Get the free K-36 - ksrevenue

Show details

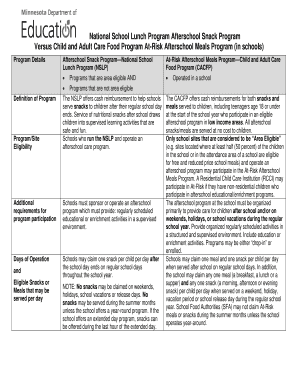

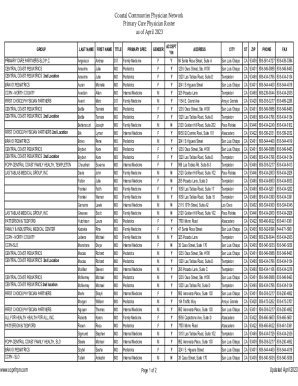

This form is used to apply for the telecommunications credit on property taxes paid by telecommunication companies. It includes sections for entering PVD ID Numbers, credit amounts, and payment dates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign k-36 - ksrevenue

Edit your k-36 - ksrevenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your k-36 - ksrevenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

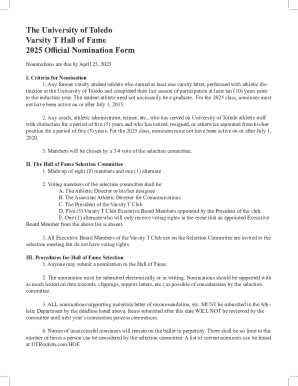

Editing k-36 - ksrevenue online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit k-36 - ksrevenue. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out k-36 - ksrevenue

How to fill out K-36

01

Gather all necessary personal and financial information.

02

Begin with filling out your personal details such as name, address, and contact information.

03

Enter your taxpayer identification number, such as your Social Security Number (SSN) or Employer Identification Number (EIN).

04

Provide details regarding your income sources, including wages, self-employment income, and any other taxable income.

05

Document all applicable deductions and credits that you are eligible for.

06

Calculate your total income and deductions, then determine your tax liability.

07

Review the form for accuracy and completeness before submission.

08

Submit the completed K-36 form to the appropriate tax authority by the specified deadline.

Who needs K-36?

01

Individuals who are required to file a tax return based on income level.

02

Business owners and self-employed individuals who report their income.

03

People who qualify for tax credits or deductions related to their specific financial situations.

Fill

form

: Try Risk Free

People Also Ask about

How to charge a K36 handheld?

Use the USB-A to USB-C cable that came with the handheld, and charge it via a PC USB port for safety.

How many games are on the K36?

【Support 9000+ Games】: retro handheld game console is equipped with a 64G TF card, supporting 9000+ games and 30+ emulators, It is equipped with a game resource package, which can be easily downloaded by yourself, and can be expanded to 512G at most.

How do I turn off the K36 console?

0:06 0:58 And basically navigate down to this uh quit. Option here select it. And click the shutdown systemMoreAnd basically navigate down to this uh quit. Option here select it. And click the shutdown system and again select with a and confirm. And this actually is more safer option as also it will preserve.

How to charge a 36V battery?

1:19 4:07 And I'm going to make sure I'm turning only the voltages to positive. Down here on the side you'reMoreAnd I'm going to make sure I'm turning only the voltages to positive. Down here on the side you're going to see this number the amps. And when you see that's turned to zero.

Is the K36 handheld any good?

The K36 is a wonderfully designed device that does what it advertises. It has some downsides like no way to connect to the internet and a severe lack of that one company's games, but outside of that it blew away my expectations. It is much more comfortable than it has any right to be.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is K-36?

K-36 is a tax form used by certain entities to report information related to income and tax liabilities in the respective jurisdiction.

Who is required to file K-36?

Generally, businesses, corporations, and certain individuals who meet specific income thresholds or have specific types of income are required to file K-36.

How to fill out K-36?

To fill out K-36, individuals or entities should gather their financial information, follow the instructions provided with the form, and accurately enter data in the required fields.

What is the purpose of K-36?

The purpose of K-36 is to ensure compliance with tax regulations by collecting detailed information about income and facilitating the assessment of tax liabilities.

What information must be reported on K-36?

K-36 requires reporting information such as total income, deductions, credits, and any relevant tax liabilities for the reporting period.

Fill out your k-36 - ksrevenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

K-36 - Ksrevenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.