Get the free 206 Sales Tax Exemptions for Nonprofit Organizations

Show details

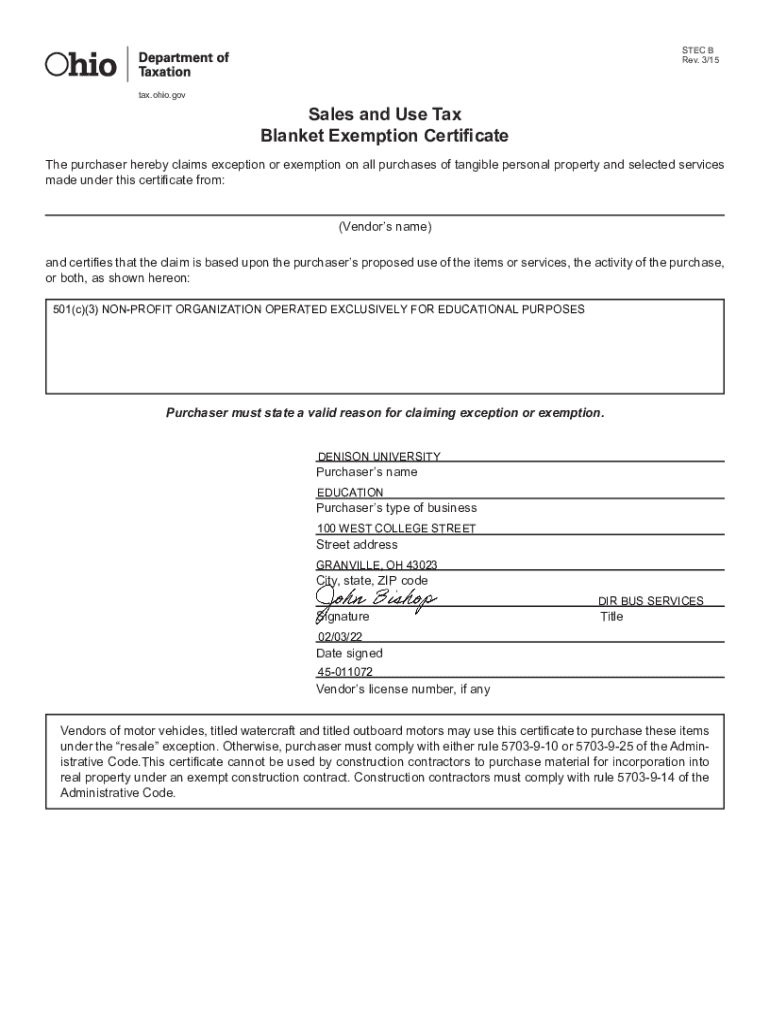

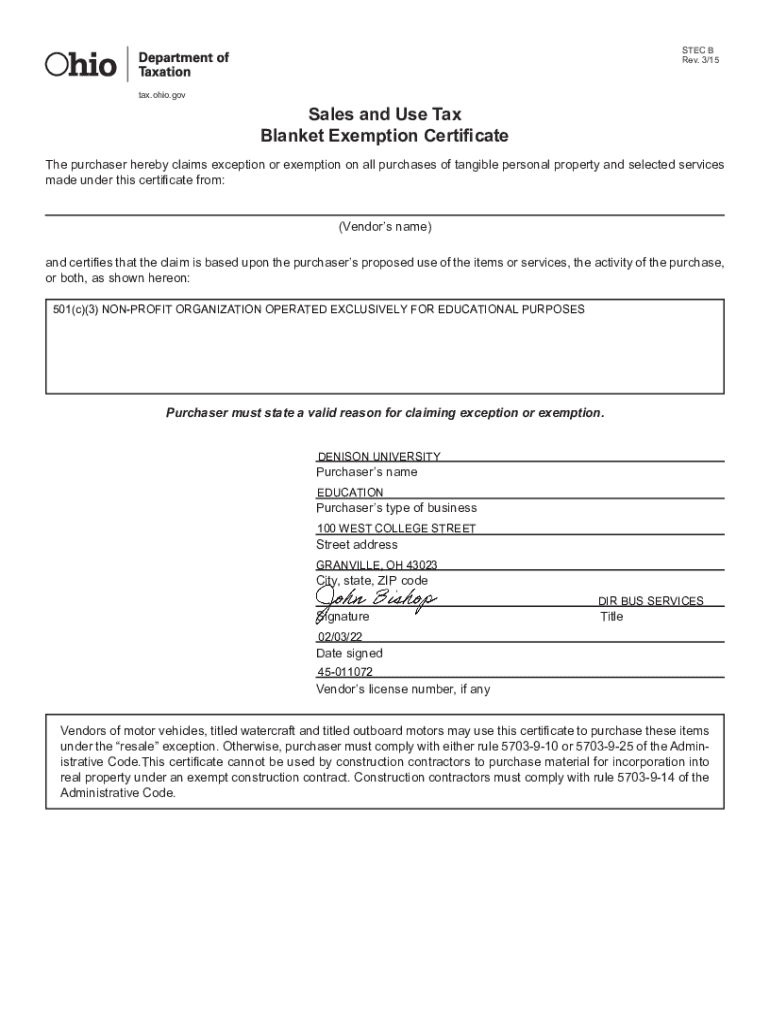

STEP B Rev. 3/15tax. Ohio. Gonzales and Use Tax Blanket Exemption Certificate The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 206 sales tax exemptions

Edit your 206 sales tax exemptions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 206 sales tax exemptions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 206 sales tax exemptions online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 206 sales tax exemptions. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 206 sales tax exemptions

How to fill out 206 sales tax exemptions

01

To fill out 206 sales tax exemptions, follow the steps below:

02

Gather all the necessary information related to the sales tax exemptions you need to claim.

03

Obtain the 206 sales tax exemption form from your local tax authority or download it from their website.

04

Read the instructions provided with the form carefully to understand the requirements and eligibility criteria.

05

Fill out the form accurately, providing all the required details such as your business information, sales transactions, and applicable exemptions.

06

Double-check the form for any errors or missing information before submitting it.

07

Attach any supporting documents or evidence required to validate your claim.

08

Submit the completed form along with the supporting documents to the appropriate tax authority.

09

Follow up with the tax authority to ensure the processing of your exemption claim.

10

Keep a copy of the filled-out form and supporting documents for your records in case of any future audits or inquiries.

11

Maintain accurate records of your sales transactions and exemptions for future reference and compliance purposes.

Who needs 206 sales tax exemptions?

01

Various entities and individuals may require 206 sales tax exemptions, including:

02

- Businesses engaged in specific industries or activities that qualify for exemptions under relevant tax laws.

03

- Non-profit organizations, charities, or educational institutions that qualify for tax-exempt status.

