Get the free TAX INCREMENT FINANCING DISTRICT GENERAL GUIDELINES - growpeoria.com

Show details

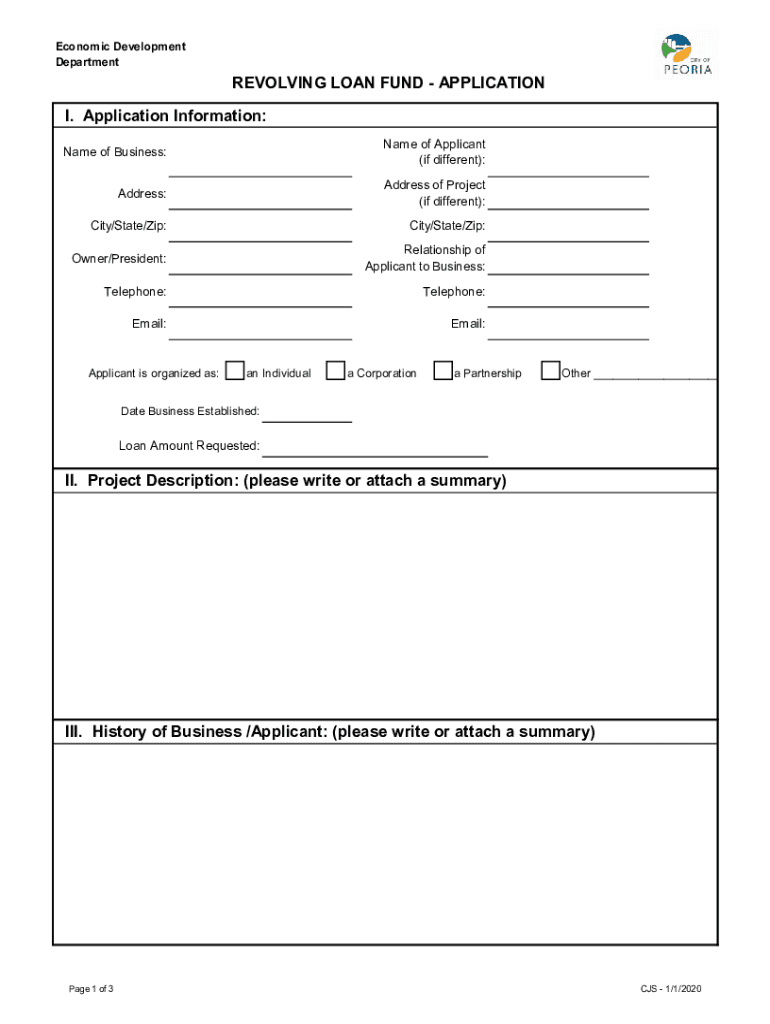

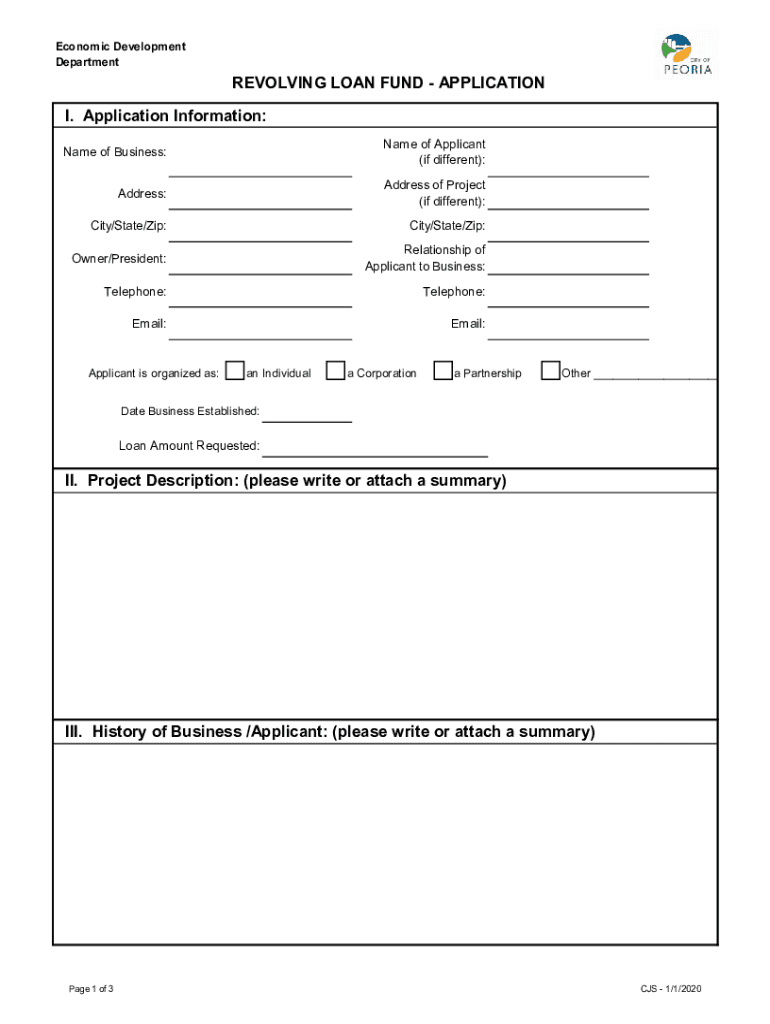

REVOLVING LOAN FUND PROGRAM2021For Information Contact: City of Peoria Economic Development Office 419 Fulton Street, Suite 207 Peoria, IL 61606 Phone: 3094948640 Cesar Suarez Senior Development Specialist

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing district

Edit your tax increment financing district form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing district form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment financing district online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax increment financing district. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing district

How to fill out tax increment financing district

01

Determine the boundaries of the tax increment financing (TIF) district. This is usually done by identifying a specific area or neighborhood that will benefit from the TIF funds.

02

Consult with local government officials and agencies to understand the requirements and process for creating a TIF district. Each municipality or jurisdiction may have specific guidelines and regulations that need to be followed.

03

Gather data and conduct an analysis of the area that will be included in the TIF district. This may involve researching property values, economic development potential, infrastructure needs, and other relevant factors.

04

Develop a redevelopment plan that outlines the goals and objectives of the TIF district. This plan should include strategies for improving the area, attracting new businesses, creating jobs, and increasing property values.

05

Seek approval from the appropriate governing bodies or decision-makers. This may involve presenting the redevelopment plan and supporting documentation, attending public hearings, and addressing any concerns or questions raised by stakeholders.

06

Once the TIF district is approved, implement the redevelopment plan by securing funding through tax increment financing. This involves capturing a portion of the increased property tax revenue generated within the TIF district and using it to finance public improvements and economic development projects.

07

Monitor and evaluate the effectiveness of the TIF district over time. This includes tracking economic indicators, reviewing performance metrics, and making adjustments to the redevelopment plan as needed.

Who needs tax increment financing district?

01

Local governments and municipalities: Tax increment financing districts are often used by local governments to revitalize blighted or underdeveloped areas, attract private investment, and stimulate economic growth.

