UK HS302 2022 free printable template

Show details

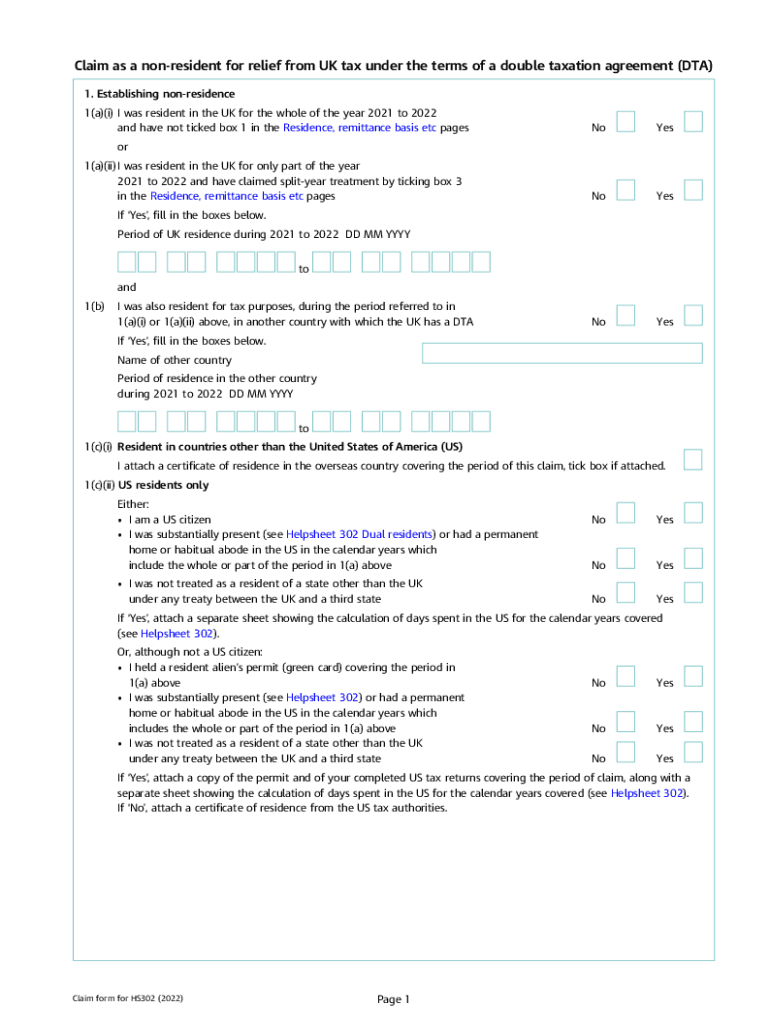

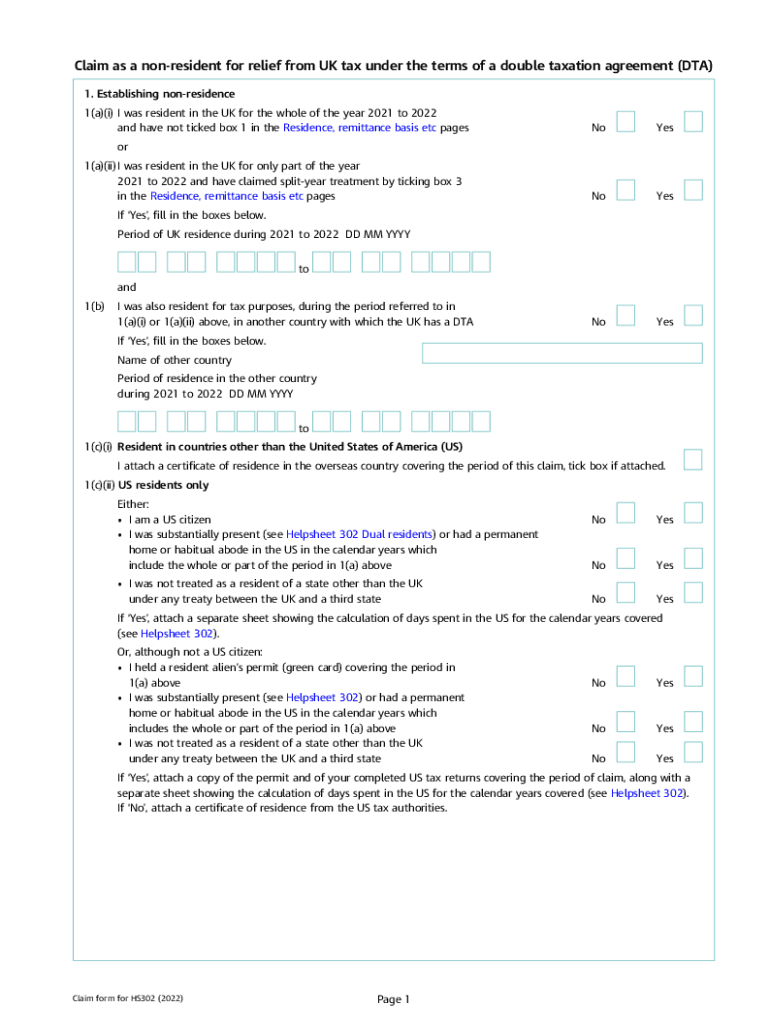

Claim as a nonresident for relief from UK tax under the terms of a double taxation agreement (DTA)

1. Establishing nonresidence

1(a)(i) I was resident in the UK for the whole of the year 2021 to 2022

and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HS302

Edit your UK HS302 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HS302 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HS302 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UK HS302. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HS302 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HS302

How to fill out UK HS302

01

Gather all relevant information about your income and expenses.

02

Obtain the UK HS302 form from the HMRC website or your local tax office.

03

Start filling out the personal details section at the top of the form.

04

Enter your income details, including all sources of income relevant to the tax year.

05

Detail your expenses accurately, making sure to categorize them correctly.

06

Calculate your tax liability based on your income and eligible expenses.

07

Review the form for any errors or missing information.

08

Sign and date the form before submitting it to HMRC either online or by post.

Who needs UK HS302?

01

Self-employed individuals who need to report their income and claim expenses.

02

Anyone with additional income sources that require tax declaration.

03

Businesses that are subject to paying taxes on profits.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim DTA relief?

To claim relief, you will need to file a return with the Indian Income Tax Department. You will also need to provide proof of payment of taxes in the other country. If you are able to successfully claim relief, you will only have to pay taxes on the income that was earned in India.

How do I fill out a UK tax return as a non resident?

Sending a Self Assessment tax return fill in a Self Assessment tax return and an SA109 form and send by post. use commercial Self Assessment software that supports SA109 reporting (this may appear as a 'residence, remittance basis etc' section) get a tax professional to report your UK income for you.

What is the form for double tax relief in the UK?

Form DT-Individual allows you to apply under the DT treaty between the UK and your country of residence for relief at source from UK Income Tax on pensions, purchased annuities, royalties and interest paid from sources in the UK.

