Get the free LOCAL REVOLVING LOAN FUNDS

Show details

LOCAL REVOLVING LOAN FUNDS (REF)Program GuideAdopted July 2004 Revised April 20221REVOLVING LOAN FUNDS Program Guide TABLE OF CONTENTS ContentsIntroduction ..............................................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local revolving loan funds

Edit your local revolving loan funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local revolving loan funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local revolving loan funds online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit local revolving loan funds. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local revolving loan funds

How to fill out local revolving loan funds

01

Gather all necessary documents and information, such as identification proof, income statements, credit history, and business plans.

02

Research and identify local revolving loan funds available in your area. This can be done by reaching out to local financial institutions, local government agencies, or conducting an online search.

03

Review the eligibility criteria for each local revolving loan fund to ensure you meet the requirements.

04

Prepare a comprehensive loan application by accurately completing all required forms and providing supporting documentation.

05

Submit the completed application along with any additional requested materials to the appropriate local revolving loan fund provider.

06

Follow up with the loan fund provider to check the status of your application and address any additional questions or requirements they may have.

07

If approved, carefully review the terms and conditions of the loan agreement before signing and accepting the funds.

08

Make timely repayments as per the agreed-upon schedule to maintain a good standing and potentially access future loan funds if needed.

09

Utilize the loan funds for their intended purpose, whether it be starting a small business, expanding an existing business, or other approved uses.

10

Keep thorough records of all financial transactions related to the loan, including receipts, invoices, and repayment documentation.

11

Regularly monitor your progress and financial situation to ensure proper utilization of the loan funds and to assess the need for any adjustments or additional funding.

Who needs local revolving loan funds?

01

Local revolving loan funds are typically beneficial for individuals or small businesses that may not qualify for traditional loans from banks or other financial institutions.

02

Entrepreneurs and startups looking for seed capital or initial funding to launch a business venture can benefit from local revolving loan funds.

03

Small business owners seeking to expand their operations, invest in new equipment, or fund marketing initiatives can also utilize these loan funds.

04

Individuals or businesses with limited credit history or less desirable credit scores may find local revolving loan funds more accessible.

05

Minority-owned businesses, women-owned businesses, and other disadvantaged or underrepresented groups often find these loan funds supportive in overcoming financial barriers.

06

Non-profit organizations or community development projects that promote economic growth and job creation may also be eligible for local revolving loan funds.

07

Ultimately, anyone who can demonstrate a viable business plan or a need for financial assistance may be eligible for and benefit from local revolving loan funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute local revolving loan funds online?

Filling out and eSigning local revolving loan funds is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the local revolving loan funds form on my smartphone?

Use the pdfFiller mobile app to fill out and sign local revolving loan funds on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I fill out local revolving loan funds on an Android device?

Use the pdfFiller mobile app and complete your local revolving loan funds and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

