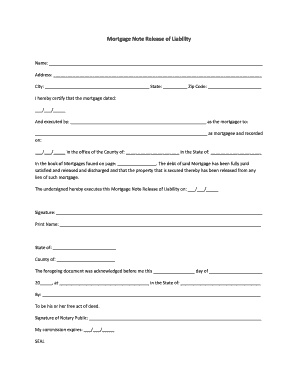

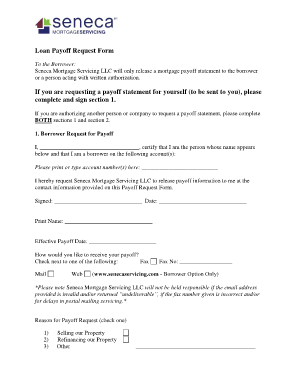

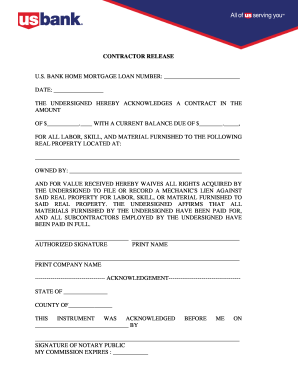

What is a free release of mortgage form?

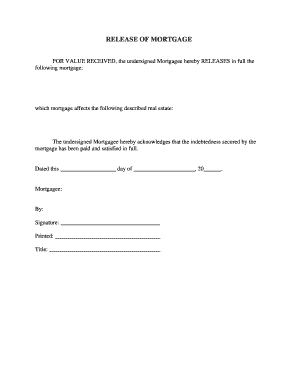

A free release of mortgage form is a legal document that confirms the release or satisfaction of a mortgage on a property. It is also known as a mortgage discharge document. This form is typically used when a property owner has fully paid off their mortgage and wants to remove the lien on their property.

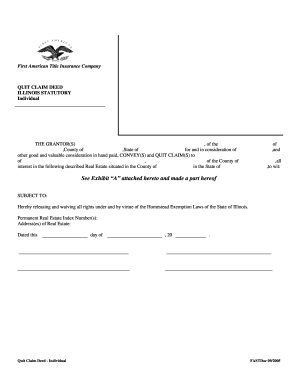

What are the types of free release of mortgage forms?

There are several types of free release of mortgage forms that may be used depending on the jurisdiction and specific requirements. Some common types include:

Full Satisfaction and Release of Mortgage Form

Partial Release of Mortgage Form

Conditional Release of Mortgage Form

Release and Reconveyance Form

How to complete a free release of mortgage form

Completing a free release of mortgage form may vary depending on the specific form and jurisdiction. However, here are some general steps to help you:

01

Obtain the correct form: Make sure to use the appropriate free release of mortgage form for your jurisdiction or state. You can often find these forms online or at your local county recorder's office.

02

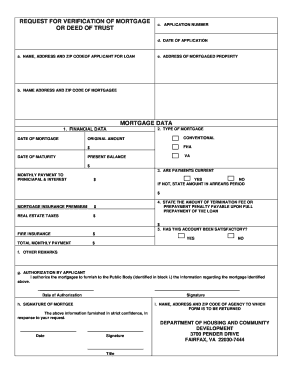

Provide property information: Fill in the property details, such as the address and legal description. This information is typically found on the original mortgage or property deed.

03

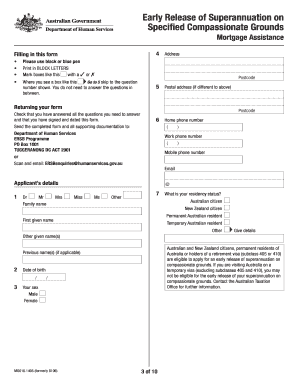

Include borrower information: Provide the names of the borrower(s) as listed on the original mortgage. Include any additional required details, such as their contact information.

04

Indicate mortgage details: Input the original mortgage details, including the mortgage amount, date of creation, and any other relevant information.

05

Sign and notarize: Sign the free release of mortgage form in the presence of a notary public. Notarization is often required to validate the document.

06

Submit the form: Once completed and notarized, submit the free release of mortgage form to the appropriate authority, such as the county recorder's office or the lender who holds the mortgage.

Remember, if you need assistance in creating, editing, or sharing your free release of mortgage form, pdfFiller can help. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to confidently complete your documents.