Canada Mortgage Refinance Rates Application Form 2017-2025 free printable template

Show details

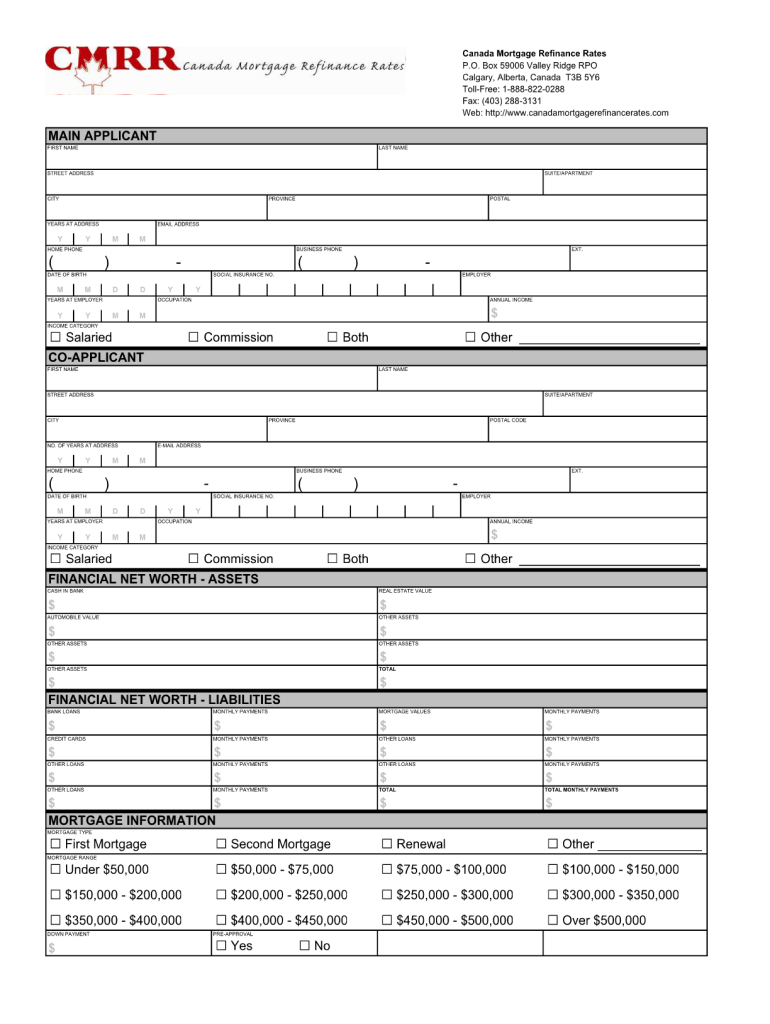

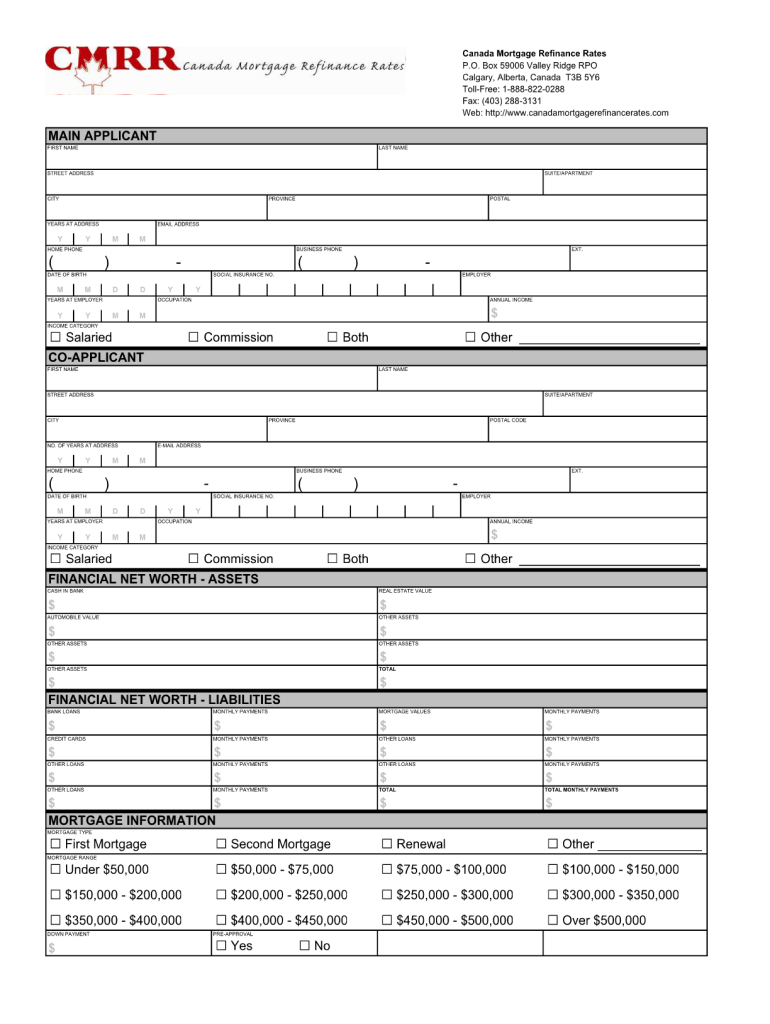

Canada Mortgage Refinance Rates P.O. Box 59006 Valley Ridge RPO Calgary, Alberta, Canada T3B 5Y6 Toll-Free: 1-888-822-0288 Fax: (403) 288-3131 Web: http://www.canadamortgagerefinancerates.com MAIN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage application form

