Get the free Tax Incentives for Preserving Historic Properties - National Park Service

Show details

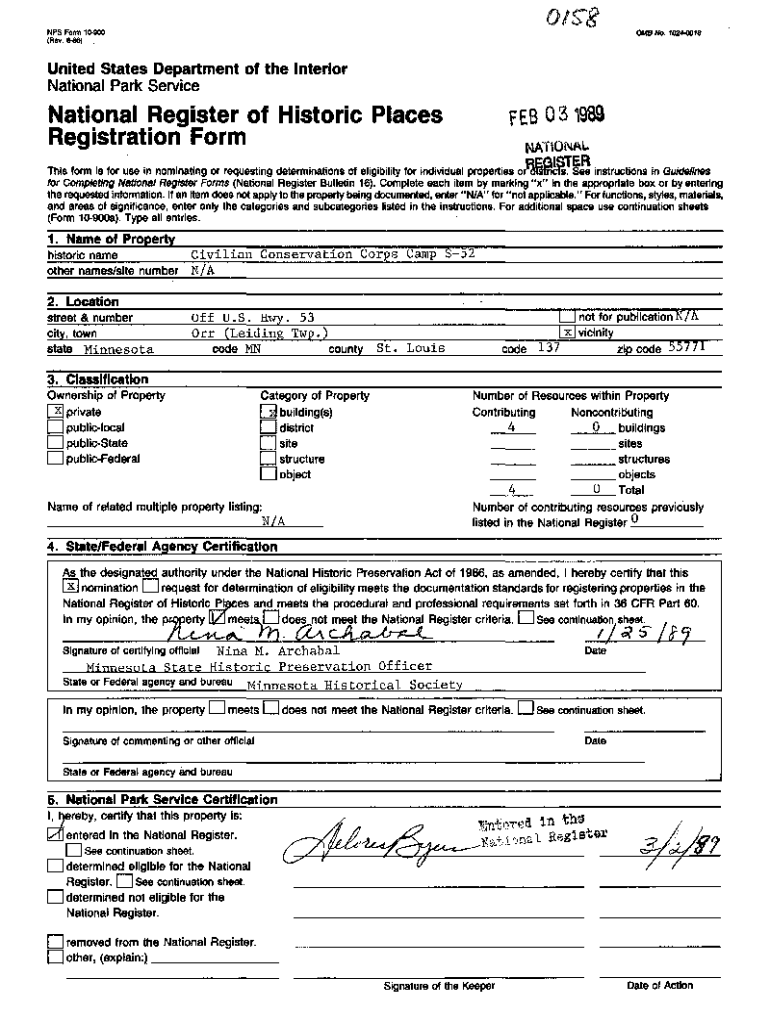

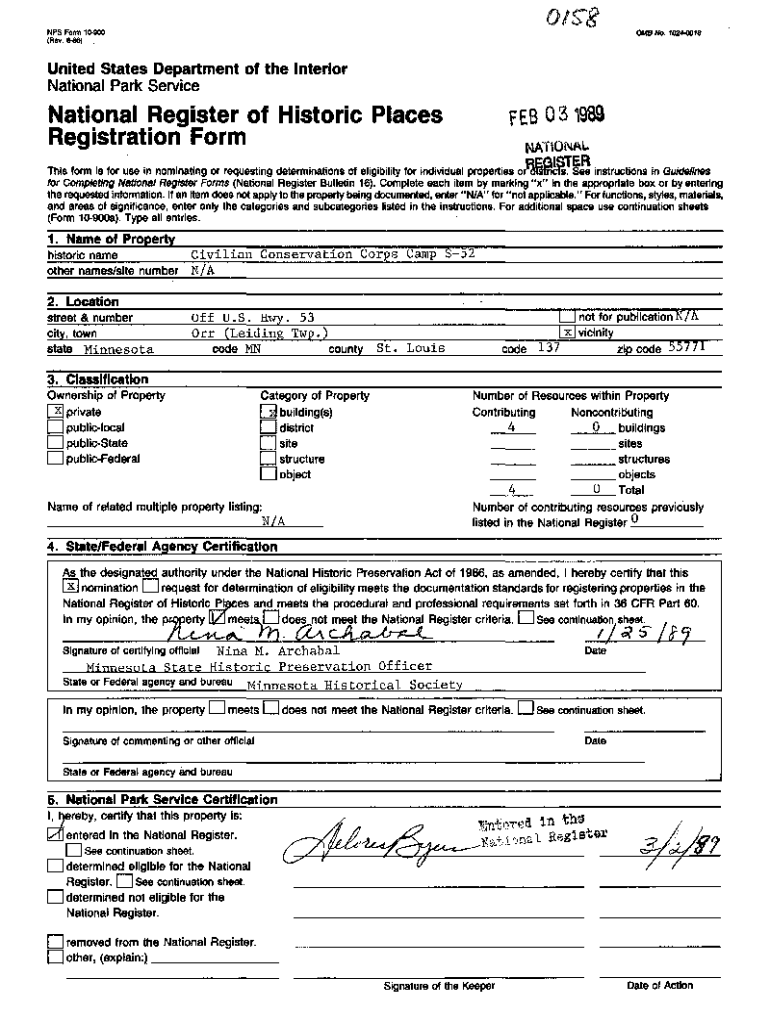

NPS Form 1O900

(Rev. 886)OM0 No. 10244018United States Department of the Interior

National Park ServiceNational Register of Historic Places

Registration FormFEB031983NATIONAL

I'm nominating or requesting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentives for preserving

Edit your tax incentives for preserving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentives for preserving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax incentives for preserving online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax incentives for preserving. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentives for preserving

How to fill out tax incentives for preserving

01

Start by gathering all the necessary documents such as receipts, invoices, and proof of expenses related to preserving.

02

Familiarize yourself with the specific tax incentives available in your jurisdiction for preserving.

03

Fill out the relevant sections of the tax form or online platform, providing accurate and detailed information about your preservation activities.

04

Ensure that you submit all required supporting documentation along with your tax return.

05

Double-check your filled-out form for any errors or omissions before submitting it.

06

File your tax return and wait for any potential review or approval from the tax authorities.

07

Keep copies of all tax forms, documents, and receipts related to your preservation activities for future reference.

Who needs tax incentives for preserving?

01

Individuals or households engaged in activities such as historic preservation, land conservation, or natural resource preservation.

02

Businesses or organizations involved in the restoration and preservation of historic buildings, sites, or landmarks.

03

Developers or investors who participate in projects that promote environmental conservation or sustainability.

04

