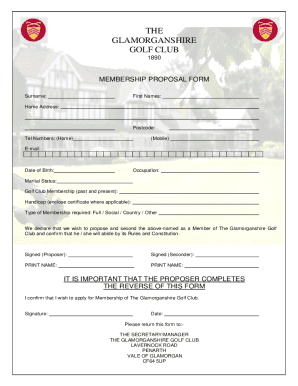

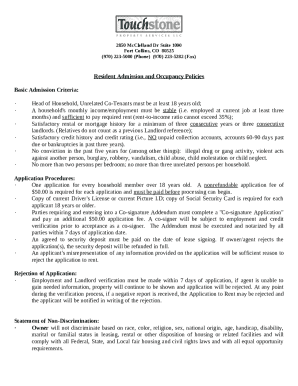

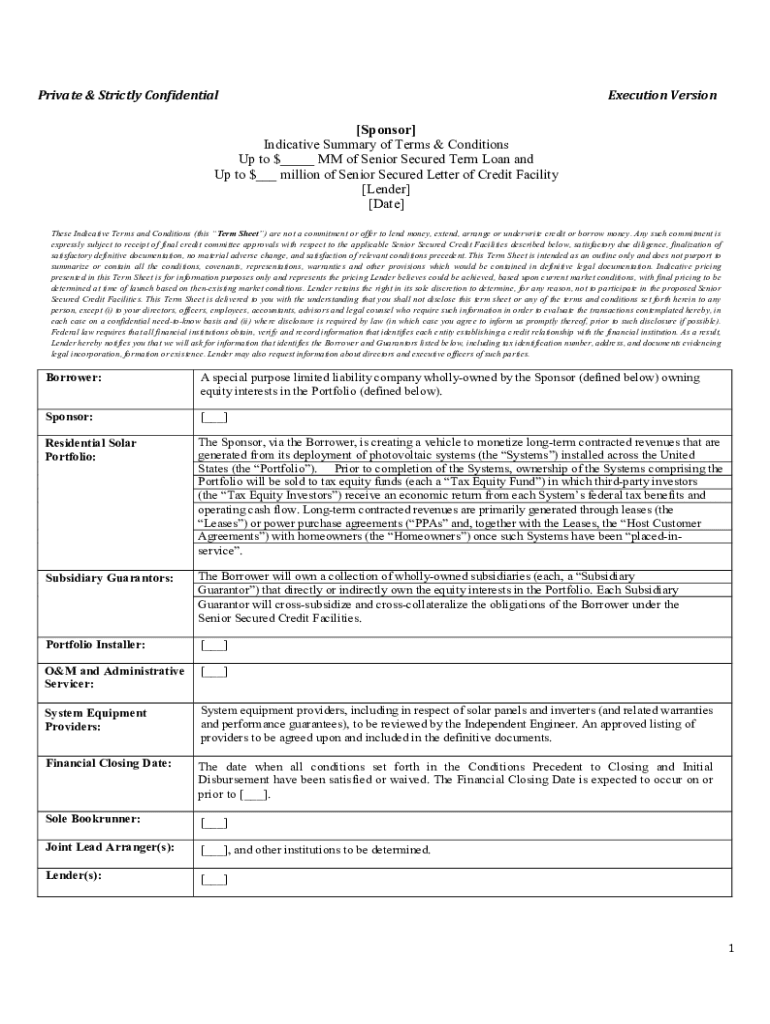

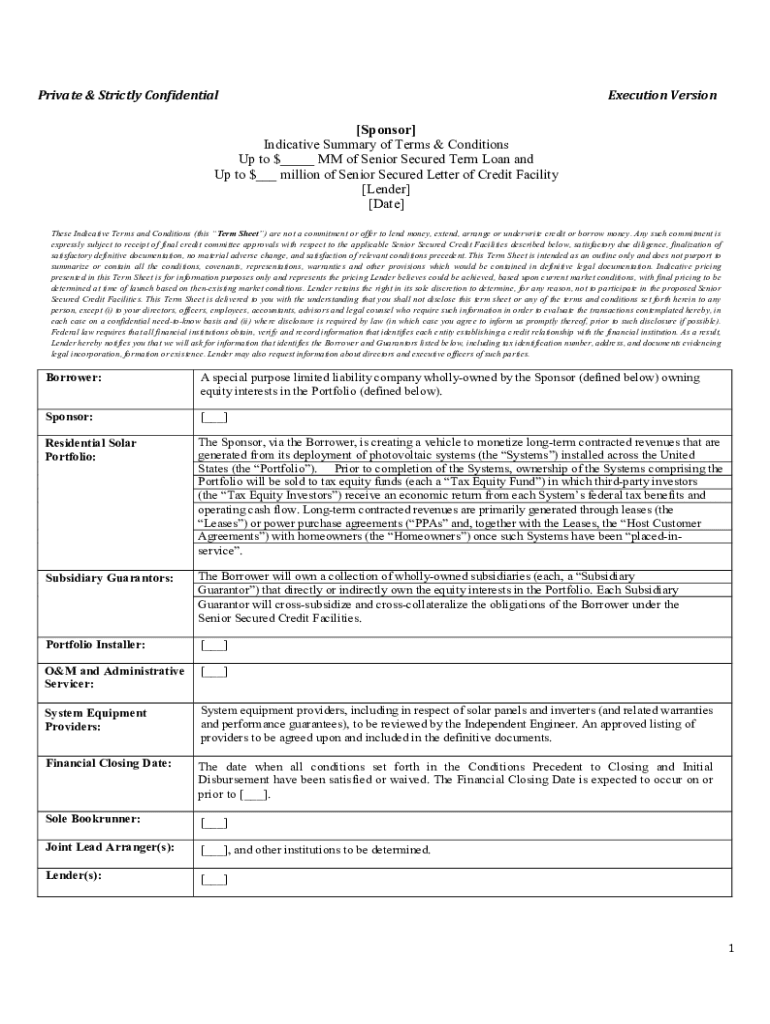

Private & Strictly ConfidentialExecution Version×Sponsor] Indicative Summary of Terms & Conditions Up to $___ MM of Senior Secured Term Loan and Up to $___ million of Senior Secured Letter of Credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign syndication back leverage loan

Edit your syndication back leverage loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your syndication back leverage loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit syndication back leverage loan online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit syndication back leverage loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out syndication back leverage loan

How to fill out syndication back leverage loan

01

To fill out syndication back leverage loan, follow these steps:

02

Gather all the necessary documents such as financial statements, business plan, credit history, and any other required information.

03

Research and choose a reputable financial institution or lender that offers syndication back leverage loans.

04

Contact the chosen lender and schedule a meeting to discuss your loan requirements and fill out an application form.

05

Provide all the required information and documents to the lender, ensuring accuracy and completeness.

06

Wait for the lender's assessment and decision on your loan application.

07

If approved, review the loan terms and conditions carefully before signing the loan agreement.

08

Fulfill any additional requirements or conditions requested by the lender.

09

Receive the loan funds and use them for the intended purpose.

10

Make timely repayments according to the agreed-upon schedule to avoid any penalties or additional charges.

11

Keep track of your loan status and communicate with the lender if any issues or questions arise.

12

Pay off the loan in full within the agreed-upon timeframe.

Who needs syndication back leverage loan?

01

Syndication back leverage loan is generally needed by businesses or individuals who require additional funds to leverage their existing assets.

02

Some common examples of those who may need syndication back leverage loans include:

03

