Get the free Low-Income Housing Tax Credit (LIHTC) - HUD User

Show details

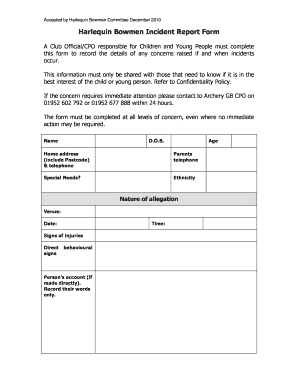

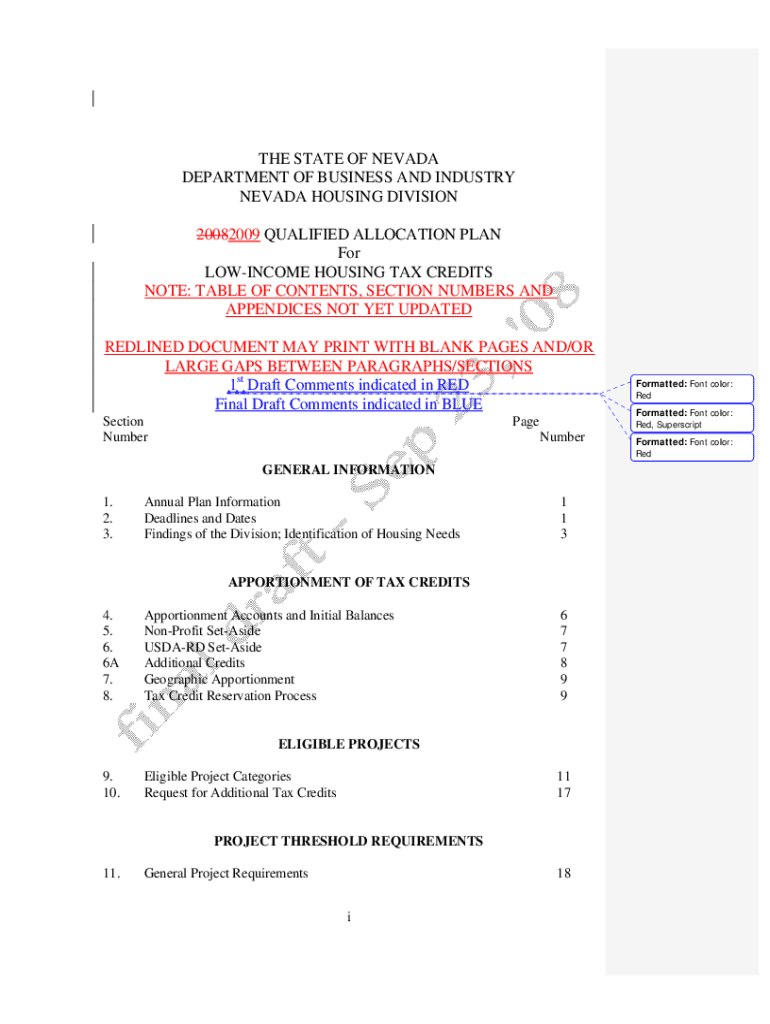

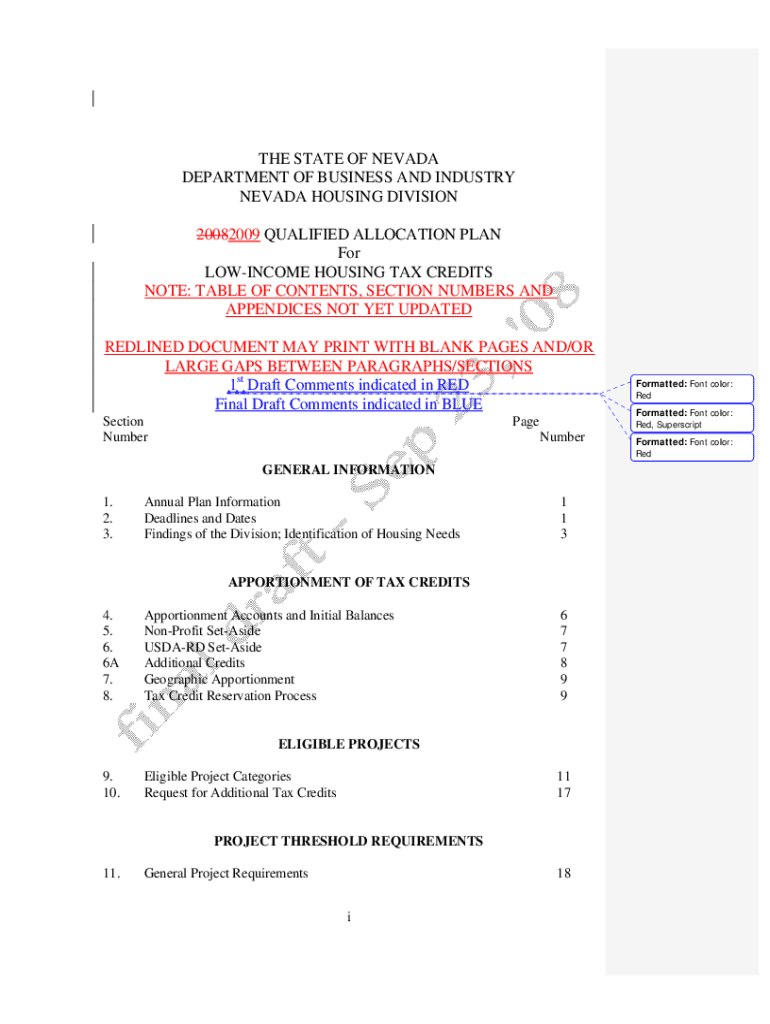

THE STATE OF NEVADA DEPARTMENT OF BUSINESS AND INDUSTRY NEVADA HOUSING DIVISION 20082009 QUALIFIED ALLOCATION PLAN For INCOME HOUSING TAX CREDITS NOTE: TABLE OF CONTENTS, SECTION NUMBERS AND APPENDICES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign low-income housing tax credit

Edit your low-income housing tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your low-income housing tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing low-income housing tax credit online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit low-income housing tax credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out low-income housing tax credit

How to fill out low-income housing tax credit

01

To fill out the low-income housing tax credit, follow these steps:

02

Obtain the necessary forms: Start by getting the appropriate forms from the Internal Revenue Service (IRS). These forms include Form 8609, Form 8586, and Form 8823.

03

Gather required information: Collect all the information needed to complete the forms, such as the project's location, type of housing, the number of low-income units, and the approximate annual income of tenants.

04

Calculate the eligible basis: Determine the eligible basis of your low-income housing project. This is done by subtracting the nonqualified basis (such as land value) from the total project costs.

05

Determine the applicable credit percentage: Check the IRS guidelines to find the correct credit percentage for your project based on the type of housing and eligibility requirements.

06

Calculate the annual tax credits: Multiply the eligible basis by the applicable credit percentage to calculate the annual tax credit amount.

07

Complete the forms: Fill out the forms accurately and include all the required information. Double-check for any errors or omissions.

08

Review and submit: Ensure all the calculations and information are correct, and review the forms before submitting them to the IRS.

09

Keep records: Maintain a copy of the filled-out forms and all supporting documents for future reference or potential audits.

Who needs low-income housing tax credit?

01

Low-income housing tax credit is beneficial for various individuals and organizations, including:

02

- Real estate developers and investors: Developers and investors who are involved in the construction or rehabilitation of low-income housing projects can utilize the tax credits to offset their tax liabilities and help finance their projects.

03

- State housing agencies: State housing agencies often allocate and administer the low-income housing tax credits to developers and projects within their jurisdictions.