02

Developers and property owners: TIF districts can provide financial incentives and support for developers and property owners to undertake redevelopment projects in designated areas. This can help increase property values and attract businesses and residents.

03

Community organizations and nonprofits: TIF districts can be used to fund community development projects and address social and economic inequities in disadvantaged areas.

04

Economic development agencies and organizations: TIF districts can be a valuable tool for economic development agencies to attract businesses, create jobs, and improve the overall economic climate of a community.

05

Residents and taxpayers: In the long run, a successful TIF district can result in improved infrastructure, increased property values, and a stronger local economy, which can benefit residents and taxpayers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out tax increment financing district using my mobile device?

Use the pdfFiller mobile app to complete and sign tax increment financing district on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit tax increment financing district on an iOS device?

Use the pdfFiller mobile app to create, edit, and share tax increment financing district from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete tax increment financing district on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your tax increment financing district from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is tax increment financing district?

A tax increment financing district is a specific area where the property tax revenue goes towards financing economic development projects and improvements.

Who is required to file tax increment financing district?

Local governments or agencies are typically required to file tax increment financing districts.

How to fill out tax increment financing district?

To fill out a tax increment financing district, one must gather all necessary financial information and follow the specific filing instructions provided by the local government.

What is the purpose of tax increment financing district?

The purpose of a tax increment financing district is to promote economic development and stimulate growth in a designated area.

What information must be reported on tax increment financing district?

Information such as property tax revenue, planned development projects, and financing plans must be reported on tax increment financing districts.

Fill out your tax increment financing district online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing District is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.