MI GR-SS-4 - City of Grand Rapids 2022-2025 free printable template

Show details

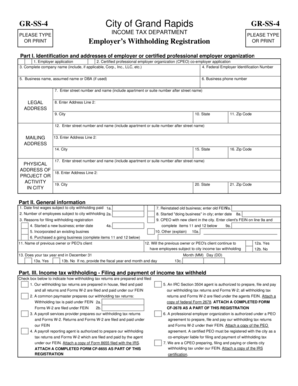

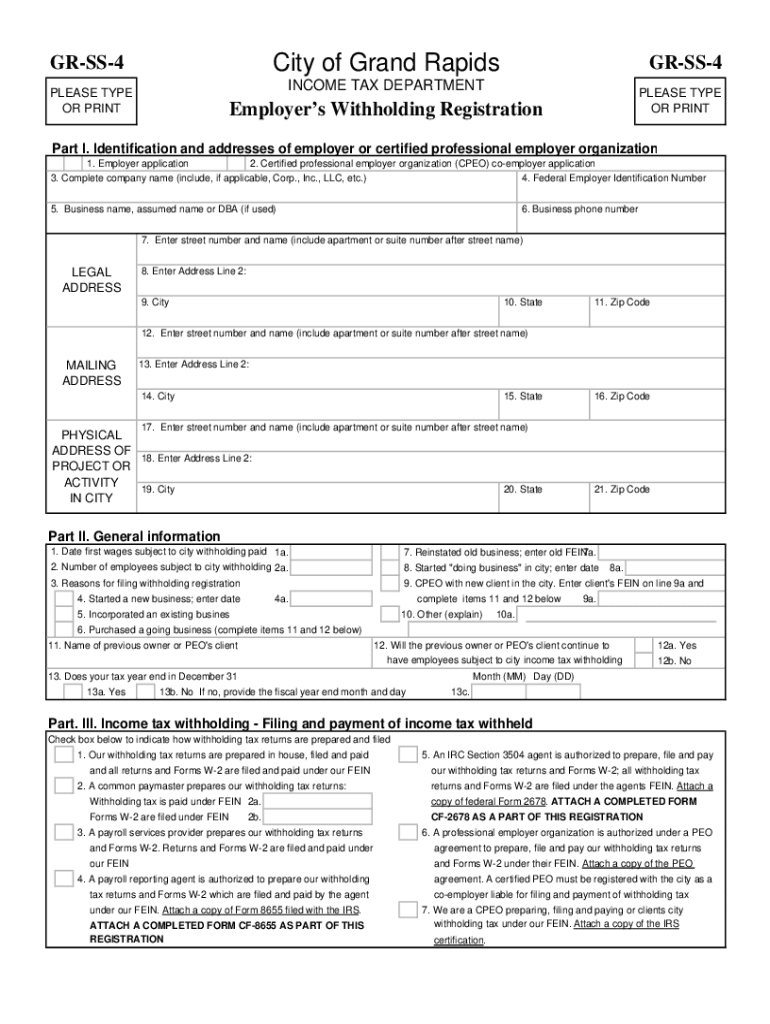

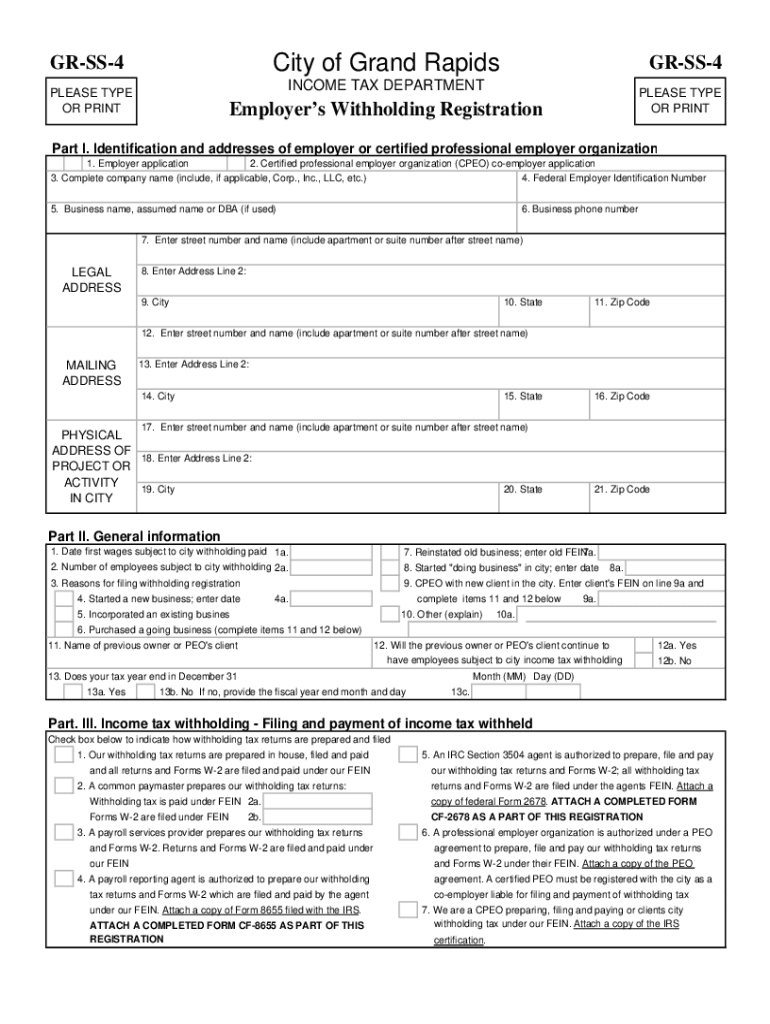

City of Grand RapidsGRSS4GRSS4INCOME TAX DEPARTMENTPLEASE TYPE OR PRINTPLEASE TYPE OR PRINTEmployers Withholding RegistrationPart I. Identification and addresses of employer or certified professional

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign michigan grss 4 rapids tax form

Edit your michigan employers withholding registration tax template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan employers withholding registration grand income add form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mi grss4 income tax form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit michigan employers withholding registration grand editpdf form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI GR-SS-4 - City of Grand Rapids Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mi grss4 grand rapids tax doc form

How to fill out MI GR-SS-4 - City of Grand Rapids

01

Obtain the MI GR-SS-4 form from the City of Grand Rapids website or local office.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information, including name, address, and contact details.

04

Provide information regarding the property in question, including its address and property tax number.

05

Complete any sections required to explain your reason for submitting the form.

06

Review all information entered for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate city department, either in person or by mail.

Who needs MI GR-SS-4 - City of Grand Rapids?

01

Property owners in Grand Rapids seeking specific information or services related to their property.

02

Individuals or businesses applying for zoning changes or seeking variances.

03

Residents looking to dispute property assessments or taxes.

04

Anyone involved in real estate transactions in Grand Rapids that require official documentation.

Fill

michigan gr ss4 income fill

: Try Risk Free

People Also Ask about michigan grss 4 employers withholding registration tax download

Where can I pick up Michigan tax forms?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Where to get grand rapids tax forms?

Email us at grwhtax@grcity.us. You can use a third-party site called Municonnect to pay your withholding or to download your customized withholding booklet.

Does the state of Michigan require you to file a tax return?

You must file a Michigan return if you file a federal return or your income exceeds your Michigan exemption allowance. A return must be filed even if you do not owe Michigan tax. Select the tax year link desired to display the list of forms available to download.

Where can I go to get IRS forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

What is the city tax withholding form for Detroit?

