Get the free Fair Market Value (FMV) Definition - Investopedia

Show details

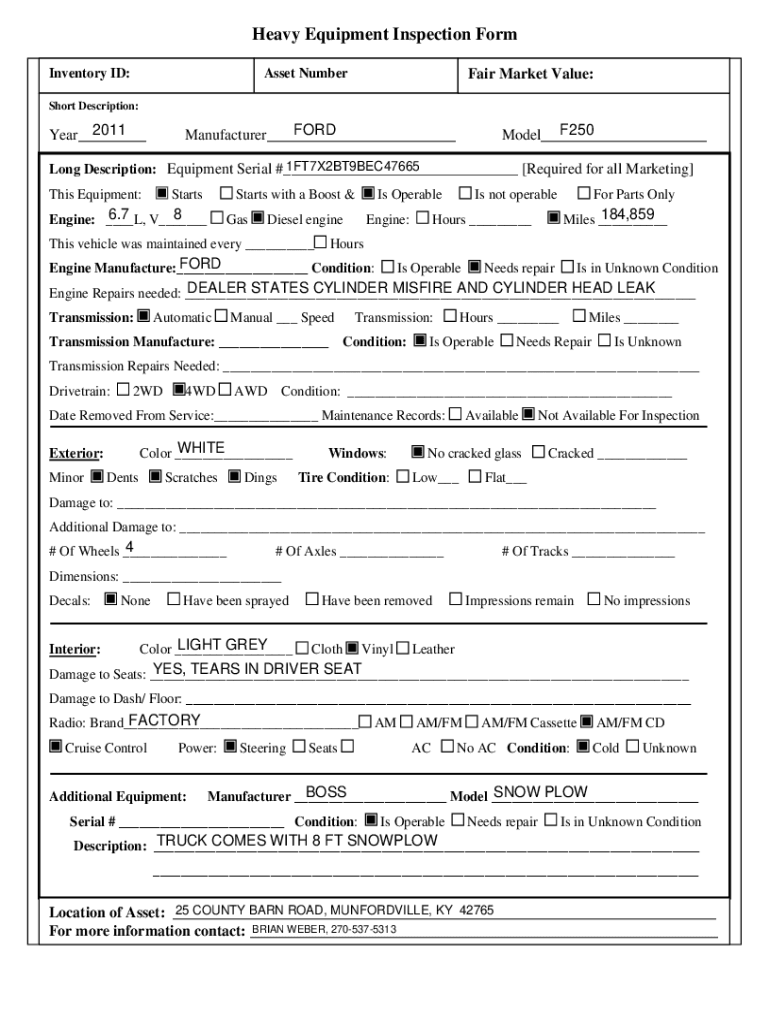

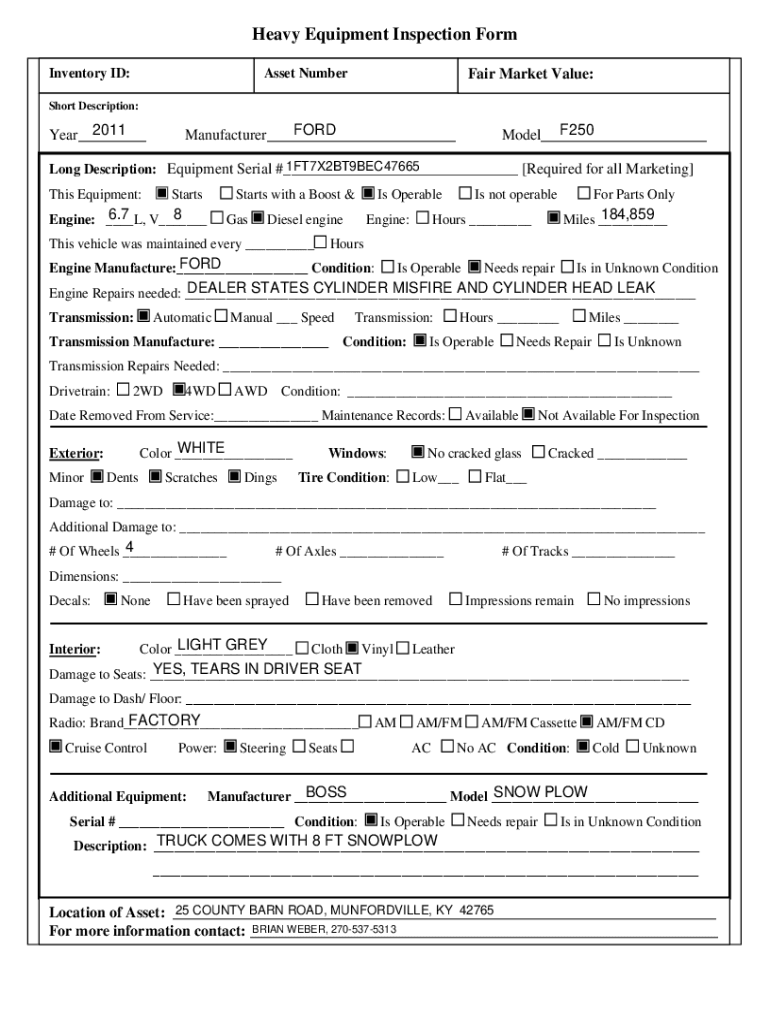

Heavy Equipment Inspection Form

Inventory ID:Asset Numbered Market Value:Short Description:2011

Year___FORD

Manufacturer___F250

Model___1FT7X2BT9BEC47665

Long Description: Equipment Serial #___

[Required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fair market value fmv

Edit your fair market value fmv form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fair market value fmv form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fair market value fmv online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fair market value fmv. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fair market value fmv

How to fill out fair market value fmv

01

To fill out fair market value (FMV), follow these steps:

02

Determine the date of valuation: The FMV is typically based on the fair market value of the asset on a specific date. Determine the valuation date before proceeding.

03

Research comparable sales: Gather information on similar assets that have been sold recently to determine their fair market value. This can be done through market research, online databases, or professional appraisers.

04

Consider relevant factors: Take into account various factors that can affect the fair market value, such as market conditions, demand, condition of the asset, and any unique characteristics it may have.

05

Calculate the FMV: Based on the research and analysis, calculate the fair market value of the asset. This can be done by averaging the sale prices of comparable assets or using other valuation methods, such as income approach or replacement cost approach.

06

Document your findings: Keep a record of the research conducted, data used, methodology applied, and any assumptions made during the valuation process.

07

Review and update regularly: Fair market values can change over time due to market fluctuations. It is important to periodically review and update the FMV to ensure its accuracy.

Who needs fair market value fmv?

01

Anyone involved in financial transactions or legal matters may need fair market value (FMV) assessments. Some common examples include:

02

- Individuals: When assessing the value of assets for tax purposes, estate planning, divorce settlements, or charitable donations.

03

