FL Tourist Development Tax Owner Application - Lee County 2022 free printable template

Show details

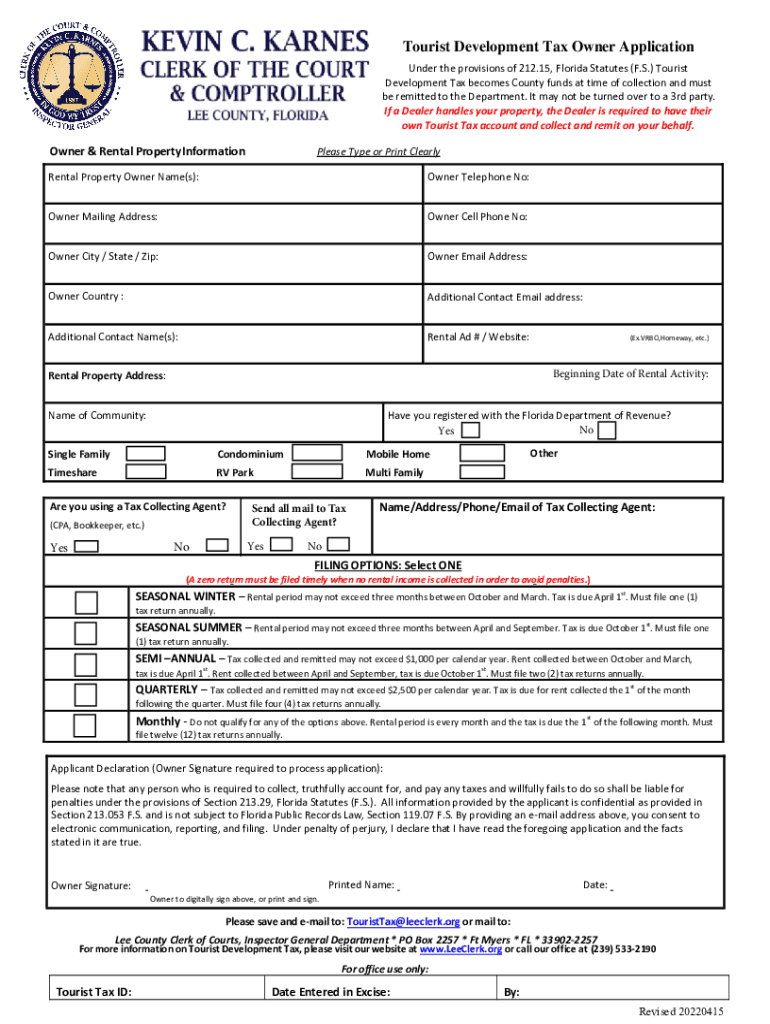

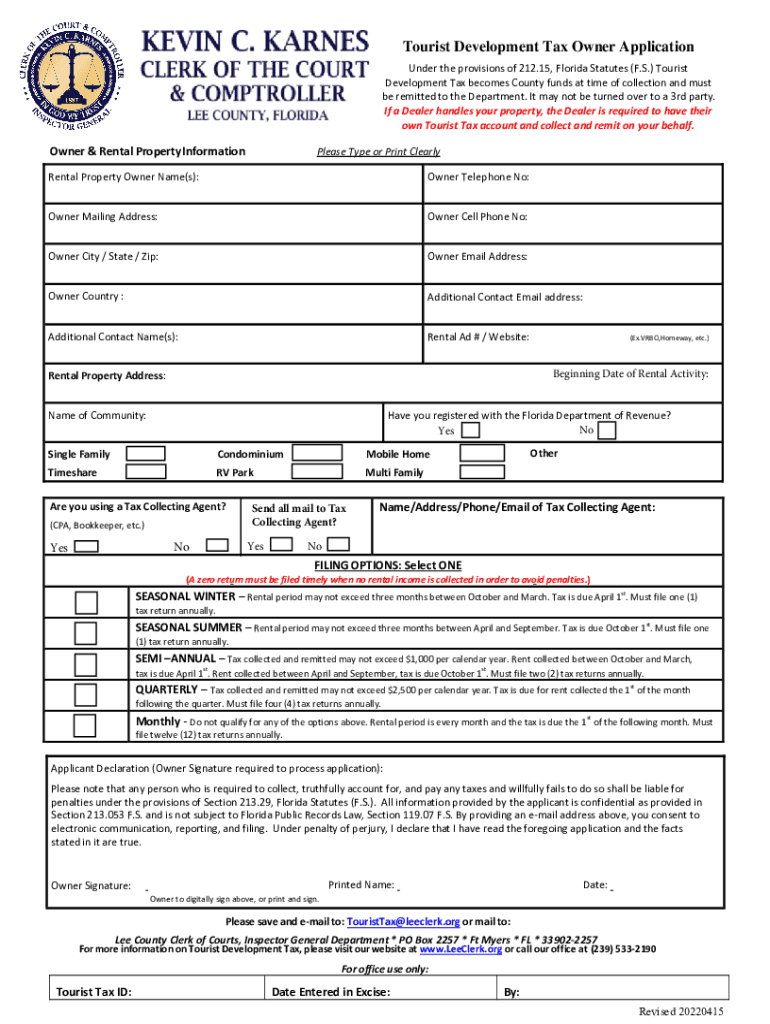

Tourist Development Tax Owner ApplicationCUnder the provisions of 212.15, Florida Statutes (F.S.) Tourist Development Tax becomes County funds at time of collection and must be remitted to the Department.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Tourist Development Tax Owner Application

Edit your FL Tourist Development Tax Owner Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Tourist Development Tax Owner Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL Tourist Development Tax Owner Application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit FL Tourist Development Tax Owner Application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Tourist Development Tax Owner Application - Lee County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL Tourist Development Tax Owner Application

How to fill out FL Tourist Development Tax Owner Application

01

Obtain the FL Tourist Development Tax Owner Application form from the appropriate county tax collector's website or office.

02

Provide personal information including your name, address, and contact information.

03

Indicate the type of property ownership (individual or business) and fill in the details accordingly.

04

Include the property address where the tourist development tax will apply.

05

Specify the dates the property will be available for rental.

06

Report the expected number of rentals and any additional relevant information.

07

Sign and date the application form to certify that all provided information is accurate.

08

Submit the completed application to the designated county office, either in person or via mail.

Who needs FL Tourist Development Tax Owner Application?

01

Individuals or businesses that own rental properties in Florida that are subject to the Tourist Development Tax.

02

Property owners who plan to rent their properties to tourists and need to report and remit the tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the tourist tax in Lee County Florida?

Must I, as a homeowner, charge tourist development tax on my own residence, or other units that I own? Yes, you must charge the 5 percent tourist development tax, as well as 6.5 percent Florida sales tax. Please contact the Florida Department of Revenue at (239) 338-2400 for information on Sales Tax.

How much is the Florida tourist tax?

The Tourist Development Tax (also referred to as tourist tax, bed tax or resort tax) is a 6% charge on the revenue from rentals of six months or less. (The tax increased to 6% on 10/1/2022.) This tax is in addition to the state sales tax (7% in Sarasota County).

What is the hotel tax in Florida?

Florida's 6% state sales tax, plus any applicable discretionary sales surtax, applies to rental charges or room rates paid for the right to use or occupy living quarters or sleeping or housekeeping accommodations for rental periods six months or less, often called “transient rental accommodations” or “transient rentals