Only one Form 5527 is required for each employee, even though the employee may be subject to withholding for two cities. When properly filled out, Form 5527 provides the employee's city of residence and the two cities or communities in which the employee earns the greatest percentage of compensation from the employer.

Do I need to file a Grand Rapids tax return?

You will need to file if you lived in the city during any part of the tax year and had taxable income. If you did not live in the city, but earned taxable income from within city limits you will also need to file.

Does Battle Creek have a city income tax?

For 2021 the following Michigan cities levy an income tax of 1% on residents and 0.5% on nonresidents. Albion, Battle Creek, Benton Harbor, Big Rapids, East Lansing, Flint, Grayling, Hamtramck, Hudson, Ionia, Jackson, Lansing, Lapeer, Muskegon, Muskegon Heights, Pontiac, Port Huron, Portland, Springfield and Walker.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get michigan employers withholding registration grand tax add?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific mi grss4 employers withholding registration rapids sign and other forms. Find the template you need and change it using powerful tools.

How can I fill out gr ss 4 grand rapids tax pdf on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your gr ss 4 grand rapids income tax blank. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete mi grss 4 grand rapids tax form on an Android device?

Complete mi grss 4 grand rapids income tax printable and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is MI GR-SS-4 - City of Grand Rapids?

MI GR-SS-4 is a tax form used by the City of Grand Rapids for reporting specific tax information as required by local tax regulations.

Who is required to file MI GR-SS-4 - City of Grand Rapids?

Individuals and businesses that have earned income or received payments subject to Grand Rapids city income tax are required to file MI GR-SS-4.

How to fill out MI GR-SS-4 - City of Grand Rapids?

To fill out MI GR-SS-4, gather all necessary income data, follow the instructions provided on the form, and input your income details accurately, ensuring all sections are completed before submission.

What is the purpose of MI GR-SS-4 - City of Grand Rapids?

The purpose of MI GR-SS-4 is to collect information regarding income earned within the city for accurate assessment of local income taxes.

What information must be reported on MI GR-SS-4 - City of Grand Rapids?

Information required on MI GR-SS-4 includes total income earned, deductions, residency status, and any applicable credits or exemptions related to local income tax.

Fill out your michigan employers withholding registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mi grss4 Grand Rapids Tax Add is not the form you're looking for?Search for another form here.

Keywords relevant to gr ss 4 employers withholding registration income blank

Related to grss4 grand rapids income

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.