- Businesses: When evaluating the value of assets for financial reporting, mergers and acquisitions, or determining asset-based lending.

04

- Appraisers: Professionals who specialize in determining FMV for various purposes, such as real estate appraisers, business valuation experts, or personal property appraisers.

05

- Insurance companies: When determining the value of insured assets.

06

- Government agencies: When assessing property taxes, determining compensation for eminent domain cases, or valuing public assets.

07

- Legal professionals: When dealing with litigation involving property disputes, bankruptcy settlements, or damage claims.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fair market value fmv?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the fair market value fmv. Open it immediately and start altering it with sophisticated capabilities.

How do I edit fair market value fmv on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share fair market value fmv on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out fair market value fmv on an Android device?

Use the pdfFiller Android app to finish your fair market value fmv and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is fair market value fmv?

Fair market value (FMV) is the price at which a property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.

Who is required to file fair market value fmv?

Individuals, businesses, or entities who have transactions involving property or assets that need to be reported to the IRS are required to file fair market value (FMV).

How to fill out fair market value fmv?

To fill out fair market value (FMV), you need to determine the current market value of the property or asset in question, ensuring that you have all necessary documentation to support your valuation.

What is the purpose of fair market value fmv?

The purpose of fair market value (FMV) is to accurately report the value of property or assets for tax purposes, ensuring compliance with IRS regulations and guidelines.

What information must be reported on fair market value fmv?

The information that must be reported on fair market value (FMV) includes details of the property or asset being valued, the valuation method used, and any supporting documentation.

Fill out your fair market value fmv online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fair Market Value Fmv is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.