Get the free PRESIDENTIAL LIFE INSURANCE COMPANY

Show details

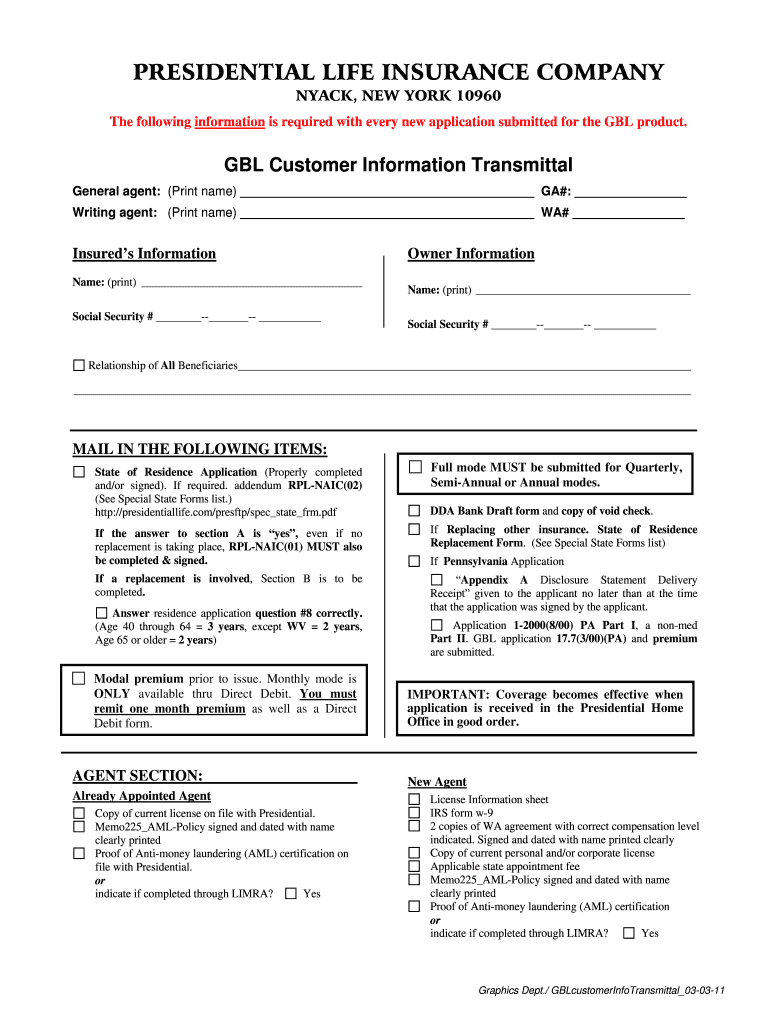

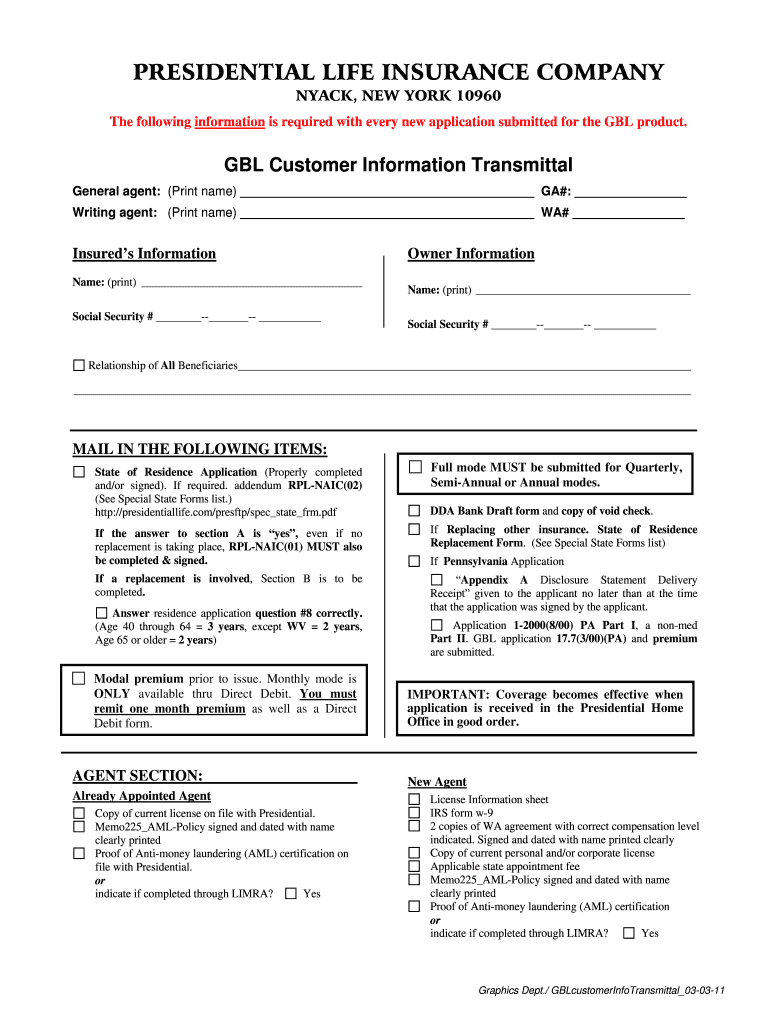

PRESIDENTIAL LIFE INSURANCE COMPANY NY ACK, NEW YORK 10960 The following information is required with every new application submitted for the GB product. GB Customer Information Transmittal General