- Real estate developers who want to expand their property portfolio.

04

- Small businesses aiming to finance growth initiatives or acquisitions.

05

- Entrepreneurs looking to fund new ventures or projects.

06

- Individuals requiring capital to invest in income-generating assets such as rental properties or stocks.

07

Overall, syndication back leverage loans can be beneficial for those who have valuable assets but need additional capital to maximize their potential.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit syndication back leverage loan in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your syndication back leverage loan, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit syndication back leverage loan on an iOS device?

Create, modify, and share syndication back leverage loan using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete syndication back leverage loan on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your syndication back leverage loan by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is syndication back leverage loan?

A syndication back leverage loan is a type of loan where a borrower uses their existing syndicated loan as collateral to secure a new loan.

Who is required to file syndication back leverage loan?

Borrowers who are seeking additional financing using their existing syndicated loan as collateral are required to file a syndication back leverage loan.

How to fill out syndication back leverage loan?

To fill out a syndication back leverage loan, borrowers need to provide information about their existing syndicated loan, the amount of additional financing requested, and any other relevant financial information.

What is the purpose of syndication back leverage loan?

The purpose of a syndication back leverage loan is to provide borrowers with additional financing by leveraging their existing syndicated loan.

What information must be reported on syndication back leverage loan?

Information such as the terms of the existing syndicated loan, the amount of additional financing requested, and the borrower's financial information must be reported on a syndication back leverage loan.

Fill out your syndication back leverage loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Syndication Back Leverage Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.