Nationwide Retirement Solutions DC-770 2022-2025 free printable template

Show details

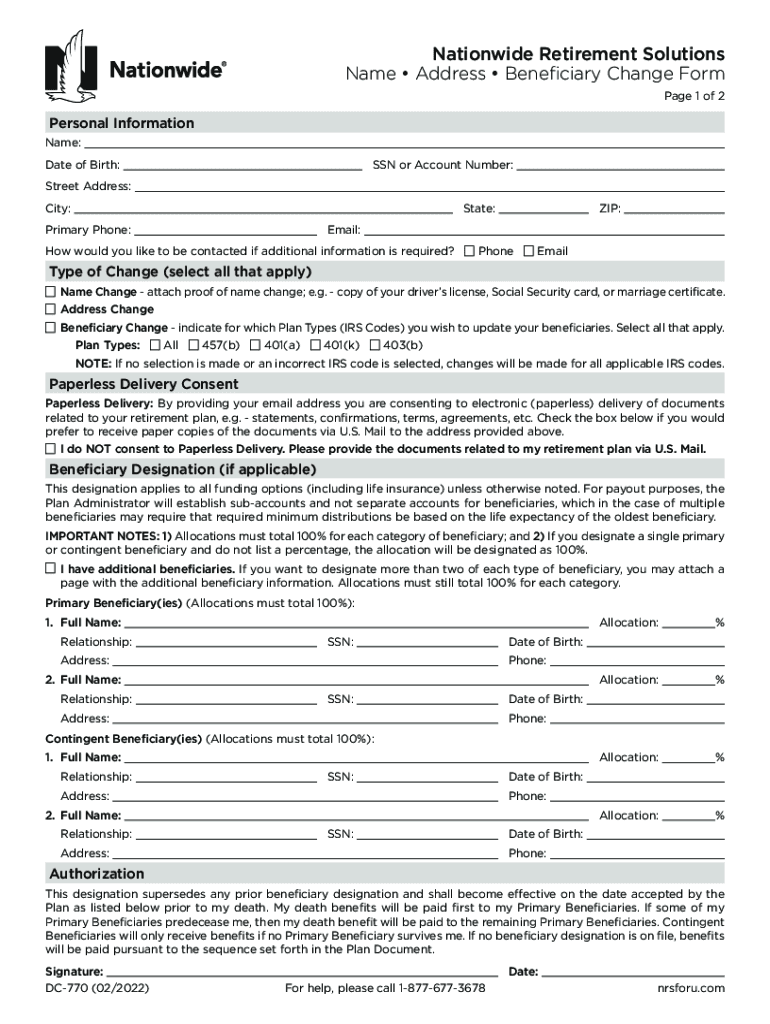

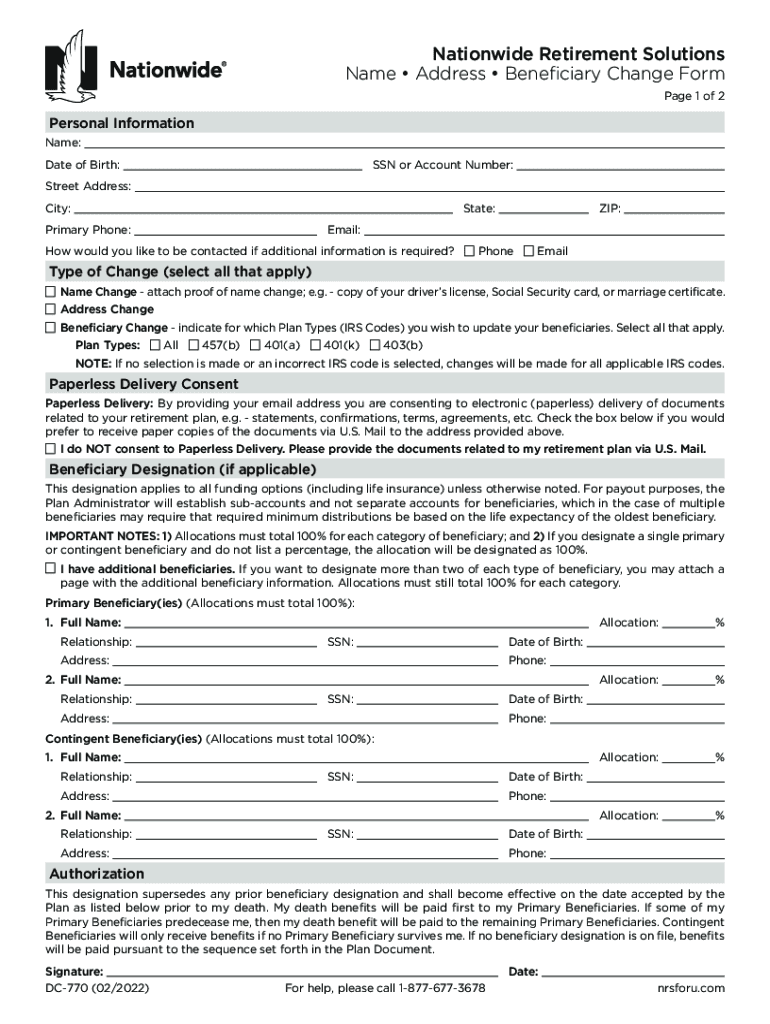

Nationwide Retirement Solutions Name Address Beneficiary Change Form Page 1 of 2Personal Information Name:Date of Birth:SSN or Account Number:Street Address:City:State:ZIP:Primary Phone:Email:How

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nationwide beneficiary change form

Edit your nationwide beneficiary change form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nationwide beneficiary change form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nationwide beneficiary change form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nationwide beneficiary change form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Nationwide Retirement Solutions DC-770 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nationwide beneficiary change form

How to fill out Nationwide Retirement Solutions DC-770

01

Obtain the Nationwide Retirement Solutions DC-770 form from your employer or the Nationwide Retirement Solutions website.

