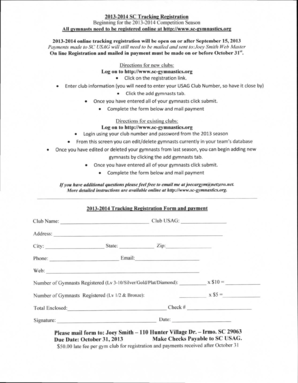

Get the free Form 355

Show details

Este formulario es utilizado para la declaración del impuesto sobre las ganancias de las corporaciones de negocios o manufacturas en Massachusetts para el año 2008. Solicita información sobre la

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 355

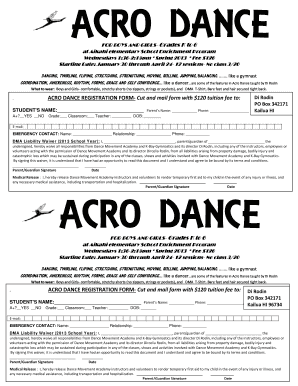

Edit your form 355 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 355 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 355 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 355. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

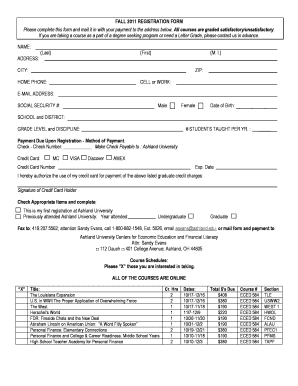

How to fill out form 355

How to fill out Form 355

01

Obtain Form 355 from the appropriate authority or website.

02

Fill in your personal information in the designated fields, including your name, address, and contact details.

03

Provide the necessary financial information and any required supporting documents.

04

Review the form for accuracy and completeness.

05

Sign and date the form at the bottom.

Who needs Form 355?

01

Individuals or businesses seeking tax relief or credits in their jurisdiction.

02

Taxpayers who have specific financial situations or qualifications that require reporting.

03

Anyone required to submit the form as part of their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is MA form 355?

The Massachusetts Corporation Excise Return Form 355 is designed for corporations operating within the state to report their income and comply with tax laws.

Who is exempt from AZ state income tax?

Arizona also allows exemptions for the following: The taxpayer or their spouse is blind. The taxpayer or their spouse is 65 years old or older.

What is Massachusetts form 355?

The Massachusetts Corporation Excise Return Form 355 is designed for corporations operating within the state to report their income and comply with tax laws.

What is the minimum tax rate for an LLC in Arizona?

LLC members are taxed at a 15.3% rate, while LLCs that choose C-corp status are taxed at 4.9%. In addition to this state income tax, LLCs pay transaction privilege tax, local city/county taxes, and occasionally industry-specific taxes. Keep reading to learn more about Arizona LLC taxes.

Is social security income taxed in AZ?

Social Security isn't taxable at the state level in Arizona and 40 other states. The exceptions — the states that do tax Social Security retirement benefits — are Colorado, Connecticut, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont and West Virginia.

What is AZ form 355?

Form 355 will show the credit calculation which then flows to Form 301 and then to Form 140/Form 140PY/Form 140NR. This also makes an addition to income in the amount of taxes paid that appears on: 140, page 5 line P.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

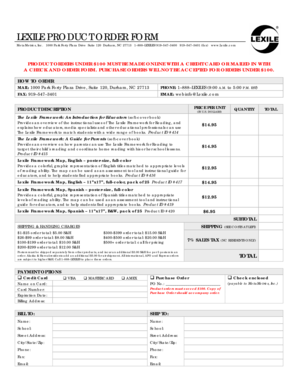

What is Form 355?

Form 355 is a tax form used by corporations in Massachusetts to report their corporate income and calculate their taxes.

Who is required to file Form 355?

Corporations doing business in Massachusetts, or those that derive income from Massachusetts sources, are required to file Form 355.

How to fill out Form 355?

To fill out Form 355, corporations must provide detailed financial information including total income, deductions, and credits, as well as their tax liability.

What is the purpose of Form 355?

The purpose of Form 355 is to report corporate income and calculate the tax owed to the state of Massachusetts.

What information must be reported on Form 355?

Form 355 requires reporting on income, deductions, tax credits, apportionment factors, and the overall tax liability of the corporation.

Fill out your form 355 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 355 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.