Edit your mortgage application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage application form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage application form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage application form

How to fill out Canada Mortgage Refinance Rates Application Form

01

Gather necessary documents: Collect your identification, mortgage statements, and income proof.

02

Visit the lender's website: Go to the website of the financial institution offering mortgage refinancing.

03

Locate the refinance application form: Find the section for mortgage refinancing and download or access the application form.

04

Fill out personal information: Input your name, address, contact details, and Social Insurance Number.

05

Provide mortgage details: Enter information about your current mortgage, including the lender, remaining balance, and interest rate.

06

State the purpose of refinancing: Explain why you want to refinance (e.g., lower interest rates, cash out, etc.).

07

Include financial information: Provide details about your income, employment status, and any other debts.

08

Review your application: Check for accuracy and completeness before submitting.

09

Submit the application: Send it online or mail it to the lender's processing center.

10

Await approval: After submission, await feedback or further requests for information from the lender.

Who needs Canada Mortgage Refinance Rates Application Form?

01

Homeowners looking to lower their mortgage interest rates.

02

Homeowners interested in accessing equity from their property.

03

Individuals seeking to consolidate debt through mortgage refinancing.

04

Homeowners who want to change the terms of their mortgage agreement.

05

Those looking to switch lenders for better mortgage terms.

Fill

form

: Try Risk Free

People Also Ask about

What is the 1003 closing document?

What is Final 1003? Final 1003 is the Form 1003 that is prepared by the lender and is signed by the borrower at loan closing. The purpose of Final 1003 is to have the borrower confirm the loan application information after all the details have been verified by the lender.

What is a 1003 mortgage application?

The 1003 mortgage application, also known as the Uniform Residential Loan Application, is the standard form nearly all mortgage lenders in the United States use. Borrowers complete this basic form—or its equivalent, Form 65—when they apply for a mortgage loan.

What is a mortgage application form?

A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.

Did the 1003 change?

Effective March 1, 2022, the old 1003 forms and legacy formats will no longer be accepted. While the look and feel of the Form 1003 changed, the loan application process does not change for lender or borrower.

What are the changes to the new Urla 1003?

Biggest changes on the form The redesigned URLA will replace Freddie Mac Form 65 and Fannie Mae Form 1003 and will require lenders to request more borrower information than ever. The new data fields include a wide range of information, such as: Borrower's mobile number(s) Borrower's email address(es)

When did the 1003 change?

Time to make yourself 100% comfortable with the new 2021 - 1003. Beginning 03/01/2021 the old 1003 goes away permanently and the new URLA is here to stay.

What is the new 1003 form?

Officially known as the uniform residential loan application — URLA for short — the 1003 application gives your lender the information required to determine whether you qualify for the loan you're applying for.

Is the new Urla still a 1003?

All loans with an application date on or after March 1, 2021 and purchased by Fannie and Freddie are required to include the redesigned URLA. The GSEs will continue to accept legacy loans (applications prior to 3/1/21) with the old form 1003 until March 1, 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgage application form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your mortgage application form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my mortgage application form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your mortgage application form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete mortgage application form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your mortgage application form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is Canada Mortgage Refinance Rates Application Form?

The Canada Mortgage Refinance Rates Application Form is a document used by homeowners in Canada to apply for refinancing their existing mortgage, allowing them to obtain better interest rates or access equity from their homes.

Who is required to file Canada Mortgage Refinance Rates Application Form?

Homeowners in Canada who wish to refinance their existing mortgage must file the Canada Mortgage Refinance Rates Application Form.

How to fill out Canada Mortgage Refinance Rates Application Form?

To fill out the Canada Mortgage Refinance Rates Application Form, applicants need to provide personal information, details about their current mortgage, and financial information such as income, expenses, and credit history.

What is the purpose of Canada Mortgage Refinance Rates Application Form?

The purpose of the Canada Mortgage Refinance Rates Application Form is to collect necessary information from homeowners so that lenders can assess their eligibility for refinancing options and determine the new interest rates.

What information must be reported on Canada Mortgage Refinance Rates Application Form?

The form must report information including the homeowner's personal details, mortgage balance, property value, income, debts, credit score, and any other financial obligations.

Fill out your mortgage application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.