Get the free Department of Revenue (DOR)Colorado General AssemblyRevenueGov. Office - Operations ...

Show details

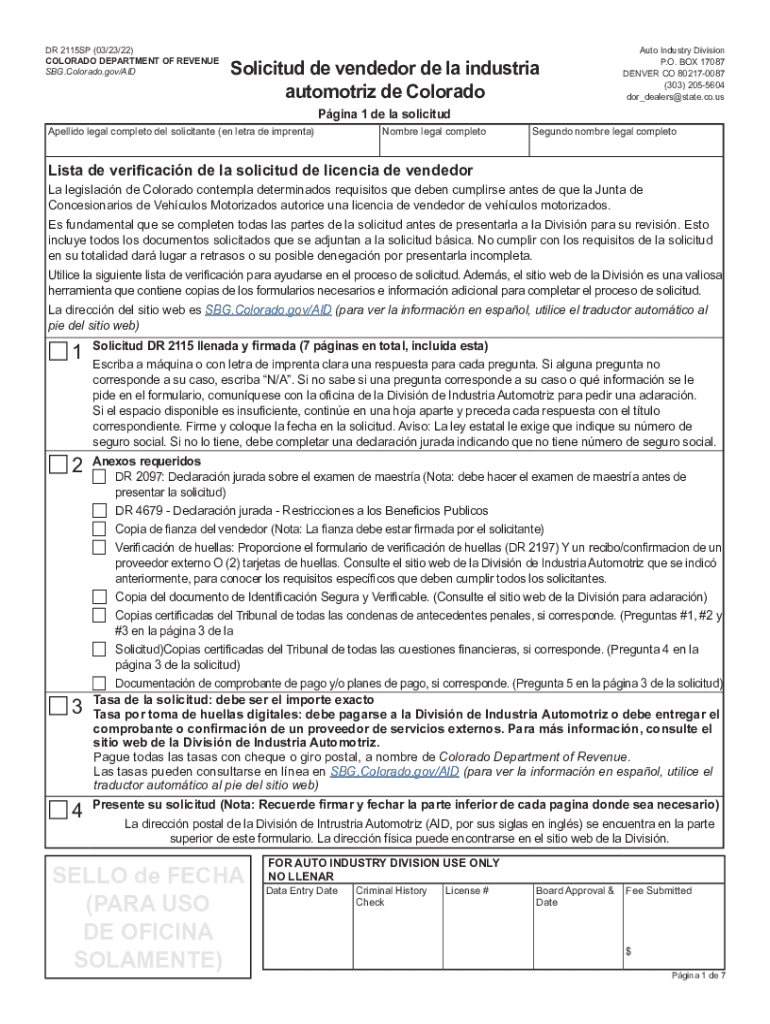

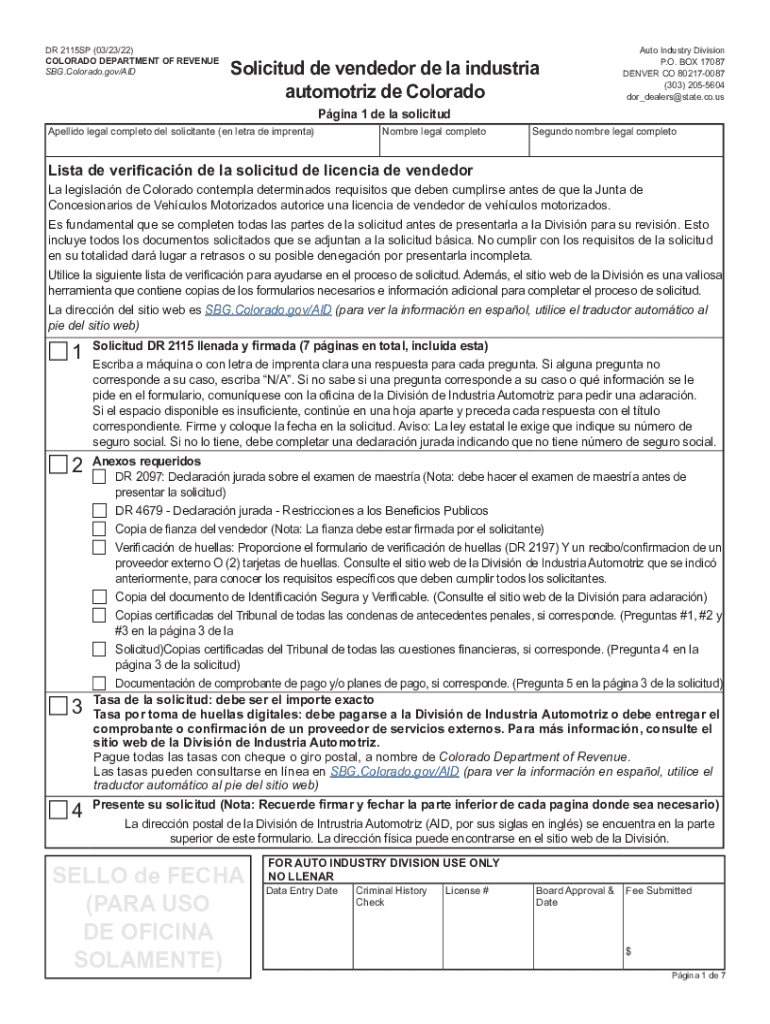

DR 2115SP (03/23/22) COLORADO DEPARTMENT OF REVENUE SBG.Colorado.gov/AIDSolicitud de vended or DE la industrial automatic de Coloradoan Industry Division P.O. BOX 17087 DENVER CO 802170087 (303) 2055604

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign department of revenue dorcolorado

Edit your department of revenue dorcolorado form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department of revenue dorcolorado form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit department of revenue dorcolorado online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit department of revenue dorcolorado. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out department of revenue dorcolorado

How to fill out department of revenue dorcolorado

01

To fill out the Department of Revenue DORColorado form, follow these steps:

02

Start by downloading the DORColorado form from the official website of the Department of Revenue.

03

Read the instructions provided with the form to understand the requirements and guidelines.

04

Gather all the necessary documents and information needed to complete the form, such as personal identification details, financial records, and any additional supporting documents.

05

Begin filling out the form by entering your personal details accurately, including your full name, address, contact information, and social security number.

06

Provide the requested information about your income, deductions, and tax liabilities as applicable.

07

Double-check all the entries to ensure accuracy and completeness.

08

Sign and date the form as required, indicating your consent and understanding of the information provided.

09

Make a copy of the completed form for your records.

10

Submit the filled-out form to the Department of Revenue via the designated method, such as mailing or online submission.

11

Keep track of any confirmation or acknowledgment of receipt provided by the Department of Revenue for future reference.

Who needs department of revenue dorcolorado?

01

Several individuals and entities can benefit from the Department of Revenue DORColorado, including:

02

- Residents of Colorado who are required to file their state taxes

03

- Individuals and businesses seeking to obtain licenses and permits for various activities such as operating a business, selling alcoholic beverages, or operating motor vehicles

04

- Taxpayers who need assistance or information regarding tax laws, deductions, credits, and filing requirements

05