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign presidential life insurance company

Edit your presidential life insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your presidential life insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit presidential life insurance company online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit presidential life insurance company. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out presidential life insurance company

How to fill out presidential life insurance company:

01

Research and gather information: Begin by researching and understanding the types of life insurance policies offered by Presidential Life Insurance Company. Evaluate your financial needs, budget, and future goals to determine the suitable policy for you.

02

Contact an agent or visit the official website: Reach out to a licensed agent who represents Presidential Life Insurance Company or visit their official website. Agents can guide you through the process and assist with any questions or concerns you may have. The website may also provide you with detailed instructions on how to fill out the application online.

03

Review and choose a policy: Carefully review the different policies available from Presidential Life Insurance Company. Consider factors such as coverage amount, premium cost, policy term, and any additional benefits or riders. Select the policy that best aligns with your needs and preferences.

04

Complete the application: Obtain a copy of the application form either from the agent or by downloading it from the company's website. Fill out the application accurately, providing all the necessary personal and financial information requested. Double-check the form for any errors or missing details before submitting it.

05

Submit supporting documents: Certain documents may be required as part of the application process, such as proof of identity, medical records, or financial statements. Ensure that all required documents are gathered and attached to your application.

06

Review and sign: Read the completed application form thoroughly to ensure its accuracy. Once satisfied, sign the application form and complete any additional signatures or authorizations as instructed.

07

Pay the premium: Determine the premium payment method and submit the necessary payment along with the application. Options may include a one-time payment, recurring monthly or annual payments, or automatic deductions from your bank account.

08

Await underwriting and approval: Once your application is submitted, Presidential Life Insurance Company will review your information, conduct underwriting, and assess the insurability risk. This process may involve a medical examination or additional documentation if required. Wait for the company's decision on your application.

09

Receive the policy: If your application is approved, you will receive the policy documents from Presidential Life Insurance Company. Carefully review the policy to ensure it accurately reflects your chosen coverage and understand the terms and conditions.

10

Maintain the policy: Stay up-to-date with your premium payments to ensure continuous coverage. Review your policy periodically, especially during significant life events, to ensure it still aligns with your changing needs and make any necessary adjustments.

Who needs presidential life insurance company:

01

Individuals with dependents: People who have dependents, such as a spouse, children, or aging parents who rely on their financial support, may need life insurance to protect their loved ones financially in the event of their death.

02

Breadwinners: If you are the main source of income for your family, it is crucial to consider life insurance. This can provide a financial safety net and ensure your loved ones' financial security even if you are no longer there to provide for them.

03

Business owners: Business owners often face unique financial risks and responsibilities. Life insurance can help safeguard their business by providing coverage for business debts, fulfilling buy-sell agreements, or ensuring continuity in case of the owner's untimely demise.

04

Estate planning: Individuals with significant estates may require life insurance to cover potential estate taxes or to provide liquidity to their heirs. Life insurance can help preserve the value of the estate and provide an inheritance for beneficiaries.

05

Individuals with specific financial goals: Some individuals may have specific financial goals, such as paying off a mortgage, funding a child's education, or leaving a charitable legacy. Life insurance policies can be structured to help fulfill these goals even after their passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute presidential life insurance company online?

Completing and signing presidential life insurance company online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the presidential life insurance company in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your presidential life insurance company right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out presidential life insurance company on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your presidential life insurance company by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is presidential life insurance company?

Presidential Life Insurance Company is an insurance company that offers life insurance policies to individuals.

Who is required to file presidential life insurance company?

Individuals who have purchased a life insurance policy from Presidential Life Insurance Company are required to file with the company.

How to fill out presidential life insurance company?

To fill out a form with the necessary information about your life insurance policy purchased from Presidential Life Insurance Company.

What is the purpose of presidential life insurance company?

The purpose of Presidential Life Insurance Company is to provide financial security for individuals and their loved ones in the event of death.

What information must be reported on presidential life insurance company?

Information such as policy number, insured amount, beneficiaries, and contact information must be reported on the presidential life insurance company form.

Fill out your presidential life insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Presidential Life Insurance Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.