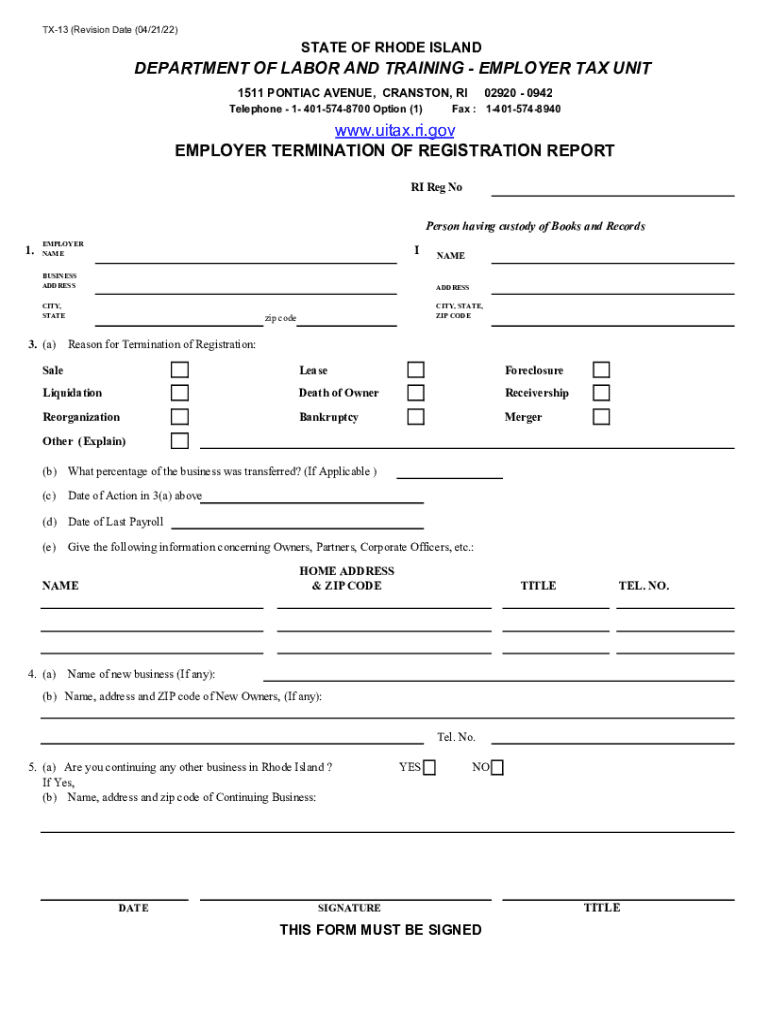

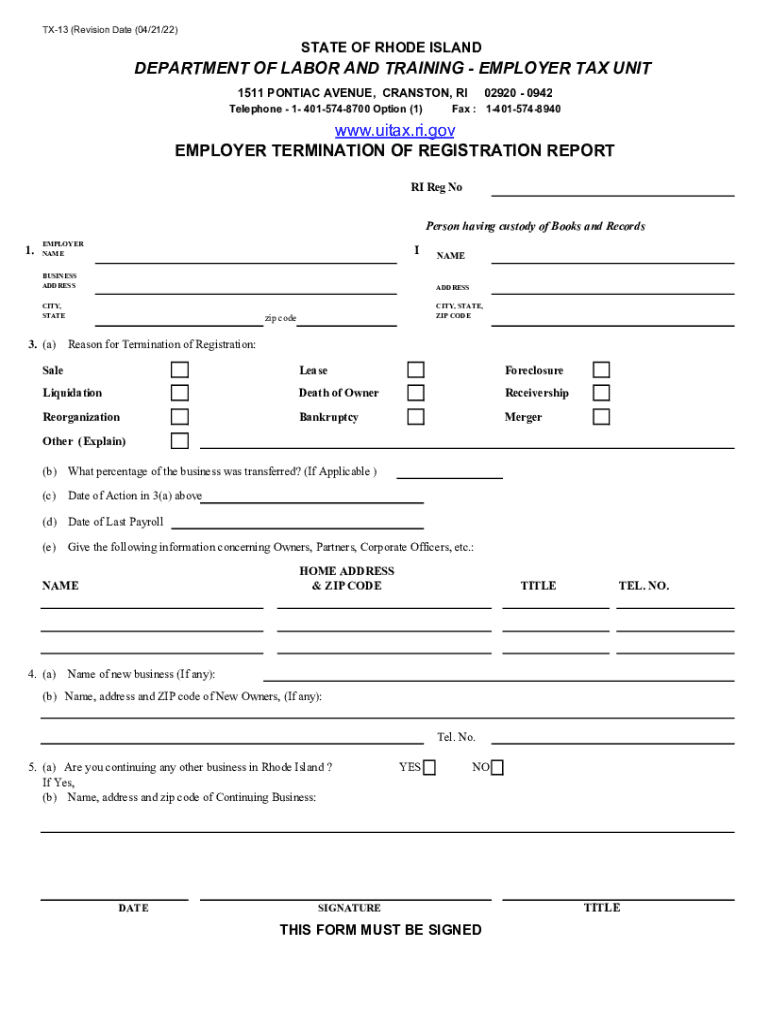

RI TX-13 2022 free printable template

Get, Create, Make and Sign quarterly tax and wage

Editing quarterly tax and wage online

Uncompromising security for your PDF editing and eSignature needs

RI TX-13 Form Versions

How to fill out quarterly tax and wage

How to fill out RI TX-13

Who needs RI TX-13?

Instructions and Help about quarterly tax and wage

Rhode Island is America's bottom state for business this year its fifth time in last place, but it's not for lack of trying to move up we have stopped the decline we have stopped the decline and working together we have ignited a comeback of this great state in our economy the comeback has yet to show up in the numbers near the bottom for business friendliness cost of doing business economy and still at the bottom for infrastructure fixing that has been a priority for governor Gina Raimondo there's more roadwork going on in this state than at any time in our lifetime funded by a controversial program to charge tolls on trucks not surprisingly unpopular with truckers like Michael Collins we need to kill this cancer in this state because it's going to spread like wildfire to other states the governor wrote her plan to re-election last year, but it still faces some skepticism got to do something as long as the money actually does go to the roads the issue is it's going to be passed on to consumers yeah somebody has to pay for it the administration says in its first three years there's been one and a half billion dollars worth of new road construction 100 miles of roads paved and nearly 200 bridges repair unemployment is now in line with a national average and 30 businesses have moved to the state but school test scores are low and economic growth is among the lowest in the country to be sure there are some things that Rhode Island can't do anything about it is a small state and has a lot of built-in disadvantages, but there are a lot of other things like the infrastructure that Rhode Island is on is in control of and the other issue with all of that it is been going on for such a long time you

People Also Ask about

What is the payroll tax in Rhode Island?

What is Rhode Island unemployment taxable wage base for 2023?

What is the employment tax in RI?

What is the Rhode Island reemployment tax?

What is the job development tax in Rhode Island?

What is Rhode Island disability tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my quarterly tax and wage in Gmail?

How do I edit quarterly tax and wage online?

How do I complete quarterly tax and wage on an iOS device?

What is RI TX-13?

Who is required to file RI TX-13?

How to fill out RI TX-13?

What is the purpose of RI TX-13?

What information must be reported on RI TX-13?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.