Get the free mid-term loan application and agreement form

Show details

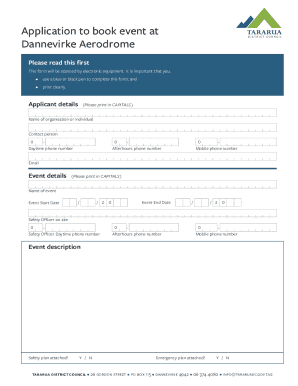

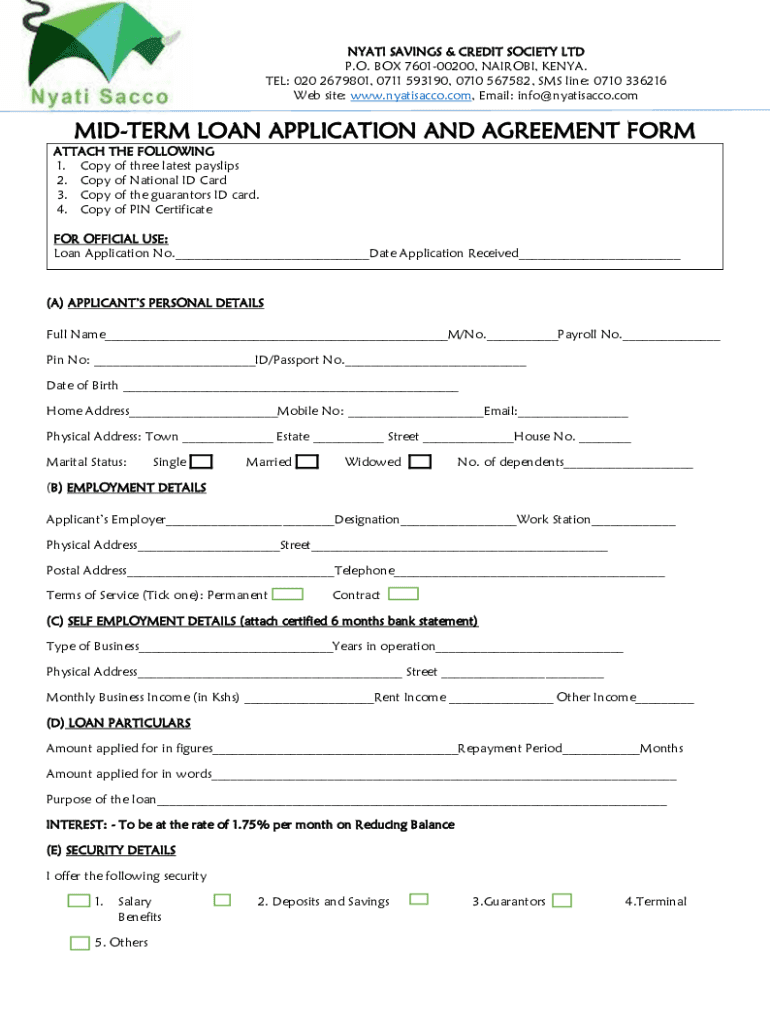

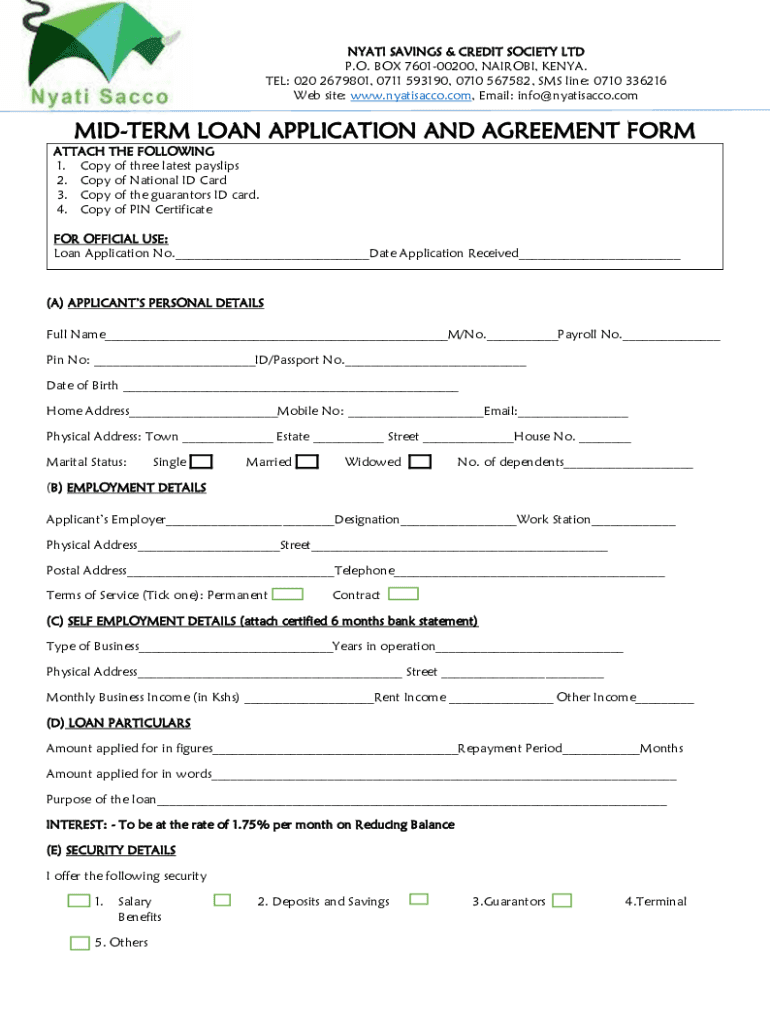

This document is an application form for a mid-term loan from Nyati Savings & Credit Society Ltd, detailing personal, employment, and financial information required for loan approval, along with necessary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nyati sacco midterm loan form

Edit your nyati sacco forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyati sacco loan forms pdf download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyati sacco downloads online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit midterm loan form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nyati sacco form

How to fill out mid-term loan application and agreement form

01

Gather personal identification documents (e.g., ID, proof of income).

02

Review the loan terms and conditions provided by the lender.

03

Fill out the application form with personal information: name, address, contact details.

04

Provide details about your financial situation, including income, expenses, and debt obligations.

05

Specify the loan amount needed and the purpose of the loan.

06

Sign the application form to confirm the information is accurate.

07

Submit the application form along with any required documentation to the lender.

Who needs mid-term loan application and agreement form?

01

Individuals seeking to finance personal projects or expenses.

02

Small business owners needing funds for business expansion or operational costs.

03

Students requiring funds for educational expenses.

04

Anyone who prefers a mid-term repayment option over short-term loans.

Fill

form

: Try Risk Free

People Also Ask about

How do I make a loan agreement?

Write your Loan Agreement in four easy steps: Provide general information about the loan. You can use this template whether you're the borrower or the lender in this agreement. Record party details. Outline the terms of the loan. Add final details as needed.

What is a term loan credit agreement?

A term loan provides borrowers with a lump sum of cash upfront in exchange for specific borrowing terms. Borrowers agree to pay their lenders a fixed amount over a certain repayment schedule with either a fixed or floating interest rate.

How do you write a simple written agreement?