04

- Non-profit organizations: Non-profit organizations that aim to provide affordable housing options for low-income individuals and families can leverage the tax credits to make their projects financially feasible.

05

- Low-income tenants: The ultimate beneficiaries of the low-income housing tax credit are the tenants who can access affordable rental units that otherwise might not be available without the credit's incentives.

06

It's important to note that eligibility requirements and regulations may vary depending on the specific jurisdiction and program guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send low-income housing tax credit to be eSigned by others?

When your low-income housing tax credit is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete low-income housing tax credit online?

With pdfFiller, you may easily complete and sign low-income housing tax credit online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit low-income housing tax credit on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing low-income housing tax credit.

What is low-income housing tax credit?

The Low-Income Housing Tax Credit (LIHTC) is a program in the United States that provides federal tax incentives to developers of affordable housing. It aims to encourage the development and rehabilitation of rental housing for low-income households.

Who is required to file low-income housing tax credit?

Property owners or developers who are eligible for the Low-Income Housing Tax Credit and wish to claim the tax credits must file the appropriate forms with the Internal Revenue Service (IRS). This typically includes entities that have built or rehabilitated qualifying housing.

How to fill out low-income housing tax credit?

To fill out the Low-Income Housing Tax Credit forms, applicants need to gather required financial information, complete IRS Form 8609, and provide details about the qualified low-income housing projects. It is also important to follow current IRS guidelines and instructions.

What is the purpose of low-income housing tax credit?

The purpose of the Low-Income Housing Tax Credit is to incentivize the construction and rehabilitation of affordable rental housing by providing tax credits to developers, thereby increasing the availability of affordable housing units for low-income individuals and families.

What information must be reported on low-income housing tax credit?

Information that must be reported on the Low-Income Housing Tax Credit includes the number of qualified low-income units, the tenants' income levels, the project location, and compliance with affordability requirements over the credit period.

Fill out your low-income housing tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Low-Income Housing Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.