Get the free Business Rates - Pay by Direct Debit - Self

Show details

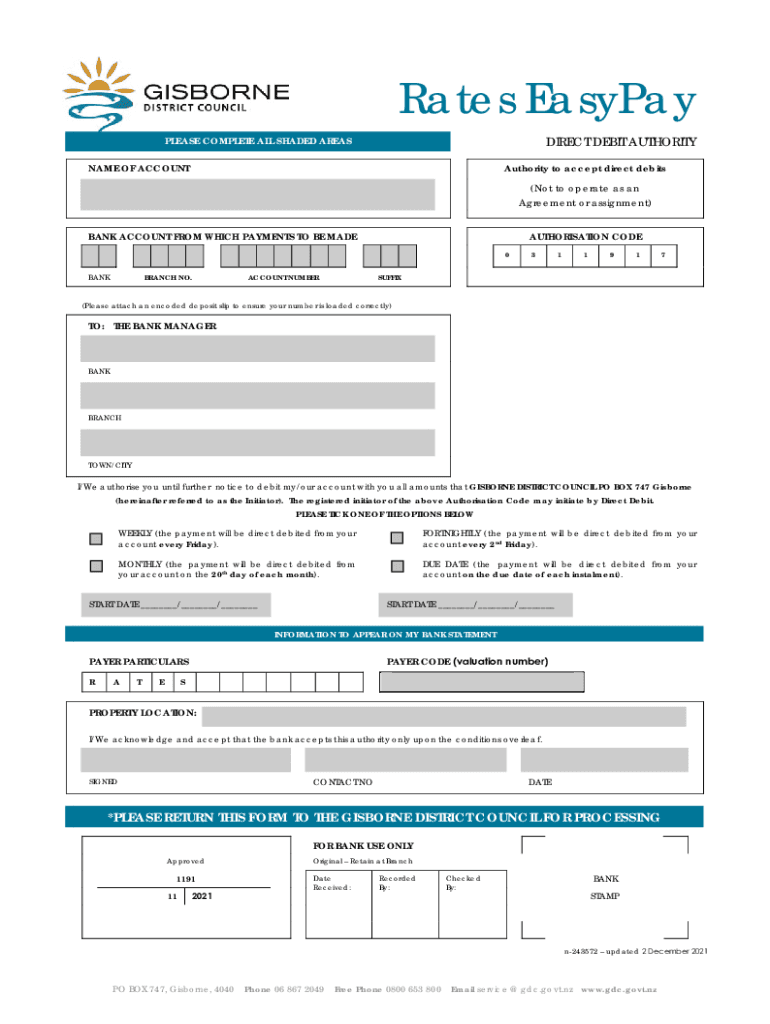

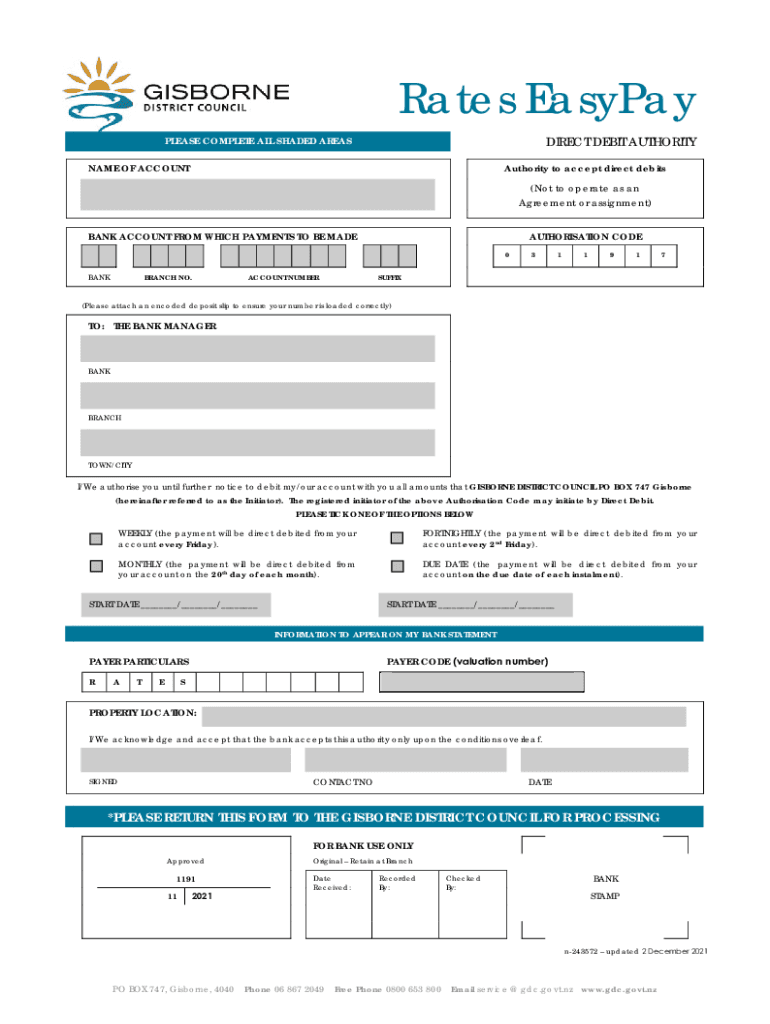

Rates Easily DIRECT DEBIT AUTHORITYPLEASE COMPLETE ALL SHADED AREAS NAME OF ACCOUNTAuthority to accept direct debits (Not to operate as an Agreement or assignment)BANK ACCOUNT FROM WHICH PAYMENTS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business rates - pay

Edit your business rates - pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business rates - pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business rates - pay online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business rates - pay. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business rates - pay

How to fill out business rates - pay

01

To fill out business rates - pay, follow these steps:

02

Gather all the necessary information about your business. This includes details about your property, its location, and its usage.

03

Visit the official government website or contact your local council to access the business rates form.

04

Fill in the required fields on the form. Provide accurate information about your business and property.

05

Make sure to include any relevant documents or supporting evidence, such as proof of property ownership or rental agreements.

06

Double-check all the information you have provided before submitting the form.

07

Once you have completed the form, submit it as per the instructions provided by your local council or on the website.

08

Keep a copy of the submitted form and any accompanying documents for your records.

09

Pay the business rates as specified by your local council. This can typically be done online, through bank transfer, or by other accepted payment methods.

10

Make a note of the payment confirmation for future reference.

11

Keep track of the due dates for future business rates payments to ensure timely submissions.

12

It is recommended to consult with your local council or a tax advisor for any specific guidelines or requirements related to filling out business rates - pay.

