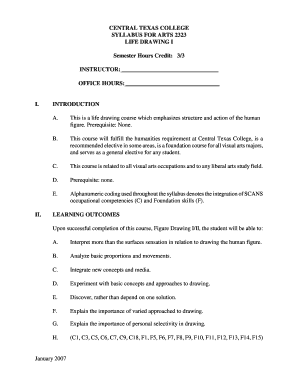

Get the free Schedule C-2

Show details

This form is used by taxpayers to determine excess deductions that may be applied to offset trade or business income, in accordance with Massachusetts law regarding adjusted gross income deductions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule c-2

Edit your schedule c-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule c-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule c-2 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule c-2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule c-2

How to fill out Schedule C-2

01

Gather necessary information: Collect all relevant financial records including income and expenses.

02

Obtain the Schedule C-2 form: Download it from the IRS website or request a copy from a tax professional.

03

Fill out personal information: Provide your name, address, and Social Security Number at the top of the form.

04

Report income: In Section A, list your business income, including gross receipts and other sources of revenue.

05

Detail expenses: In Section B, categorize and report all deductible business expenses such as advertising, utilities, and salaries.

06

Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss in Section C.

07

Review and verify: Double-check all entries for accuracy and ensure that totals match your financial records.

08

Submit the form: Attach Schedule C-2 to your tax return when filing, ensuring to keep a copy for your records.

Who needs Schedule C-2?

01

Self-employed individuals: Those who operate a business as sole proprietors.

02

Freelancers: Independent contractors who report income from multiple clients.

03

Small business owners: Owners of single-member LLCs or sole proprietorships needing to report business income and expenses.

Fill

form

: Try Risk Free

People Also Ask about

Who fills out Schedule C?

Schedule C is typically for people who operate sole proprietorships or single-member LLCs. A Schedule C is not the same as a 1099 form. Although, you may need IRS Form 1099 (a 1099-NEC or 1099-K in particular) to fill out a Schedule C.

Will a schedule C trigger an audit?

When you're filing your taxes for the year, your Schedule C form will show your reported income. If you incorrectly report your income, it can increase your chance of being audited. This includes: Reporting a higher-than-average income.

What is line 2 on Schedule C?

As you work your way through the Schedule C form, you do the math as instructed. Here's how it goes: Line 1: enter your gross income from receipts or sales, before any self-employed tax deductions. Line 2: enter total returns and allowances (the amount issued in refunds for the tax year)

How do I prove my schedule C income?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

What is the minimum income to file a Schedule C?

Schedule C FAQ There is no minimum income for filing a Schedule C. If you earn any self-employment income you'll need to report it on Schedule C. However, the limit for paying self-employment tax is $400. If you earn less than $400, you typically do not have to file Schedule SE or pay self-employment tax.

What is the Part 2 of Schedule C?

Part 2 calculates and reports business expenses before home office deductions. This section also helps you figure out total expenses, expenses for business use of home, tentative profit or loss, and net profit or loss.

Can I fill out my own schedule C?

You can download all versions of a Schedule C on the IRS website. You can also use online tax preparation software to access a Schedule C and complete your tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule C-2?

Schedule C-2 is a form used by certain taxpayers to report estimated tax payments or overpayment credits applied to the current year's taxes.

Who is required to file Schedule C-2?

Taxpayers who have made estimated tax payments or who wish to claim a credit for an overpayment from a prior year may be required to file Schedule C-2.

How to fill out Schedule C-2?

To fill out Schedule C-2, taxpayers need to provide their personal information, report any estimated tax payments made, and claim any overpayment credits using the provided spaces in the form.

What is the purpose of Schedule C-2?

The purpose of Schedule C-2 is to ensure that taxpayers accurately report their estimated tax payments and any credits from previous year overpayments to the IRS.

What information must be reported on Schedule C-2?

Information required on Schedule C-2 includes the taxpayer's identification details, the amount of estimated tax payments made, and any applicable overpayment credits from prior years.

Fill out your schedule c-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule C-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.