Get the free MORTGAGE APPLICATION FORM - coast2coastfinance com

Show details

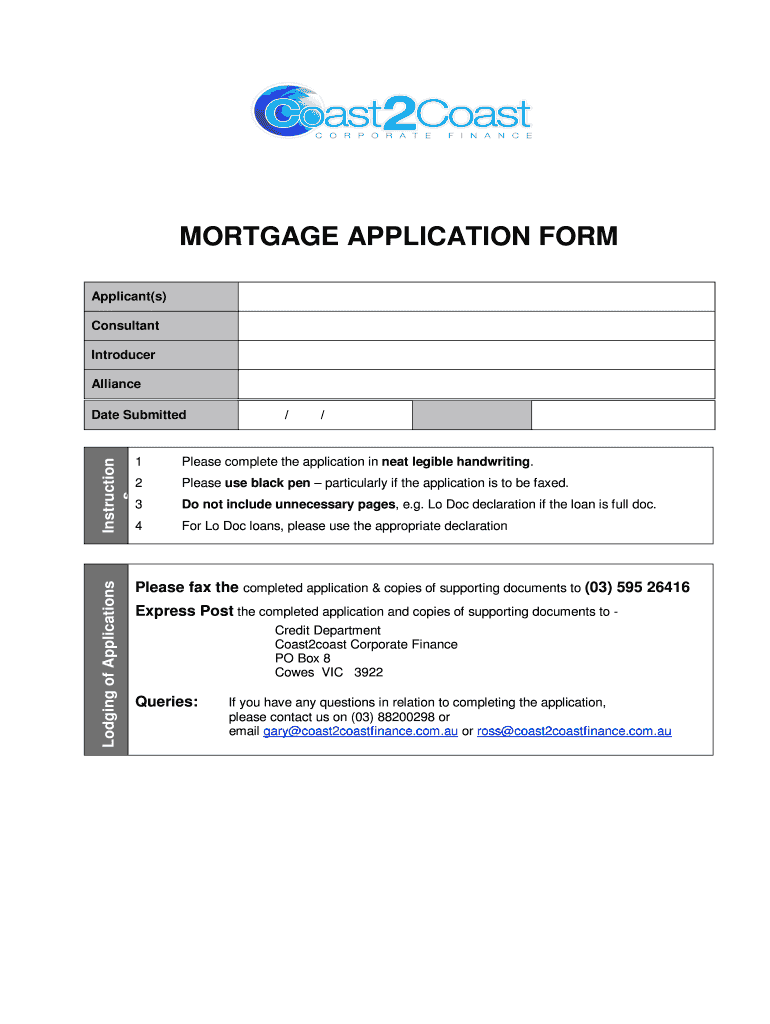

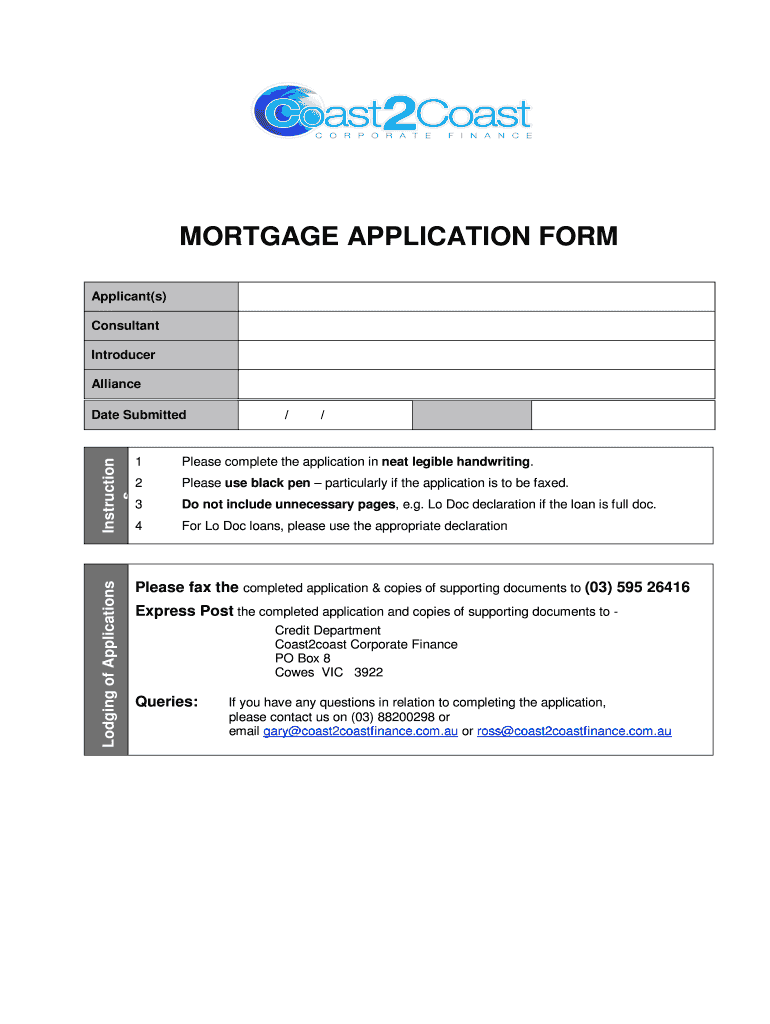

MORTGAGE APPLICATION FORM Applicant s Consultant Introducer Alliance Date Submitted / Please complete the application in neat legible handwriting. Please use black pen particularly if the application is to be faxed* Do not include unnecessary pages e*g* Lo Doc declaration if the loan is full doc* For Lo Doc loans please use the appropriate declaration Lodging of Applications Instruction s Please fax the completed application copies of supporting documents to 03 595 26416 Express Post the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage application form

Edit your mortgage application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage application form online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage application form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage application form

How to fill out MORTGAGE APPLICATION FORM

01

Begin with personal information: Fill out your full name, contact details, and social security number.

02

Provide property details: Include the address and type of property you wish to purchase.

03

State your employment information: Add the name of your employer, your job title, and your annual income.

04

List your financial information: Include details about your assets, such as bank accounts and investments, and your liabilities, like existing loans.

05

Specify the type of loan: Indicate whether you're applying for a fixed-rate mortgage, adjustable-rate mortgage, etc.

06

Fill out the loan amount: Specify how much money you're requesting from the lender.

07

Include information about down payment: State how much money you plan to put down upfront on the property.

08

Review your application: Ensure that all information is accurate and complete.

09

Sign and date the application: Provide your signature and the date to validate the application.

Who needs MORTGAGE APPLICATION FORM?

01

Individuals looking to buy a home or property.

02

First-time home buyers seeking financing.

03

Homeowners refinancing their existing mortgage.

04

Real estate investors acquiring rental properties.

Fill

form

: Try Risk Free

People Also Ask about

What are the 4 Cs that lenders use to qualify a borrower?

The 4 Cs of mortgage lending Credit. Are you likely to pay back the loan? Your past borrowing behavior tells mortgage lenders how reliable you are at paying your debts. Capacity. Can you afford to pay a mortgage? Capital. What resources can you tap to pay your mortgage? Collateral. What's securing the loan?

What is a 1003 form in a mortgage?

