Get the free 401 (k) Savings Plan Enrollment Guide - Empower

Show details

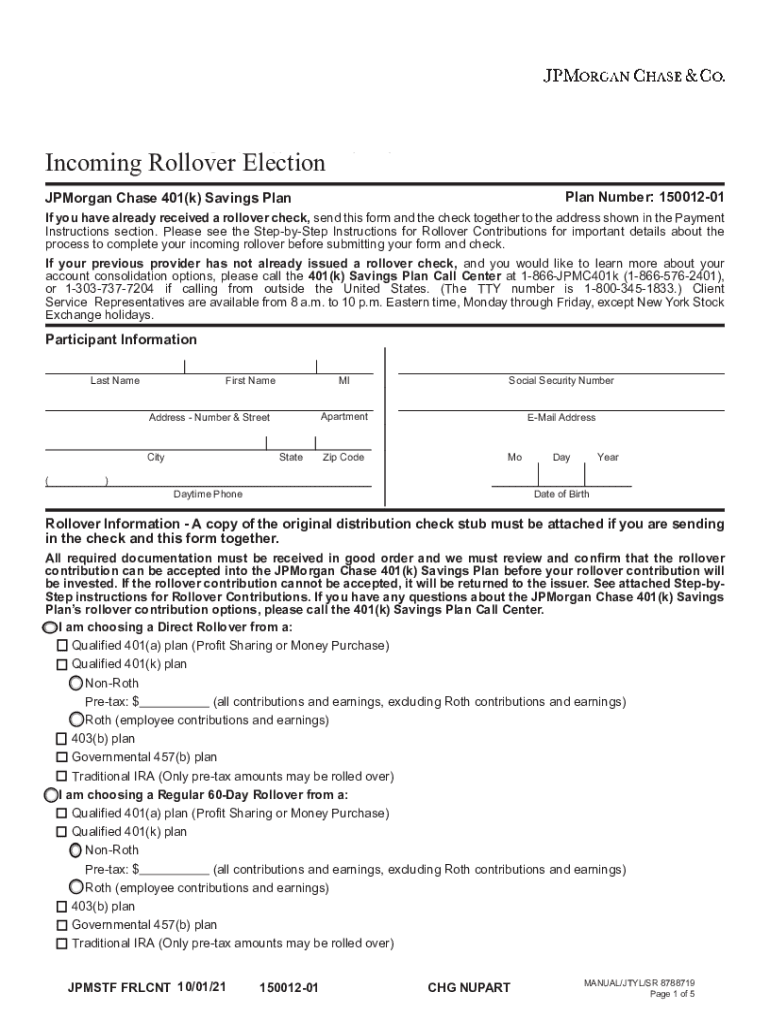

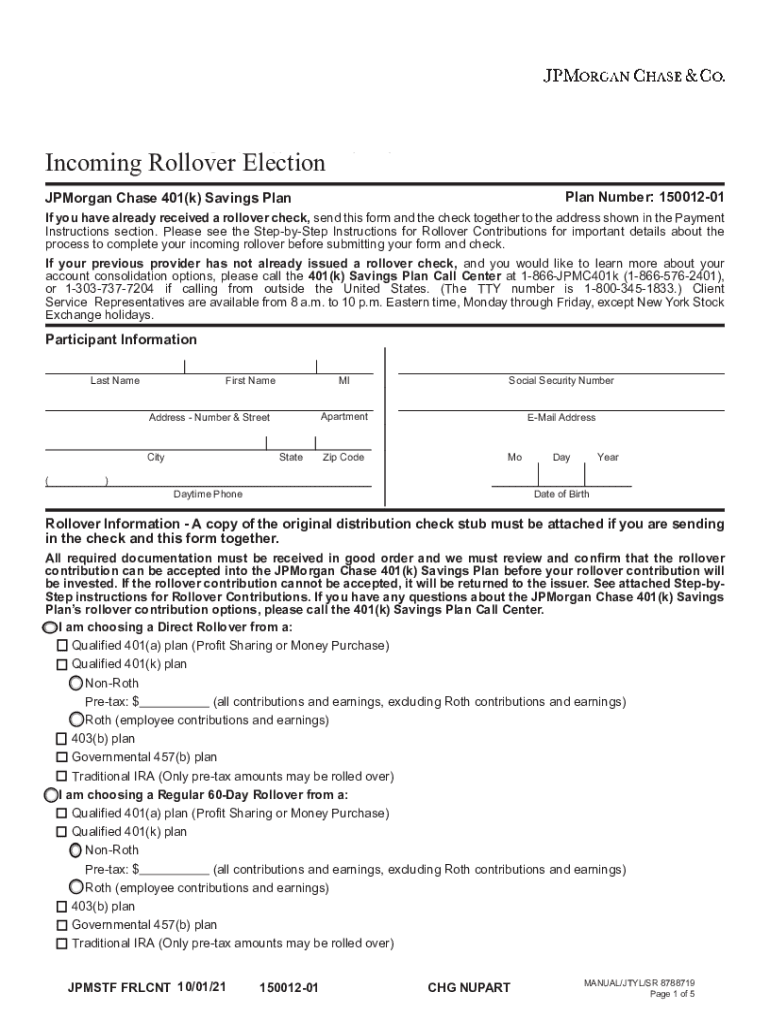

401(k) Savings Plan Enrollment Guide Your Guide to the JPMorgan Chase 401(k) Savings Unwelcome! You will be automatically enrolled in the 401(k) Savings Plan in approximately 31 days. Unless you elect

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401 k savings plan

Edit your 401 k savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401 k savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401 k savings plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 401 k savings plan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401 k savings plan

How to fill out 401 k savings plan

01

Start by understanding the basics of the 401(k) savings plan, such as eligibility requirements, contribution limits, and investment options.

02

Determine if your employer offers a 401(k) plan and if you are eligible to participate. If yes, request the necessary enrollment forms from your employer.

03

Review and complete the enrollment forms, providing all required personal information and designating your contribution amount. It is recommended to contribute at least the minimum percentage that your employer matches, as this is essentially free money.

04

Choose your investment options from the available funds within the plan. Consider your risk tolerance, time horizon, and diversification when selecting funds.

05

Decide whether to make traditional (pre-tax) or Roth (after-tax) contributions. Traditional contributions are tax-deductible, while Roth contributions provide tax-free withdrawals in retirement.

06

Monitor and manage your 401(k) account regularly. Review investment performance, rebalance your portfolio if needed, and adjust your contribution amount as your financial situation changes.

07

Take advantage of any employer matching contributions by contributing enough to maximize the match. This is essentially a guaranteed return on your investment.

08

Avoid early withdrawals from your 401(k) account, as they may be subject to taxes, penalties, and the loss of potential future earnings.

09

Keep track of your overall retirement savings and consider diversifying your investments by also contributing to other retirement accounts, such as IRAs.

10

Consult with a financial advisor if you have any questions or need personalized advice regarding your 401(k) savings plan.

11

Regularly review and update your retirement savings strategy as your goals and financial situation evolve.

Who needs 401 k savings plan?

