Get the free Tax Increment Financing (TIF) Employment Skills Training ...

Show details

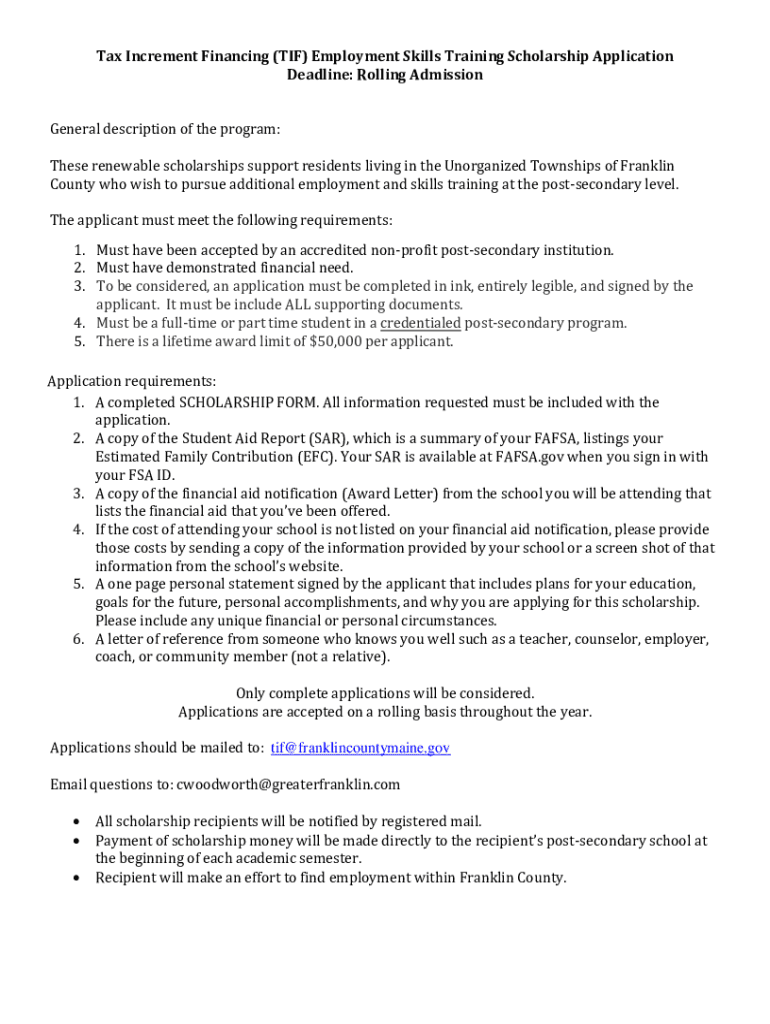

Tax Increment Financing (TIF) Employment Skills Training Scholarship Application Deadline: Rolling Admission General description of the program: These renewable scholarships support residents living

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing tif

Edit your tax increment financing tif form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing tif form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment financing tif online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax increment financing tif. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing tif

How to fill out tax increment financing tif

01

To fill out a Tax Increment Financing (TIF) application, follow these steps:

02

Begin by acquiring the TIF application form from your local government or economic development department.

03

Carefully read the instructions attached to the application form to understand the required documents and information.

04

Gather all the necessary financial, legal, and project-related documents that need to be submitted with the application.

05

Fill out the application form clearly and accurately, ensuring that all sections are completed.

06

Include all the requested supporting documents, such as financial statements, project plans, proof of ownership, etc.

07

Double-check all the information provided to avoid any errors or missing details.

08

Submit the completed application form along with the supporting documents to the designated department or office.

09

Pay any required application fees if applicable.

10

Wait for the review process to be completed, and be prepared to respond to any additional inquiries or requests for more information.

11

Once the application is approved, follow the instructions provided by the TIF program to utilize the financing for your intended purposes.

12

Note: The specific steps and requirements may vary depending on the jurisdiction and TIF program. It is essential to consult local authorities for accurate guidance.

Who needs tax increment financing tif?

01

Tax Increment Financing (TIF) is typically utilized by:

02

- Local governments and municipalities: They use TIF to promote economic development, revitalize blighted areas, and attract investment to their jurisdictions.

03

- Developers and property owners: TIF can provide financial assistance for real estate development or infrastructure projects, making it attractive for developers looking to invest in designated TIF districts.

04

- Business owners: TIF can support businesses in TIF districts through infrastructure improvements, access to funding, and tax incentives, fostering growth and expansion.

05

- Community organizations: TIF can be utilized by non-profit or community organizations to support community development initiatives within designated TIF areas.

06

Overall, tax increment financing is beneficial for entities looking to stimulate economic growth, enhance property values, and promote community development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax increment financing tif from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax increment financing tif into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out the tax increment financing tif form on my smartphone?

Use the pdfFiller mobile app to fill out and sign tax increment financing tif. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete tax increment financing tif on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your tax increment financing tif by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is tax increment financing tif?

Tax increment financing (TIF) is a public financing method used for redevelopment, infrastructure, and other community-improvement projects.

Who is required to file tax increment financing tif?

Property owners within a designated TIF district are typically required to file tax increment financing reports.

How to fill out tax increment financing tif?

Tax increment financing reports are usually filled out by property owners or developers within the TIF district and submitted to the relevant government authority.

What is the purpose of tax increment financing tif?

The purpose of TIF is to capture the increase in property tax revenue generated by redevelopment projects within a designated TIF district and use that revenue to fund further development and improvements.

What information must be reported on tax increment financing tif?

Reports typically include details on property values, improvements made, revenue generated, and how the TIF funds are being used.

Fill out your tax increment financing tif online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing Tif is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.