How to draft a contract in 13 simple steps Start with a contract template. Understand the purpose and requirements. Identify all parties involved. Outline key terms and conditions. Define deliverables and milestones. Establish payment terms. Add termination conditions. Incorporate dispute resolution.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

What is the structure of a loan agreement?

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

How do you write a loan agreement format?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How do I write a simple loan agreement?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to write a loan application in English?

By following these steps, you can ensure that your request is well-received and considered favourably. Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Assure the Lender of Repayment. Highlight Your Creditworthiness. Include Any Collateral (If Applicable)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mid-term loan application and agreement form?

A mid-term loan application and agreement form is a document used by borrowers to apply for a mid-term loan, detailing the terms, conditions, and agreements necessary for obtaining such a loan.

Who is required to file mid-term loan application and agreement form?

Individuals or businesses seeking to obtain a mid-term loan from a financial institution are required to file the mid-term loan application and agreement form.

How to fill out mid-term loan application and agreement form?

To fill out the mid-term loan application and agreement form, one must provide personal information, financial details, loan amount requested, purpose of the loan, and any required documentation as specified by the lender.

What is the purpose of mid-term loan application and agreement form?

The purpose of the mid-term loan application and agreement form is to formally request a mid-term loan and to outline the borrower's consent to the terms set forth by the lender.

What information must be reported on mid-term loan application and agreement form?

Key information that must be reported on the mid-term loan application and agreement form includes the borrower's personal and business information, income, credit history, requested loan amount, loan purpose, and repayment terms.

Fill out your mid-term loan application and agreement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyati Sacco Loan Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.