How do I claim double taxation relief UK?

Ask the foreign tax authority for a form, or apply by letter if they do not have one. Before you apply, you must prove you're eligible for tax relief by either: completing the form and sending it to HM Revenue and Customs ( HMRC ) - they'll confirm whether you're resident and send the form back to you.

Do I need to complete a UK tax return if I am non resident?

Non-residents only pay tax on their UK income - they do not pay UK tax on their foreign income. Residents normally pay UK tax on all their income, whether it's from the UK or abroad. But there are special rules for UK residents whose permanent home ('domicile') is abroad.

Does the UK have a double taxation agreement with us?

The U.S./U.K. tax treaty—formally known as the “Convention between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and on Capital Gains”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete UK HS302 online?

pdfFiller has made it easy to fill out and sign UK HS302. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit UK HS302 in Chrome?

UK HS302 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out UK HS302 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your UK HS302. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is UK HS302?

UK HS302 is a form used in the UK for reporting and assessing the importation and exportation of goods, particularly concerning the compliance with UK customs regulations.

Who is required to file UK HS302?

Businesses and individuals who import or export goods into or out of the UK are required to file UK HS302 to ensure compliance with customs regulations.

How to fill out UK HS302?

To fill out UK HS302, you need to provide information such as the description of the goods, their value, country of origin, and any relevant codes. Ensure to follow the guidance provided by HM Revenue and Customs.

What is the purpose of UK HS302?

The purpose of UK HS302 is to facilitate the accurate reporting of goods being imported or exported, which helps in monitoring trade, calculating duties, and ensuring compliance with trade regulations.

What information must be reported on UK HS302?

The information that must be reported on UK HS302 includes the commodity codes, description of goods, value, weight, quantity, and country of origin, along with any other data required by HM Revenue and Customs.

Fill out your UK HS302 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK hs302 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.