- Companies and organizations engaging in various regulated activities that require compliance with state tax and revenue regulations

06

- Individuals or businesses involved in purchasing, selling, or transferring assets and properties and need to fulfill tax and revenue obligations

07

- Municipalities and local government entities that rely on the Department of Revenue to administer and collect taxes on their behalf

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find department of revenue dorcolorado?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific department of revenue dorcolorado and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in department of revenue dorcolorado?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your department of revenue dorcolorado to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the department of revenue dorcolorado form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign department of revenue dorcolorado and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is department of revenue dorcolorado?

The Colorado Department of Revenue (DOR) is the state agency responsible for managing the collection of taxes, administering state tax laws, overseeing vehicle registration and title services, and regulating various state businesses.

Who is required to file department of revenue dorcolorado?

Individuals and entities that earn income in Colorado, including businesses, employees, and independent contractors, are generally required to file with the Colorado Department of Revenue, particularly for state income tax or when conducting business operations.

How to fill out department of revenue dorcolorado?

To fill out forms for the Colorado Department of Revenue, you can obtain necessary forms from their website, follow the instructions provided for each form, ensure to include all required information, and submit it online or by mail based on your filing needs.

What is the purpose of department of revenue dorcolorado?

The purpose of the Colorado Department of Revenue is to collect state taxes, enforce tax laws, issue licenses and registrations, facilitate compliance with tax obligations, and promote fair and efficient tax administration.

What information must be reported on department of revenue dorcolorado?

Filers must report their income, deductions, credits, and other pertinent financial information that reflects their tax liability, including any business income and liabilities, on the forms designated by the Colorado Department of Revenue.

Fill out your department of revenue dorcolorado online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Department Of Revenue Dorcolorado is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.