Get the free Schedule K (Form 990) - irs

Show details

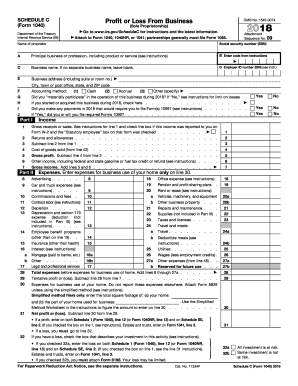

This document provides instructions for completing Schedule K (Form 990), which is used by organizations to report certain information on their outstanding tax-exempt bond liabilities. It details

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule k form 990

Edit your schedule k form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule k form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule k form 990 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule k form 990. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule k form 990

How to fill out Schedule K (Form 990)

01

Gather necessary financial information for the organization.

02

Obtain the correct version of Schedule K (Form 990).

03

Complete the top section of the form, including the organization's name, employer identification number, and tax year.

04

Fill out the required financial activities related to tax-exempt bonds, including proceeds and expenses.

05

Provide information on any qualified 501(c)(3) bonds if applicable.

06

List the amounts reported in the organization's Schedule A, Schedule B, or Schedule D as they pertain to the tax-exempt bonds.

07

Review all entries for accuracy and consistency with other forms submitted.

08

Sign and date the form, if required.

Who needs Schedule K (Form 990)?

01

Organizations that issue tax-exempt bonds.

02

Tax-exempt organizations required to report information regarding tax-exempt bond obligations.

03

Entities that engage in financing activities that involve tax-exempt bonds.

Fill

form

: Try Risk Free

People Also Ask about

How does a schedule K affect my taxes?

Key takeaways Individuals use the information on their Schedule K-1 regarding their share of income, losses, deductions, and credits to file their individual annual tax returns. Depending on the scenario, income on a Schedule K-1 may be treated as self-employment income, earned income, or investment income.

What is reported on a schedule K?

What Is Schedule K-1? Schedule K-1 is a federal tax document used to report the income, losses, and dividends for a business' or financial entity's partners or an S corporation's shareholders. The K-1 form is also used to report income distributions from trusts and estates to beneficiaries.

What is the difference between schedule K and K1?

Schedule K-1 is more specific than what Schedule K lists. K-1 reports on the different amounts of income that vary for each/every partner of a partnership or s-corp.

Who must file Schedule K?

Schedule K-1 is an IRS form used by partnerships, S corporations, and estates and trusts to declare the income, deductions, and credits that partners, shareholders, and beneficiaries have received in the tax year. Individual taxpayers transfer the financial information on their K-1s to their tax returns.

What is the K-9 tax form used for?

The K9 form addresses specific financial transactions requiring detailed reporting. It is primarily used by entities engaged in activities that demand comprehensive disclosure of financial data to ensure transparency and adherence to regulatory standards.

What is a form K filing?

Key Takeaways. The Schedule K-1 is the form that reports the amounts passed to each party with an interest in an entity, like a business partnership or an S corporation. The parties use the information on the K-1 to prepare their separate tax returns.

What is the Schedule K for 990?

Purpose of Schedule Schedule K (Form 990) is used by an organization that files Form 990 to provide certain information on its outstanding liabilities associated with tax-exempt bond issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule K (Form 990)?

Schedule K (Form 990) is a supplementary form used by non-profit organizations to report information about their activities related to controlled entities and financial relationships with those entities.

Who is required to file Schedule K (Form 990)?

Organizations that report information on Form 990 and have certain controlled entities or business relationships must file Schedule K.

How to fill out Schedule K (Form 990)?

To fill out Schedule K, organizations must provide detailed information about their controlled entities, including the names, types, and nature of financial relationships, along with relevant disclosures.

What is the purpose of Schedule K (Form 990)?

The purpose of Schedule K is to provide transparency regarding the organization's relationships with controlled entities and to ensure compliance with IRS regulations.

What information must be reported on Schedule K (Form 990)?

Schedule K requires reporting on the controlled entities, including their names, types, activities, financial data, and the organization's level of control or influence over these entities.

Fill out your schedule k form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule K Form 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.