Farmers or agricultural businesses implementing practices to preserve soil fertility, biodiversity, or water resources.

05

Any taxpayer eligible for specific tax incentives or deductions provided by their local authorities for preserving.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax incentives for preserving for eSignature?

When you're ready to share your tax incentives for preserving, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the tax incentives for preserving in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax incentives for preserving and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit tax incentives for preserving straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing tax incentives for preserving.

What is tax incentives for preserving?

Tax incentives for preserving are government programs that provide financial benefits or deductions to individuals or organizations who work to protect and preserve natural or cultural resources.

Who is required to file tax incentives for preserving?

Individuals or organizations who have participated in programs or activities that qualify for tax incentives for preserving are required to file for these incentives.

How to fill out tax incentives for preserving?

Tax incentives for preserving can be filled out by providing information about the specific program or activity that qualifies for the incentives, as well as any relevant documentation or proof of participation.

What is the purpose of tax incentives for preserving?

The purpose of tax incentives for preserving is to encourage individuals and organizations to participate in conservation efforts by providing financial benefits or deductions as a form of incentive.

What information must be reported on tax incentives for preserving?

Information that must be reported on tax incentives for preserving includes details about the conservation program or activity, the specific resources being preserved, and any financial benefits or deductions being claimed.

Fill out your tax incentives for preserving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentives For Preserving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.