What is tourist development tax in Tallahassee?

The tourist development tax is a local option tax passed by Leon County residents in 1988. Currently set at five percent (5%), the tax is based on the total payment received for the rental or lease of living quarters and accommodations rented for six (6) months or less.

How much is resort fee tax in Florida?

There is a 4% tax on the rent of a room or rooms in any hotel, motel, rooming house or apartment house, and a 2% tax levied on the total sales price of all food, beverages, alcoholic beverages (including beer and wine) sold in any restaurant, bar, or nightclub.

What is the tourist tax in Florida?

Tourist development tax is a 5 percent tax on the gross rental amount. The dealer is responsible to collect and remit the tax from any person or other party who rents, leases or lets for consideration living quarters or accommodations for a period of six months or less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my FL Tourist Development Tax Owner Application in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your FL Tourist Development Tax Owner Application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit FL Tourist Development Tax Owner Application online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your FL Tourist Development Tax Owner Application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit FL Tourist Development Tax Owner Application on an Android device?

You can make any changes to PDF files, like FL Tourist Development Tax Owner Application, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is FL Tourist Development Tax Owner Application?

The FL Tourist Development Tax Owner Application is a form used to register properties for the collection of a local tax that supports tourism-related projects and services.

Who is required to file FL Tourist Development Tax Owner Application?

Property owners who rent or lease transient accommodations are required to file the FL Tourist Development Tax Owner Application.

How to fill out FL Tourist Development Tax Owner Application?

To fill out the FL Tourist Development Tax Owner Application, complete the required fields with accurate property and owner information, including tax identification numbers, property address, and type of accommodation.

What is the purpose of FL Tourist Development Tax Owner Application?

The purpose of the FL Tourist Development Tax Owner Application is to ensure proper collection of the tourist development tax and to facilitate the reporting and enforcement of tax compliance.

What information must be reported on FL Tourist Development Tax Owner Application?

The information that must be reported includes the owner's name and contact details, property address, type of rental activity, and any additional required local or state identification numbers.

Fill out your FL Tourist Development Tax Owner Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Tourist Development Tax Owner Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.