Get the free ********************** Assessment Appeals Procedure for the 10/1 ...

Show details

North Stoning ton Board of Assessment Appeals Members: Lisa Marcella Candy Palmer Paula WoodwardSection 12110 through Section 12117a of the Connecticut General Statutes have been amended by the passage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assessment appeals procedure for

Edit your assessment appeals procedure for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your assessment appeals procedure for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit assessment appeals procedure for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit assessment appeals procedure for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out assessment appeals procedure for

How to fill out assessment appeals procedure for

01

First, gather all the necessary documentation and evidence to support your case. This may include property records, inspection reports, appraisal documents, and any relevant communication with the assessor's office.

02

Next, review the specific guidelines and requirements for filing an assessment appeal in your jurisdiction. This information can usually be found on the website of your local tax assessment board or office.

03

Prepare a written assessment appeal by following the prescribed format and including all the required information. This typically includes your contact information, property details, reasons for the appeal, and any supporting evidence or arguments.

04

Submit your completed assessment appeal form and supporting documents to the appropriate agency or office within the specified deadline. Be sure to keep copies for your records and request a confirmation of receipt if available.

05

After submitting your appeal, you may be required to attend a hearing or meeting to present your case in person. Prepare your arguments and evidence in advance, and be ready to answer any questions or address any concerns raised by the assessor or appeal board.

06

In some cases, you may be able to negotiate with the assessor's office or reach a settlement before the hearing. Consider exploring these options if you believe it could lead to a fair resolution.

07

Finally, be patient and follow up with the assessment appeals board or office to track the progress of your appeal. It may take some time before a decision is reached, but staying informed and involved throughout the process can increase your chances of a successful outcome.

Who needs assessment appeals procedure for?

01

Assessment appeals procedures are typically needed by property owners who believe that the assessed value of their property is incorrect or unfair. This includes homeowners, business owners, and other real estate owners.

02

Anyone who feels that their property has been overvalued or not properly assessed for tax purposes may benefit from the assessment appeals procedure. It provides an opportunity to challenge the assessment and request a reassessment or adjustment of the property's value.

03

Additionally, individuals who have experienced significant changes in their property's market value, such as renovations, damage, or changing market conditions, may find it necessary to file an assessment appeal.

04

It is important to note that the eligibility criteria and specific procedures for assessment appeals may vary depending on the jurisdiction. It is always recommended to consult the local tax assessment board or office for accurate and up-to-date information regarding who can benefit from the assessment appeals procedure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send assessment appeals procedure for to be eSigned by others?

To distribute your assessment appeals procedure for, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute assessment appeals procedure for online?

Filling out and eSigning assessment appeals procedure for is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out assessment appeals procedure for on an Android device?

Use the pdfFiller Android app to finish your assessment appeals procedure for and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

