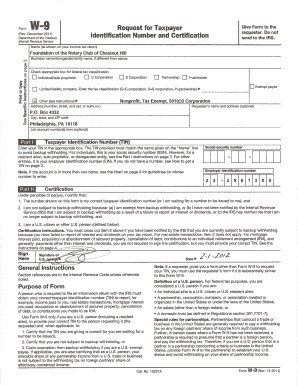

Get the free Virginia Schedule CR

Show details

Schedule CR is used for calculating various nonrefundable and refundable tax credits in Virginia. It includes credits for low-income individuals, enterprise zones, recyclable materials, conservation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign virginia schedule cr

Edit your virginia schedule cr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virginia schedule cr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing virginia schedule cr online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit virginia schedule cr. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out virginia schedule cr

How to fill out Virginia Schedule CR

01

Begin by obtaining the Virginia Schedule CR form.

02

Review the instructions associated with the form for specific guidelines.

03

Fill in your personal information, including your name and address, at the top of the form.

04

Enter your Virginia taxable income as reported on your Virginia Form 760.

05

Calculate your nonrefundable and refundable credits as applicable.

06

Complete the sections pertaining to each specific credit you are claiming, such as any credits for low-income individuals, solar energy equipment, etc.

07

Ensure all figures are accurate and consistent with your documentation.

08

Review the additional questions to determine if other credits apply.

09

Sign and date the form before submission.

Who needs Virginia Schedule CR?

01

Individuals who are filing a personal income tax return in Virginia and are eligible for certain tax credits.

02

Taxpayers who qualify for nonrefundable or refundable credits in Virginia, which may include credits for low-income housing, solar energy systems, and more.

Fill

form

: Try Risk Free

People Also Ask about

How much is income tax on $70,000 in Virginia?

If you make $70,000 a year living in Virginia as a single filer, you will be taxed $13,707. Your average tax rate is 14.93% and your marginal tax rate is 22%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

What is the Virginia reciprocity tax form?

If you are a resident of a reciprocity state, accept employment in Virginia, and meet the criteria for exemption, complete Form VA-4 to certify your exemption and give the form to your employer. You will need to re-certify your exemption every year.

What is the Virginia state withholding tax for non-residents?

The PTE is required to withhold 5% of the share of taxable income from Virginia sources that is allocable to each nonresident owner.

Do I have to pay Virginia state taxes if I work remotely?

As a remote worker, you must pay tax on all your income to the state you live in (excluding Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming; these states do not have personal income tax).

What is form 763s Virginia?

The state of Virginia allows a special nonresident claim for taxes paid to the state by nonresidents in error, or under special circumstances. Both spouses must complete a separate Form 763-S when both filers have Virginia income tax withheld.

At what age do you stop paying state taxes in Virginia?

Age 65 or over: Each filer who is age 65 or over by January 1 may claim an additional exemption. When a married couple uses the Spouse Tax Adjustment, each spouse must claim his or her own age exemption.

What is the Virginia non resident tax return form?

Nonresidents of Virginia must file a Form 763. (A person is considered a nonresident of Virginia if they lived in Virginia for less than 183 days in a calendar year). An instruction booklet with return mailing address is also available on the website. Part-Year Residents of Virginia file a Form 760PY.

Am I eligible for Virginia state tax rebate?

Are you eligible? Not every taxpayer is eligible. If you had a tax liability last year, you will receive up to $200 if you filed individually, and up to $400 if you filed jointly.

What is the tax form for a non resident?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign students, scholars, teachers, researchers and exchange visitors for more information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Virginia Schedule CR?

Virginia Schedule CR is a form used by taxpayers to report and claim various credits against their Virginia income tax liability.

Who is required to file Virginia Schedule CR?

Taxpayers in Virginia who wish to claim certain tax credits, such as the tax credit for low-income individuals, must file Virginia Schedule CR.

How to fill out Virginia Schedule CR?

To fill out Virginia Schedule CR, taxpayers need to provide their personal information, specify the credits they are claiming, and complete the relevant sections related to those credits.

What is the purpose of Virginia Schedule CR?

The purpose of Virginia Schedule CR is to facilitate the claiming of tax credits by providing the necessary information to the Virginia Department of Taxation.

What information must be reported on Virginia Schedule CR?

Taxpayers must report their name, address, Social Security number, the type of credits being claimed, and any other pertinent details required for each specific credit being requested.

Fill out your virginia schedule cr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Virginia Schedule Cr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.