A completed Form 65 is used to begin the process of determining the Borrower's credit reputation and capacity to repay the Mortgage. If a residential mortgage credit report (RMCR) is ordered, the information on the Form 65 must be provided to the consumer reporting agency that is to issue the RMCR.

What are the 4 Cs of mortgage underwriting?

Credit, Capacity, Cash, and Collateral are the four Cs of home loans. Knowing them inside and out and making each a priority before purchasing a home will ensure you get the best rates and repayment options out there.

What are the 4 C's required for mortgage underwriting?

Mortgage application requirements Employment and income details: Information about your employment and proof of income, such as pay stubs or tax returns. Assets and liabilities: Details about your savings, investments, properties and existing debts. Credit history: Your credit score and credit report.

What are the 5 Cs of mortgage underwriting?

The Underwriting Process of a Loan Application One of the first things all lenders learn and use to make loan decisions are the “Five C's of Credit": Character, Conditions, Capital, Capacity, and Collateral. These are the criteria your prospective lender uses to determine whether to make you a loan (and on what terms).

What are the four Cs of credit underwriting?

Standards may differ from lender to lender, but there are four core components — the four C's — that lenders will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE APPLICATION FORM?

A mortgage application form is a formal document that potential borrowers complete to apply for a mortgage loan. It contains personal, financial, and property information to assist lenders in assessing the borrower's creditworthiness and the risk associated with the loan.

Who is required to file MORTGAGE APPLICATION FORM?

Anyone looking to secure a mortgage loan for purchasing a property or refinancing an existing mortgage is required to file a mortgage application form.

How to fill out MORTGAGE APPLICATION FORM?

To fill out a mortgage application form, you need to provide personal identification details, employment and income information, details about your debts and assets, and information about the property you wish to finance.

What is the purpose of MORTGAGE APPLICATION FORM?

The purpose of the mortgage application form is to collect necessary information from a borrower so that lenders can evaluate the borrower's financial situation and determine the eligibility for a mortgage loan.

What information must be reported on MORTGAGE APPLICATION FORM?

The information typically required on a mortgage application form includes the borrower's name, address, Social Security number, employment history, income, current debts, and details about the property being purchased or refinanced.

Fill out your mortgage application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Application Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.