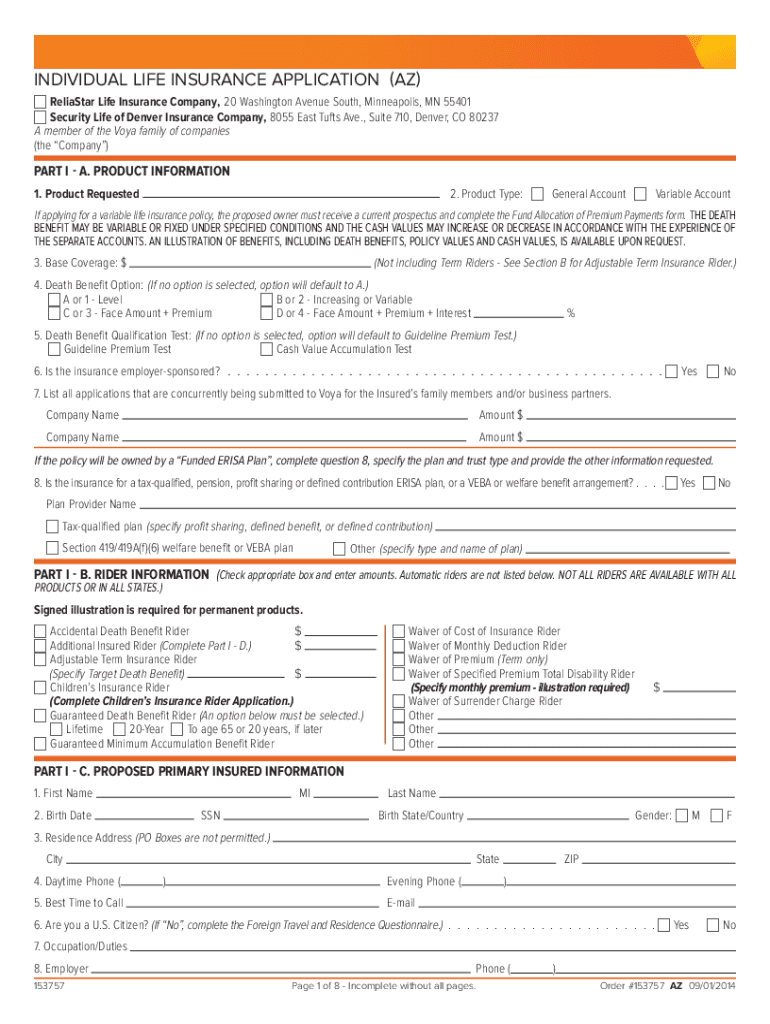

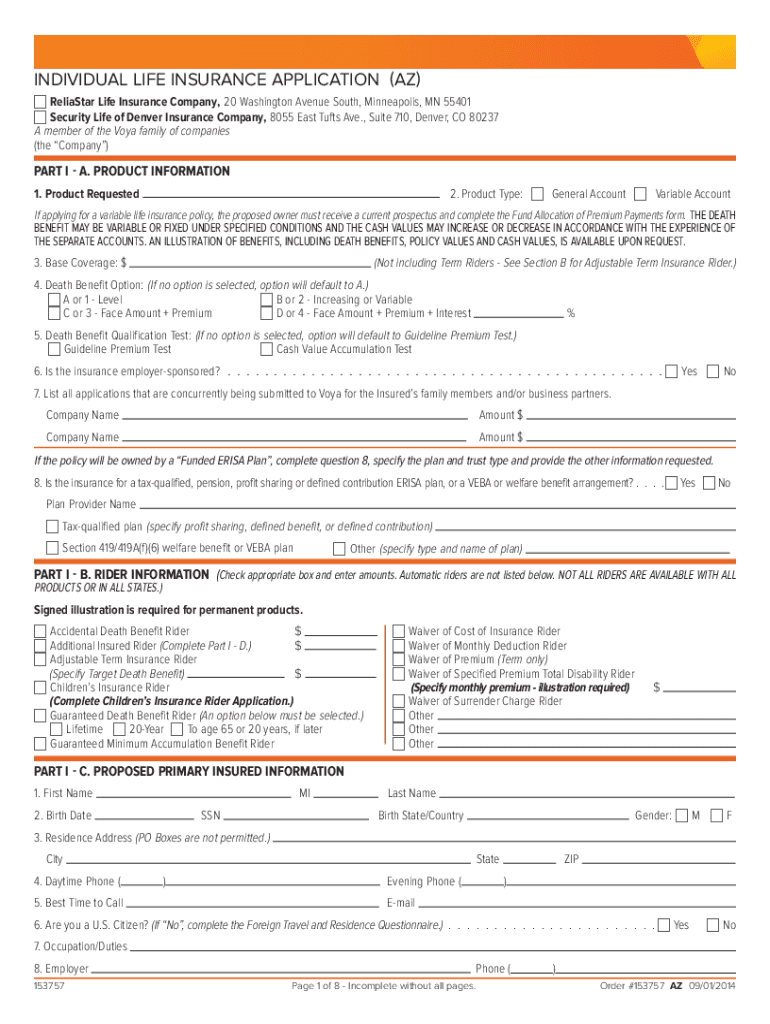

Get the free Individual Life Insurance Application (AZ)

Show details

Register Life Insurance Company

Security Life of Denver Insurance Company

Members of the Goya family of companiesIndividual Life Insurance

ApplicationTerm ProductsVariable and General Account Products

Arizona

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual life insurance application

Edit your individual life insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual life insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit individual life insurance application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit individual life insurance application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual life insurance application

How to fill out individual life insurance application

01

Start by gathering all the necessary information and documents, such as your personal details, contact information, and identification documents.

02

Determine the type and amount of life insurance coverage you need.

03

Research and compare different insurance providers to find the best policy for your needs.

04

Fill out the application form accurately and honestly, providing all the requested information.

05

Be prepared to answer questions about your medical history, lifestyle habits, and any pre-existing conditions.

06

Review the application thoroughly before submitting to ensure there are no errors or missing information.

07

Submit the completed application along with any required supporting documents.

08

Follow up with the insurance provider to confirm receipt of your application and to inquire about the next steps in the process.

09

Cooperate with any additional requirements, such as medical examinations or interviews, if requested.

10

Wait for the application to be reviewed and processed. You may be contacted for further information or clarification.

11

Once your application is approved, carefully review the policy terms and conditions before accepting it.

12

Make the required initial premium payment to activate your life insurance coverage.

13

Keep a copy of the completed application and all correspondence with the insurance provider for your records.

14

Review your life insurance policy annually or whenever there are major life changes to ensure it continues to meet your needs.

Who needs individual life insurance application?

01

Individuals who have dependents and want to financially protect their loved ones in case of their untimely death.

02

Individuals who have significant financial obligations, such as mortgages or debts, that they want to cover in the event of their death.

03

Individuals who want to ensure their funeral and burial expenses are covered without burdening their family members.

04

Individuals who want to leave a financial legacy or inheritance for their beneficiaries.

