OneFamily (formerly Family Investments) 20200 free printable template

Show details

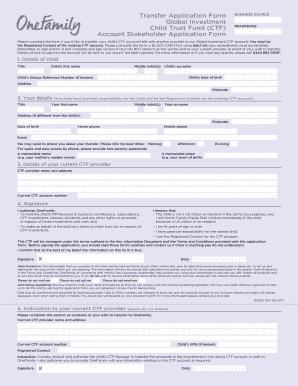

Business SourceTransfer Application Form

Global Investment Child Trust Fund (CTF)

Account Stakeholder Application FormReferencePlease complete this form if you'd like to transfer your children CTF

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OneFamily formerly Family Investments 20200

Edit your OneFamily formerly Family Investments 20200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OneFamily formerly Family Investments 20200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OneFamily formerly Family Investments 20200 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OneFamily formerly Family Investments 20200. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OneFamily (formerly Family Investments) 20200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OneFamily formerly Family Investments 20200

How to fill out OneFamily (formerly Family Investments) 20200

01

Gather all necessary personal information, including your name, address, date of birth, and National Insurance number.

02

Collect details about your financial situation, including income, savings, and any investments.

03

Review the eligibility criteria for OneFamily (formerly Family Investments) to ensure you qualify.

04

Fill out each section of the application form, providing accurate and complete information.

05

Double-check the form for any errors or omissions before submitting.

06

Submit the completed form through the designated method, whether online or via postal mail.

Who needs OneFamily (formerly Family Investments) 20200?

01

Individuals or families looking for investment options for their children.

02

Those seeking financial support for future educational expenses.

03

Parents and guardians who want to save for milestones such as birthdays or special occasions.

04

People interested in long-term savings plans with potential growth opportunities.

Fill

form

: Try Risk Free

People Also Ask about

How do I set up a Child Trust Fund?

How to Set Up a Trust Fund for a Child Specify the purpose of the Trust. Clarify how the Trust will be funded. Decide who will manage the Trust. Legally create the Trust and Trust Documents. Transfer assets into and fund the Trust.

How do I access my child's trust fund at 18?

You, or a close friend or relative, need to apply to the Court of Protection ( COP ) for a financial deputyship order so you can manage your child's account when they turn 18. Once the account matures, the money can either be taken out or transferred into an ISA .

How do I get my Child Trust Fund money?

They can do this by contacting their Child Trust Fund provider. When the account-holder turns 18 years old, they can access and withdraw the money in their Child Trust Fund account.

How do I log into my child's trust fund?

You'll need to fill in a form on the HMRC website using your Government Gateway user ID and password, but don't worry if you don't have these – you can create them for this purpose. You'll also need either your child's Unique Reference Number from their annual CTF statement, or their National Insurance number.

How do I get money out of my child's trust fund?

You'll need to log into your online account where you can withdraw money either by bank transfer or by asking us to post a cheque. You also now have the option to move money into an ISA or a Lifetime ISA. If you've not yet decided, it's ok to do nothing!

How do you know if you have a Child Trust Fund?

Contact the Child Trust Fund provider directly if you know who the account is with. If you do not know the Child Trust Fund provider, you can ask: your parent or guardian. HM Revenue and Customs ( HMRC ) to find a Child Trust Fund - they can tell you where the account was originally opened.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OneFamily formerly Family Investments 20200 for eSignature?

Once you are ready to share your OneFamily formerly Family Investments 20200, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in OneFamily formerly Family Investments 20200 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your OneFamily formerly Family Investments 20200, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out OneFamily formerly Family Investments 20200 on an Android device?

Use the pdfFiller Android app to finish your OneFamily formerly Family Investments 20200 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is OneFamily (formerly Family Investments) 20200?

OneFamily (formerly Family Investments) 20200 is a specific financial product or form related to an investment or savings scheme that aims to help families manage their finances effectively.

Who is required to file OneFamily (formerly Family Investments) 20200?

Individuals or entities who have invested in OneFamily products or are managing savings plans associated with OneFamily are required to file the OneFamily 20200 form.

How to fill out OneFamily (formerly Family Investments) 20200?

To fill out the OneFamily 20200 form, gather all necessary financial documents, provide accurate personal and investment information, and follow the instructions provided in the form guidelines carefully.

What is the purpose of OneFamily (formerly Family Investments) 20200?

The purpose of OneFamily 20200 is to collect and report relevant financial information related to family investments for tracking, compliance, and management purposes.

What information must be reported on OneFamily (formerly Family Investments) 20200?

Information that must be reported typically includes details of investments, account balances, transaction history, and any income generated from these investments.

Fill out your OneFamily formerly Family Investments 20200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OneFamily Formerly Family Investments 20200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.