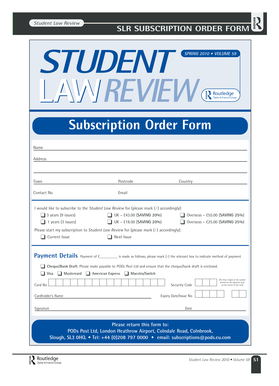

Get the free IRA RECHARACTERIZATION REQUEST

Show details

Formulario para solicitar la recharacterización de activos de una cuenta IRA, incluyendo instrucciones y detalles requeridos para completar la solicitud.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira recharacterization request

Edit your ira recharacterization request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira recharacterization request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira recharacterization request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira recharacterization request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira recharacterization request

How to fill out IRA RECHARACTERIZATION REQUEST

01

Obtain the IRA Recharacterization Request form from your IRA custodian.

02

Fill out your personal information, including your name, address, and social security number.

03

Indicate the type of IRA account you are recharacterizing (Traditional or Roth).

04

Specify the amount you wish to recharacterize.

05

Provide details about the account from which the funds are being recharacterized and the account to which they are being transferred.

06

Sign and date the form, certifying that the information is accurate.

07

Submit the completed form to your IRA custodian, along with any required documentation.

Who needs IRA RECHARACTERIZATION REQUEST?

01

Individuals who contributed to a Roth IRA but wish to switch to a Traditional IRA for tax reasons.

02

Those who made contributions to the wrong type of IRA and need to correct the mistake.

03

Investors who wish to take advantage of changing market conditions by shifting their investments.

Fill

form

: Try Risk Free

People Also Ask about

What is the reason for recharacterization?

Recharacterizing a contribution from one type of IRA to another gives you the opportunity to change your mind or correct a mistake—say, you contributed to a Roth even though your income was too high.

How do you recharacterize an IRA contribution?

The deadline for a timely correction of an excess contribution is the tax-filing deadline (plus extensions) in the year you made the excess contribution. To be eligible to remove your excess contribution after the tax-filing deadline, you must file your taxes on time or file for an extension to file your return.

How do I show IRA recharacterization on my tax return?

Report the nondeductible traditional IRA portion of the recharacterized contribution, if any, on Form 8606, Part I. Don't report the Roth IRA contribution (whether or not you recharacterized all or part of it) on Form 8606. Attach a statement to your return explaining the recharacterization.

Do I need to amend my tax return for recharacterization?

Note: If you recharacterize a contribution made in the previous calendar year, it impacts your tax return even though the recharacterization activity will be reported on the next year's Form 1099-R. You may need to file an amended return if you have already filed your tax return for that year.

Can you reverse an IRA contribution Fidelity?

If you would like to remove an excess contribution from a Fidelity Advisor SARSEP, SEP, or SIMPLE IRA, complete the FA SARSEP, SEP, and SIMPLE IRA Return of Excess Contribution form. For other types of distribution requests, contact your Financial Advisor for additional instructions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA RECHARACTERIZATION REQUEST?

An IRA Recharacterization Request is a process that allows individuals to undo or reverse a contribution made to a traditional IRA or Roth IRA by transferring the funds from one IRA account to another.

Who is required to file IRA RECHARACTERIZATION REQUEST?

Individuals who wish to reverse a previous IRA contribution, typically those who want to change the type of IRA account it was contributed to, must file an IRA Recharacterization Request.

How to fill out IRA RECHARACTERIZATION REQUEST?

To fill out an IRA Recharacterization Request, individuals need to provide their personal details, specify the amount to recharacterize, indicate the original IRA type, the target IRA type, and include any necessary documentation, such as account numbers.

What is the purpose of IRA RECHARACTERIZATION REQUEST?

The purpose of an IRA Recharacterization Request is to allow taxpayers to adjust their IRA contributions in response to changing financial situations, tax implications, or eligibility criteria, thereby optimizing their retirement savings.

What information must be reported on IRA RECHARACTERIZATION REQUEST?

The information that must be reported on an IRA Recharacterization Request includes the contributor's name, Social Security number, the amount being recharacterized, the original and target IRA account numbers, and the date of the initial contribution.

Fill out your ira recharacterization request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Recharacterization Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.