04

- Government entities or agencies eligible for exemptions when purchasing goods or services.

05

- Individuals or entities involved in inter-state commerce, where certain transactions may be exempt from sales tax.

06

- Qualifying individuals or businesses engaged in international trade or export activities, which may be eligible for exemptions on specific types of transactions.

07

- Individuals or entities participating in specific initiatives or programs aimed at promoting economic development or job creation, which could qualify for temporary or targeted exemptions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 206 sales tax exemptions directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign 206 sales tax exemptions and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete 206 sales tax exemptions online?

pdfFiller has made it easy to fill out and sign 206 sales tax exemptions. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit 206 sales tax exemptions on an Android device?

With the pdfFiller Android app, you can edit, sign, and share 206 sales tax exemptions on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is 206 sales tax exemptions?

206 sales tax exemptions refer to a list of items that are exempt from sales tax.

Who is required to file 206 sales tax exemptions?

Businesses or individuals who qualify for the exemptions are required to file 206 sales tax exemptions.

How to fill out 206 sales tax exemptions?

To fill out 206 sales tax exemptions, you need to provide detailed information about the exempt items and the reasons for exemption.

What is the purpose of 206 sales tax exemptions?

The purpose of 206 sales tax exemptions is to provide relief to individuals or businesses on certain items by exempting them from sales tax.

What information must be reported on 206 sales tax exemptions?

The information that must be reported on 206 sales tax exemptions include details of the exempt items, reasons for exemption, and any supporting documentation.

Fill out your 206 sales tax exemptions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

206 Sales Tax Exemptions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.