05

Individuals who want to replace lost income for their family members if they were to die prematurely.

06

Individuals who want to have a peace of mind knowing that their loved ones will be financially secure after their passing.

07

Individuals who have specific financial goals, such as funding their children's education, that they want to protect.

08

Individuals who want to have access to cash value or investment opportunities offered by certain types of life insurance policies.

09

Individuals who want to use life insurance as a part of their estate planning strategy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute individual life insurance application online?

pdfFiller makes it easy to finish and sign individual life insurance application online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out individual life insurance application using my mobile device?

Use the pdfFiller mobile app to fill out and sign individual life insurance application. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out individual life insurance application on an Android device?

Complete your individual life insurance application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is individual life insurance application?

An individual life insurance application is a formal document that an individual submits to an insurance company to apply for a life insurance policy. It gathers essential information about the applicant's health, lifestyle, and financial status to evaluate the risk and determine the premium.

Who is required to file individual life insurance application?

Any individual seeking to obtain a life insurance policy must file an individual life insurance application. This includes applicants of all ages and health statuses.

How to fill out individual life insurance application?

To fill out an individual life insurance application, gather personal information such as your name, address, date of birth, social security number, and details about your health history. Complete all sections of the application accurately, truthfully, and sign where required.

What is the purpose of individual life insurance application?

The purpose of the individual life insurance application is to provide the insurer with necessary information to assess the risk associated with insuring the applicant, determine coverage eligibility, and calculate premium amounts.

What information must be reported on individual life insurance application?

The information that must be reported on an individual life insurance application includes personal identification details, medical history, lifestyle choices (such as smoking or alcohol use), occupation, and any other factors that may affect insurability.

Fill out your individual life insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Life Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.