02

Enter your personal details, including your name, address, and Social Security number at the top of the form.

03

Select the type of retirement plan you wish to enroll in or make changes to.

04

Fill in the contribution percentage or amount you wish to contribute to your retirement account.

05

Review the investment options available and select your preferred investment allocations.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to your employer's HR department or to Nationwide Retirement Solutions as instructed.

Who needs Nationwide Retirement Solutions DC-770?

01

Employees who are eligible to participate in a retirement savings plan offered by their employer.

02

Individuals looking to change their contribution amounts or investment options in their current retirement account.

03

Anyone interested in starting a new retirement savings plan with Nationwide Retirement Solutions.

Fill

form

: Try Risk Free

People Also Ask about

Is Social Security sending out letters to people?

It is a scam! Phone scammers may send official-looking letters or reports by U.S. mail, email, text, or social media message to convince you they are legitimate. The letters may appear to be from SSA or SSA OIG, with official letterhead and government jargon. They may also contain misspellings and typos.

Should I be worried about continuing disability review?

Don't worry. The SSA is not looking for a reason to end your benefits. If you can show that you still have the medical condition that is keeping you from working and that you are under medical care, your benefits will likely continue. Over 90% of adults who undergo CDRs have their benefits continued.

Should I worry about a continuing disability review?

Unless your condition has improved enough for you to work, a continuing disability review is not much to worry about. You won't have to prove your disability over again.

What happens during a continuing disability review?

WHAT IS A CONTINUING DISABILITY REVIEW? Social Security periodically reviews your medical impairment(s) to determine if you continue to have a disabling condition. If we determine that you are no longer disabled or blind, your benefits will stop. We call this review a continuing disability review (CDR).

How do you know if SSA is investigating you?

YOU MAY BE UNDER SSA INVESTIGATION AT YOUR CONSULTATIVE EXAMINATION. Typically, when the SSA decides to start an investigation, they will have an investigator follow you at your Consultative Examination. The people who follow you are not police officers, they are investigators.

Why would the Social Security Administration be sending me a letter?

Whenever we send you a notice, it is because there is something you should know or do about your claim, benefit status or benefit amount. We send you a notice before we make a change to your benefit amount or eligibility. We will send a notice whenever we must tell you about activity on your case.

What are the chances of passing a CDR?

In fact, far from it – more than 90% of applicants who undergo a CDR are approved for continued benefits. Having a basic understanding of how CDRs work, and what information you will be expected to provide, can help increase those odds.

Who are considered Social Security beneficiaries?

Your spouse, children, and parents could be eligible for benefits based on your earnings. You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died.

How much do Social Security beneficiaries receive?

The latest such increase, 8.7 percent, becomes effective January 2023. The monthly maximum Federal amounts for 2023 are $914 for an eligible individual, $1,371 for an eligible individual with an eligible spouse, and $458 for an essential person.

Does Social Security have beneficiaries?

Monthly Social Security benefits are payable from the Old-Age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Funds. Such benefits are paid to several types of beneficiaries. Supplemental Security Income (SSI) benefits are paid from the general fund of the Treasury.

How do you pass a continuing disability review?

If you want to keep yours, here are some tips on how to pass a continuing disability review: Follow Your Treatment Protocol. Learn More About Your Condition. Answer the Short Form Honestly. Keep Copies of Your Medical Records. Inform the SSA of Any Change in Address.

How do I pass a continuing disability review?

If you want to keep yours, here are some tips on how to pass a continuing disability review: Follow Your Treatment Protocol. Learn More About Your Condition. Answer the Short Form Honestly. Keep Copies of Your Medical Records. Inform the SSA of Any Change in Address.

What does SSN beneficiary mean?

A Social Security beneficiary is someone who receives Social Security or Supplemental Security Income (SSI) payments. When a beneficiary passes away, there are certain steps that must be taken to cancel benefits or transfer the payments to an eligible survivor.

What are the 3 types of beneficiaries?

Your beneficiary can be a person, a charity, a trust, or your estate.

What triggers a continuing disability review?

Generally, if your health hasn't improved, or if your disability still keeps you from working, you'll continue to receive your benefits. Our review process gives you the opportunity to show that you still have a qualifying disability and ensures that your benefits aren't stopped incorrectly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nationwide beneficiary change form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your nationwide beneficiary change form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send nationwide beneficiary change form for eSignature?

nationwide beneficiary change form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit nationwide beneficiary change form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute nationwide beneficiary change form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Nationwide Retirement Solutions DC-770?

Nationwide Retirement Solutions DC-770 is a form used for specific retirement plan administration and reporting requirements, generally related to defined contribution plans.

Who is required to file Nationwide Retirement Solutions DC-770?

Employers and plan administrators managing defined contribution retirement plans are typically required to file Nationwide Retirement Solutions DC-770.

How to fill out Nationwide Retirement Solutions DC-770?

To fill out Nationwide Retirement Solutions DC-770, gather necessary plan information, complete each section of the form accurately, and submit it as per the filing instructions provided by Nationwide.

What is the purpose of Nationwide Retirement Solutions DC-770?

The purpose of Nationwide Retirement Solutions DC-770 is to ensure compliance with retirement plan regulations, facilitate reporting of plan activities, and provide information necessary for the management of the plan.

What information must be reported on Nationwide Retirement Solutions DC-770?

Information that must be reported on Nationwide Retirement Solutions DC-770 includes participant demographics, contribution details, investment selections, and any distributions made from the plan.

Fill out your nationwide beneficiary change form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nationwide Beneficiary Change Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.