01

The 401(k) savings plan is beneficial for anyone who wants to save for retirement and take advantage of potential tax advantages.

02

Employees who have access to a 401(k) plan through their employer should strongly consider participating, especially if there is an employer match.

03

Self-employed individuals can also set up a solo 401(k) plan to save for retirement and potentially benefit from higher contribution limits.

04

Even individuals who already have other retirement savings vehicles, such as IRAs, can still benefit from a 401(k) plan as it provides additional options for tax-deferred savings.

05

Overall, anyone who wants to secure their financial future and build a nest egg for retirement can benefit from having a 401(k) savings plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 401 k savings plan?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 401 k savings plan and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit 401 k savings plan on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 401 k savings plan. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit 401 k savings plan on an Android device?

You can make any changes to PDF files, such as 401 k savings plan, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is 401 k savings plan?

A 401(k) savings plan is a retirement savings account offered by employers that allows employees to save and invest a portion of their paycheck before taxes are taken out, often featuring employer matching contributions.

Who is required to file 401 k savings plan?

Employers who sponsor a 401(k) plan are required to file regulatory documents and tax forms, such as Form 5500, to report information about the plan's financial condition, investments, and operations.

How to fill out 401 k savings plan?

To fill out a 401(k) savings plan, an employee typically completes an enrollment form, selecting contribution percentages, investment options, and providing personal information. Employers provide guidance and the necessary forms.

What is the purpose of 401 k savings plan?

The purpose of a 401(k) savings plan is to help employees save for retirement by allowing tax-deferred contributions, thus encouraging long-term savings and investment growth.

What information must be reported on 401 k savings plan?

Required information includes plan assets, liabilities, income, expenses, and participant contributions, as well as the overall financial status of the plan.

Fill out your 401 k savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401 K Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.