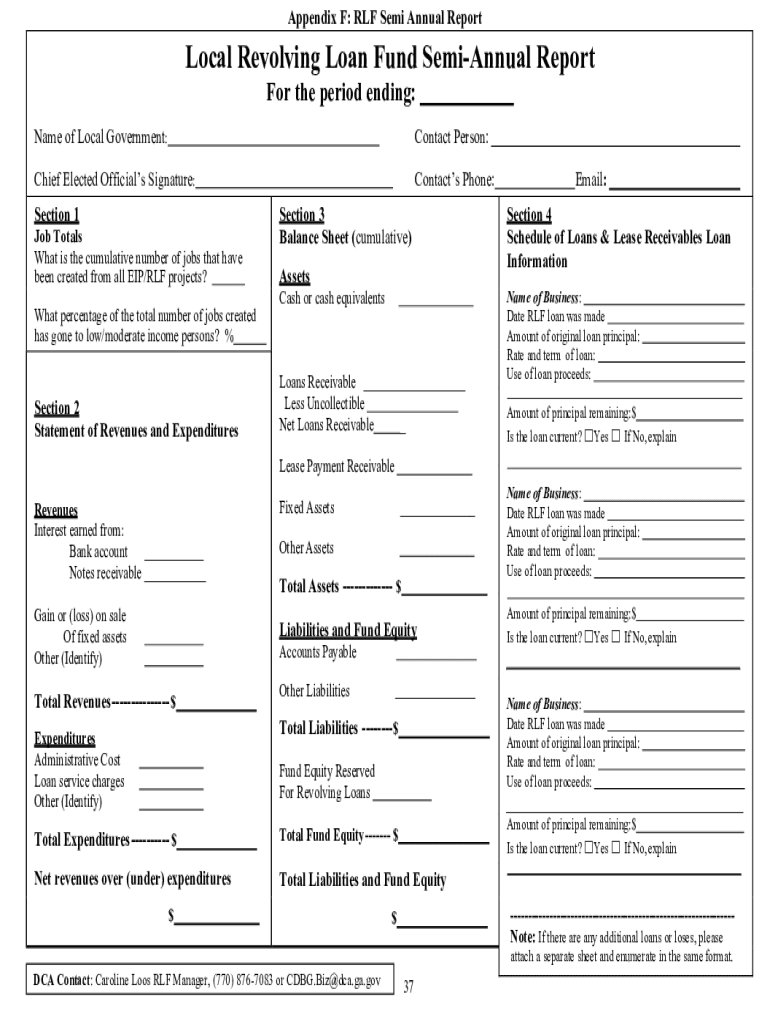

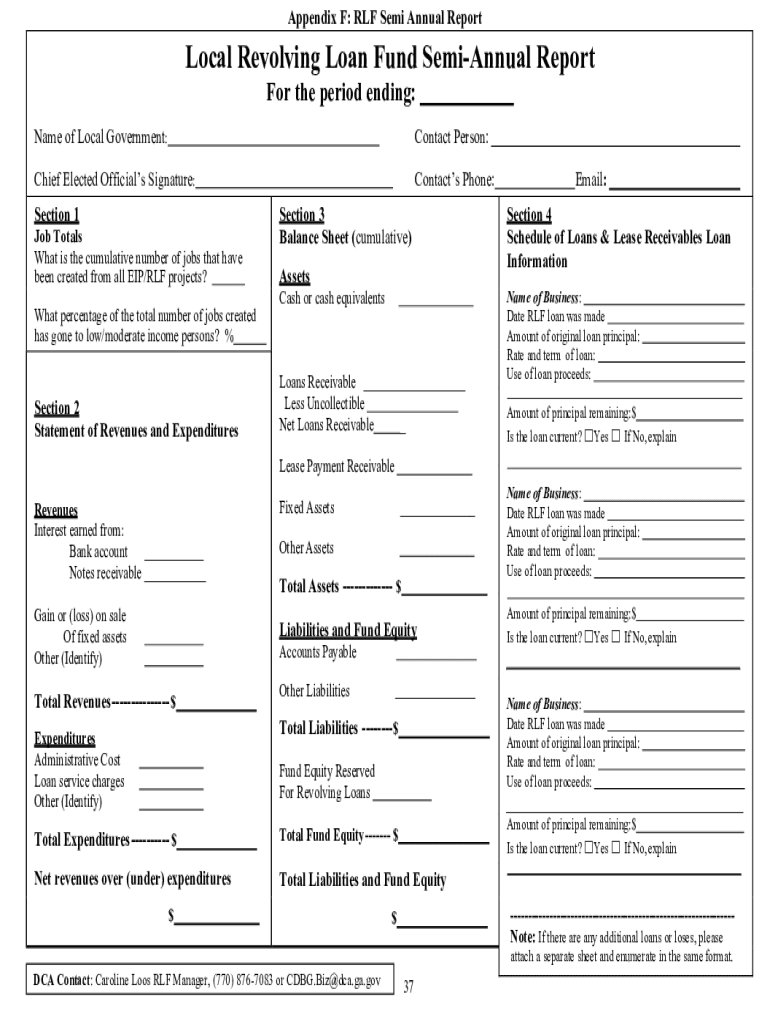

What is local revolving loan funds?

Local revolving loan funds are sources of money that can be borrowed and repaid multiple times, typically for the purpose of supporting economic development in a specific community.

Who is required to file local revolving loan funds?

Local governments, organizations, or entities that administer or receive funding from local revolving loan funds are required to file reports on the status of the loans.

How to fill out local revolving loan funds?

To fill out local revolving loan funds, one typically needs to provide information on the amount of funds received, loan recipients, interest rates, repayment schedules, and outcomes of the loans.

What is the purpose of local revolving loan funds?

The purpose of local revolving loan funds is to provide financial assistance to businesses, organizations, or individuals in a community to promote economic growth, job creation, and development.

What information must be reported on local revolving loan funds?

Information that must be reported on local revolving loan funds typically includes details on loan recipients, amount of funds disbursed, interest rates, repayment schedules, and outcomes of the loans.

Fill out your local revolving loan funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Revolving Loan Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.