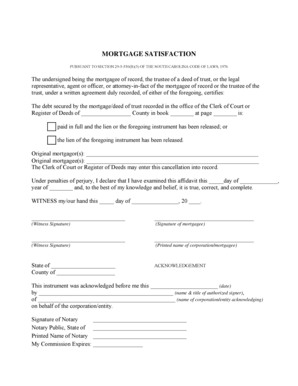

Satisfaction Of Mortgage Not Filed

What is satisfaction of mortgage not filed?

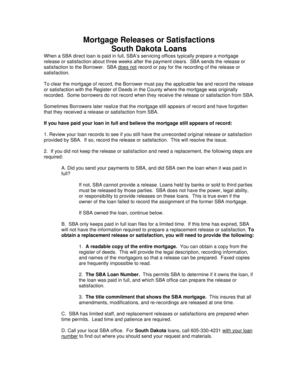

Satisfaction of mortgage not filed refers to a situation where the lender does not officially record that the mortgage has been paid off and satisfied. This can lead to confusion and potential issues in proving that the debt has been fully repaid.

What are the types of satisfaction of mortgage not filed?

There are two main types of satisfaction of mortgage not filed: partial satisfaction, where only a portion of the mortgage is marked as paid, and complete satisfaction, where the entire mortgage debt has been repaid but not officially recorded.

How to complete satisfaction of mortgage not filed

To complete satisfaction of mortgage not filed, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.