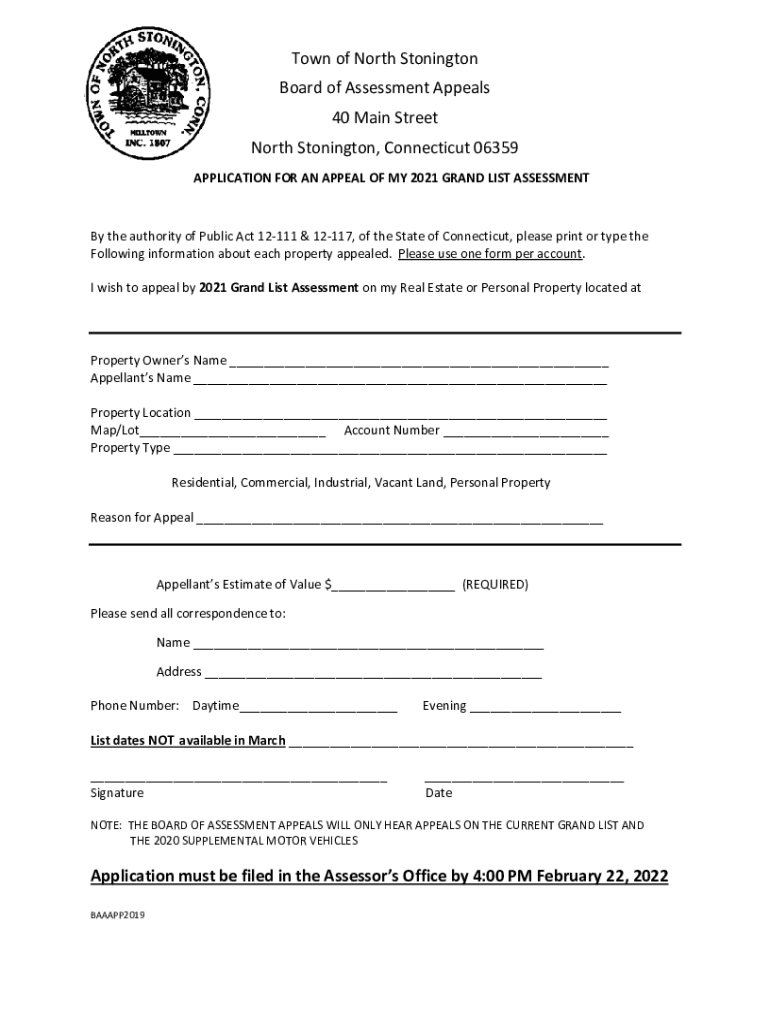

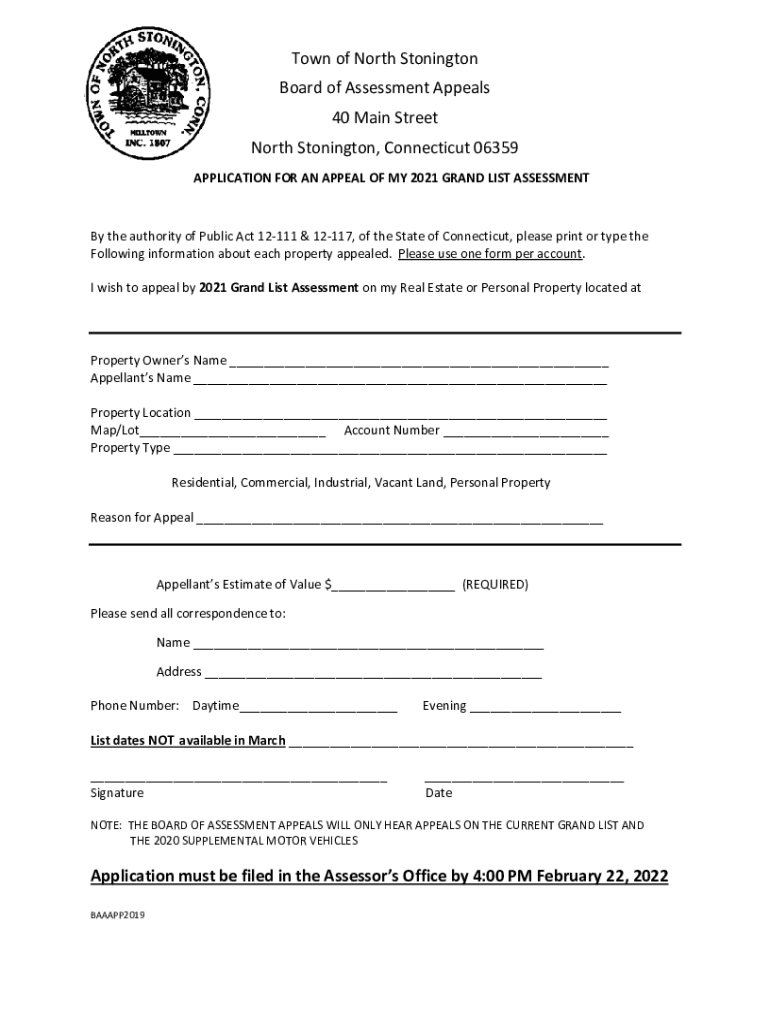

What is assessment appeals procedure for?

The assessment appeals procedure is for property owners to challenge the assessed value of their property for tax purposes.

Who is required to file assessment appeals procedure for?

Property owners who believe their property has been overvalued by the assessor are required to file assessment appeals procedure.

How to fill out assessment appeals procedure for?

Property owners can typically fill out assessment appeals procedure forms provided by the local tax assessor's office and submit evidence to support their claim.

What is the purpose of assessment appeals procedure for?

The purpose of assessment appeals procedure is to ensure that property owners are being taxed at a fair and accurate value based on the market conditions.

What information must be reported on assessment appeals procedure for?

Property owners must report the reasons for disputing the assessed value, provide evidence such as recent sales of comparable properties, and detail any improvements or damages affecting the property value.

Fill out your assessment appeals procedure for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Assessment Appeals Procedure For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.