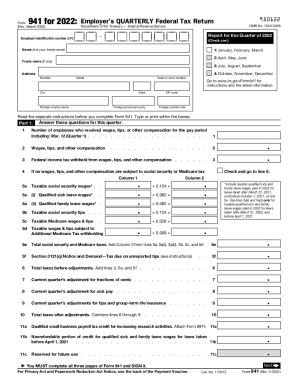

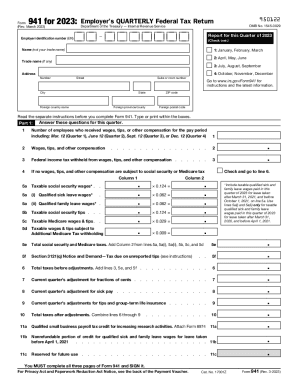

IRS 941 2022 free printable template

Instructions and Help about IRS 941

How to edit IRS 941

How to fill out IRS 941

About IRS previous version

What is IRS 941?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 941

What should I do if I need to correct a mistake on my IRS 941 after filing?

If you discover an error on your IRS 941 after submission, you can amend the form by filing Form 941-X. This form allows you to correct any mistakes made in previously filed quarterly returns. Be sure to follow the instructions closely to ensure successful processing of the amendment.

How can I verify if my IRS 941 has been received and processed?

You can check the status of your IRS 941 by calling the IRS or using their online tools. Ensure you have your submission details handy, as you'll need to provide information to verify your submission status. Keeping track of any confirmation numbers received during e-filing can also assist in this process.

What should I do if I receive an audit notice related to my IRS 941?

Upon receiving an audit notice for your IRS 941, carefully review the information requested and gather all necessary documents to support your filing. Respond to the notice by the specified deadline, and consider consulting a tax professional to help navigate the audit process effectively.

Are e-signatures accepted when filing IRS 941 electronically?

Yes, e-signatures are accepted for electronic filings of IRS 941. However, ensure that you comply with the IRS standards for electronic signatures, as improper use can lead to processing issues. Check with your e-filing software to confirm its compatibility with e-signature requirements.

What common errors should I be aware of when filing IRS 941?

Common errors when filing IRS 941 include incorrect employer identification numbers (EIN), miscalculating tax liabilities, and failure to check all required boxes. To avoid these issues, double-check your entries and utilize IRS resources or software that provides checks for common mistakes before submission.

See what our users say