Get the free Sr Director of Tax jobs in San Francisco, CA - Indeed.com

Show details

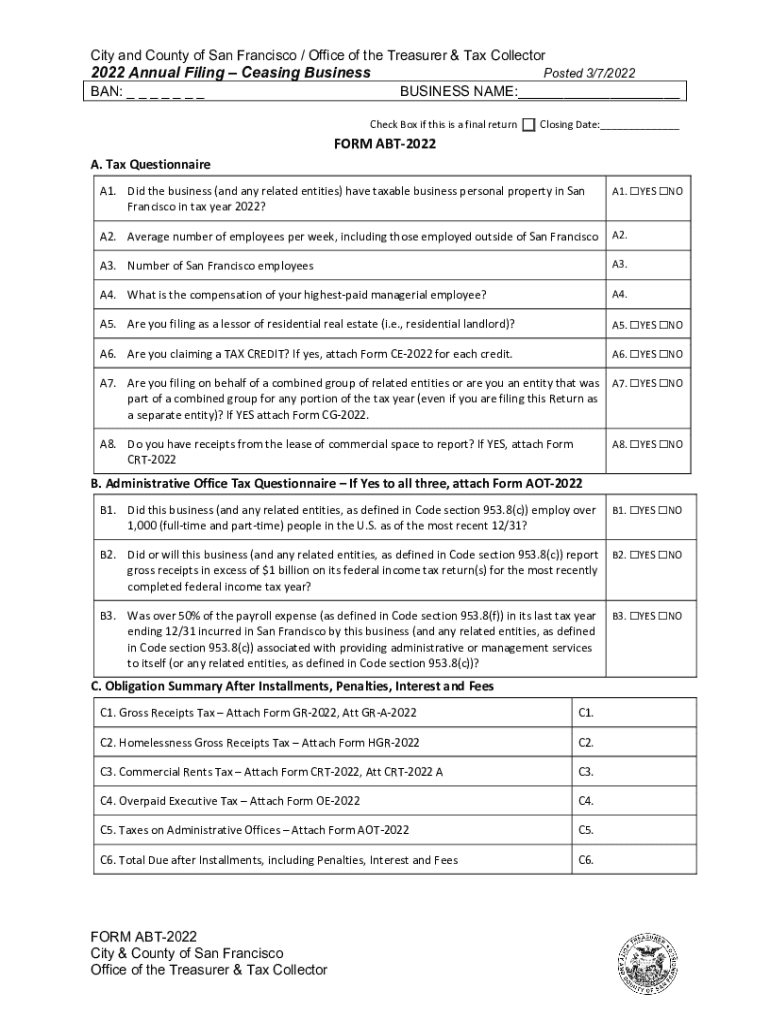

City and County of San Francisco / Office of the Treasurer & Tax Collector2022 Annual Filing Ceasing Business BAN: _ _ _ _ _ _ _Posted 3/7/2022BUSINESS NAME:___Check Box if this is a final return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sr director of tax

Edit your sr director of tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sr director of tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sr director of tax online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sr director of tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sr director of tax

How to fill out sr director of tax

01

To fill out the position of Sr Director of Tax, follow these steps:

02

Start by reviewing the job description and requirements to understand the specific responsibilities and qualifications for the role.

03

Update your resume to highlight relevant experience in tax management, leadership, and strategic decision-making.

04

Prepare a cover letter specifically tailored to showcase your skills and qualifications for the Sr Director of Tax position.

05

Research the company and its tax department to gain a better understanding of their goals and challenges.

06

Fill out the application form provided by the company, ensuring all required fields are completed accurately and honestly.

07

Attach your updated resume and cover letter to the application form.

08

Submit the completed application along with any other required documents through the designated method (online submission, email, or mail).

09

Follow up with the company to confirm receipt of your application and to express your continued interest in the position.

10

Prepare for potential interviews by familiarizing yourself with common interview questions, practicing your responses, and researching the company further.

11

Attend any interviews scheduled by the company, showcasing your expertise, experience, and enthusiasm for the role.

12

After the interview process, wait for a response from the company regarding the status of your application.

13

If selected, negotiate the terms of employment (salary, benefits, start date, etc.) with the company.

14

Once all terms are agreed upon, complete any necessary paperwork, such as signing an employment contract, and prepare for your new role as Sr Director of Tax.

15

If not selected, continue to search for other opportunities and consider seeking feedback from the company to improve your future applications.

Who needs sr director of tax?

01

Sr Director of Tax is needed by companies and organizations that have complex tax structures and obligations. This role is typically required by large corporations, multinational companies, financial institutions, or organizations with extensive operations and significant tax responsibilities.

02

The Sr Director of Tax is responsible for overseeing and managing all aspects of the company's tax strategy, compliance, and reporting. They play a crucial role in minimizing tax risks, optimizing tax savings, and ensuring compliance with tax laws and regulations. The position is essential for organizations that deal with intricate tax matters and require strategic tax planning and guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sr director of tax?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the sr director of tax in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my sr director of tax in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your sr director of tax and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out sr director of tax on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your sr director of tax, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is sr director of tax?

The Senior Director of Tax is a high-level executive responsible for overseeing an organization's tax strategy, compliance, and planning.

Who is required to file sr director of tax?

Typically, organizations or entities with significant tax obligations or complex financial structures are required to have tax filings managed by a Senior Director of Tax.

How to fill out sr director of tax?

Filling out the Senior Director of Tax involves collecting accurate financial information, ensuring compliance with tax laws, and submitting the required documentation to the tax authorities.

What is the purpose of sr director of tax?

The purpose of the Senior Director of Tax is to manage tax risks, ensure compliance with tax regulations, and provide strategic guidance on tax-related issues to maximize the organization's tax efficiency.

What information must be reported on sr director of tax?

Information to be reported typically includes income, deductions, credits, and any relevant financial data that affects tax liabilities.

Fill out your sr director of tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sr Director Of Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.