IE Form 1 (Firms) 2021-2025 free printable template

Show details

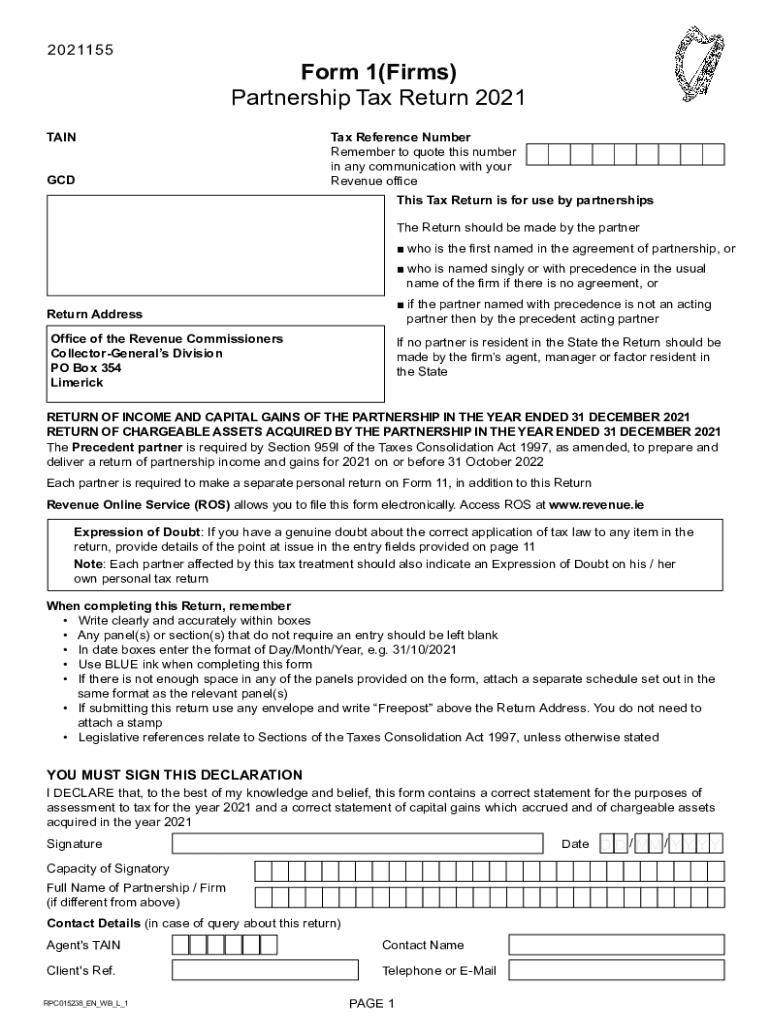

2021155Form 1(Firms) Partnership Tax Return 2021TAIN GDAX Reference Number Remember to quote this number in any communication with your Revenue office This Tax Return is for use by partnerships The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2021 ireland revenue tax form

Edit your form 1 firms online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1 partnership return online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1 partnership. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IE Form 1 (Firms) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out revenue partnership tax return form

How to fill out IE Form 1 (Firms)

01

Gather all required documents, including Company Registration Certificate, Tax Registration Certificate, and any relevant licenses.

02

Download the IE Form 1 (Firms) from the official website or obtain a hard copy from the relevant authority.

03

Fill in your firm's name as registered and ensure it matches the documents.

04

Provide the firm's address, making sure to include postal codes and contact information.

05

Indicate the nature of your business activities in the relevant section.

06

List all partners, shareholders, or directors of the firm, including their identification details.

07

Confirm the firm's legal status by selecting the appropriate options from the list provided.

08

Review the form for completeness and accuracy to avoid any delays.

09

Sign and date the form at the designated area.

10

Submit the completed form along with any supporting documents to the appropriate regulatory body.

Who needs IE Form 1 (Firms)?

01

Any business entity or firm that is seeking to register or update its information with the relevant regulatory authority.

02

Firms that are required to comply with local regulations for operating in their respective jurisdictions.

03

New businesses that are applying for necessary licenses and permits to commence operations.

Fill

form 1 firms partnership tax return form

: Try Risk Free

People Also Ask about form 1 firms partnership tax return

What is the difference between ITR 1 and ITR-2?

Under Form ITR-1, the individual is not earning an income from through activities like the lottery, gambling etc. On the other hand, in ITR-2, the individual earns through activities like a lottery, gambling etc. The individual earns from 1 house property only. The individual earns from more than 1 house property.

What is the difference between ITR 1 and ITR 3?

ITR 1 is for Income from Salary/Pension and other sources. Who can file ITR 3? Any individual taxpayer or a HUF can file ITR 3 if they get profits and gains from business or profession.

Is form 1065 the same as K-1?

Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. The partnership files a copy of Schedule K-1 (Form 1065) with the IRS to report your share of the partnership's income, deductions, credits, etc.

Who can file ITR-2?

ITR-2 can be filed by individuals or HUFs who: Are not eligible to file ITR-1 (Sahaj) Do not have income from profit and gains of business or profession and also do not have income from profits and gains of business or profession in the nature of:

What is the form 1 for income tax?

ITR-1 is a simplified one-page form for individuals receiving income of up to Rs 50 lakh from the following sources : Income from salary/pension. Income from one house property (excluding cases where loss is brought forward from previous years)

Who can file ITR-1?

An ITR-1 can be filed by a resident individual who meets the following criteria: -Total income for the fiscal year does not exceed 50 lakh.

What is the meaning of itr1?

ITR-1 can be filed by a Resident Individual whose: • Total income does not exceed ₹ 50 lakh during the FY. • Income is from salary, one house property, family pension income, agricultural income (up to ₹5000/-), and other sources, which include: o Interest from Savings Accounts.

What is difference between ITR 1 and ITR 4?

ITR-1 is used only when the income is mainly from three heads i.e. salary, one house property, and other sources (except casual income). On the other hand, ITR-4S applies to four heads of income i.e. presumptive business income, salary, one house property, and other sources (except casual income).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2021 ireland partnership for eSignature?

When you're ready to share your tax taxable partnership, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete form 1 partnership form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your revenue firms partnership, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete form 1 firms 2021-2025 on an Android device?

Use the pdfFiller Android app to finish your form 1 firms 2021-2025 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IE Form 1 (Firms)?

IE Form 1 (Firms) is a regulatory document that businesses must submit to provide information about their operations, financial status, and compliance with relevant laws.

Who is required to file IE Form 1 (Firms)?

Firms, including corporations, partnerships, and sole proprietorships, that engage in specific regulated activities are required to file IE Form 1.

How to fill out IE Form 1 (Firms)?

To fill out IE Form 1 (Firms), businesses need to provide accurate and detailed information about their company structure, financial information, and any other required disclosures as outlined in the form's instructions.

What is the purpose of IE Form 1 (Firms)?

The purpose of IE Form 1 (Firms) is to ensure compliance with industry regulations, facilitate monitoring by regulatory bodies, and collect essential data for economic and policy analysis.

What information must be reported on IE Form 1 (Firms)?

Information that must be reported on IE Form 1 (Firms) includes the firm's identification details, financial statements, ownership structure, operational data, and other pertinent disclosures as specified by the regulatory authority.

Fill out your form 1 firms 2021-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1 Firms 2021-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.