Who needs business rates - pay?

01

Business rates - pay is applicable to businesses and property owners in the United Kingdom.

02

Any individual, partnership, company, or organization using a non-domestic property for business purposes may be liable for business rates.

03

This includes but is not limited to:

04

- Retail shops and stores

05

- Offices

06

- Industrial or warehouse premises

07

- Business parks

08

- Public houses and restaurants

09

- Hotels and guesthouses

10

- Non-profit organizations

11

It is advisable to contact your local council or tax authorities for clarification on whether your specific business or property falls under the business rates - pay scheme.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business rates - pay from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your business rates - pay into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get business rates - pay?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific business rates - pay and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit business rates - pay online?

The editing procedure is simple with pdfFiller. Open your business rates - pay in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is business rates - pay?

Business rates are taxes paid on non-domestic properties, such as shops, offices, and warehouses.

Who is required to file business rates - pay?

Business owners and tenants of non-domestic properties are required to file business rates.

How to fill out business rates - pay?

Business rates can be filled out online or through the local council's website.

What is the purpose of business rates - pay?

The purpose of business rates is to contribute towards local services such as police, fire department, and waste management.

What information must be reported on business rates - pay?

Information such as the property's rateable value, property description, and contact details must be reported on business rates.

Fill out your business rates - pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Rates - Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.