Get the free Revocable Transfer on Death Deed - Montana State University

Show details

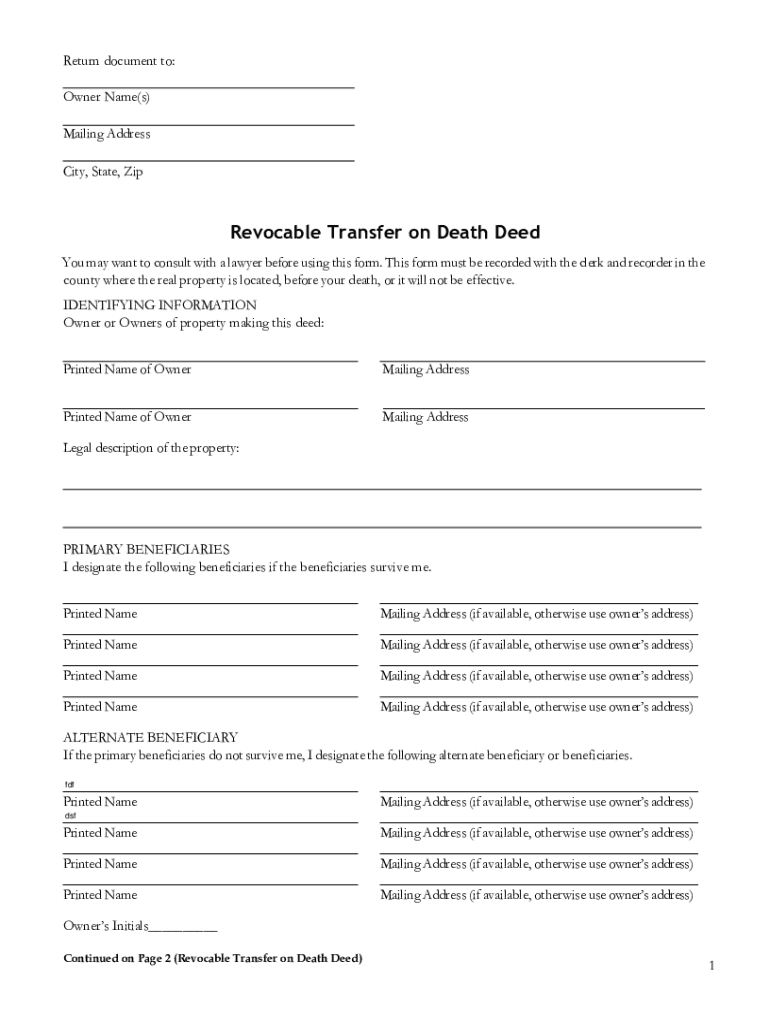

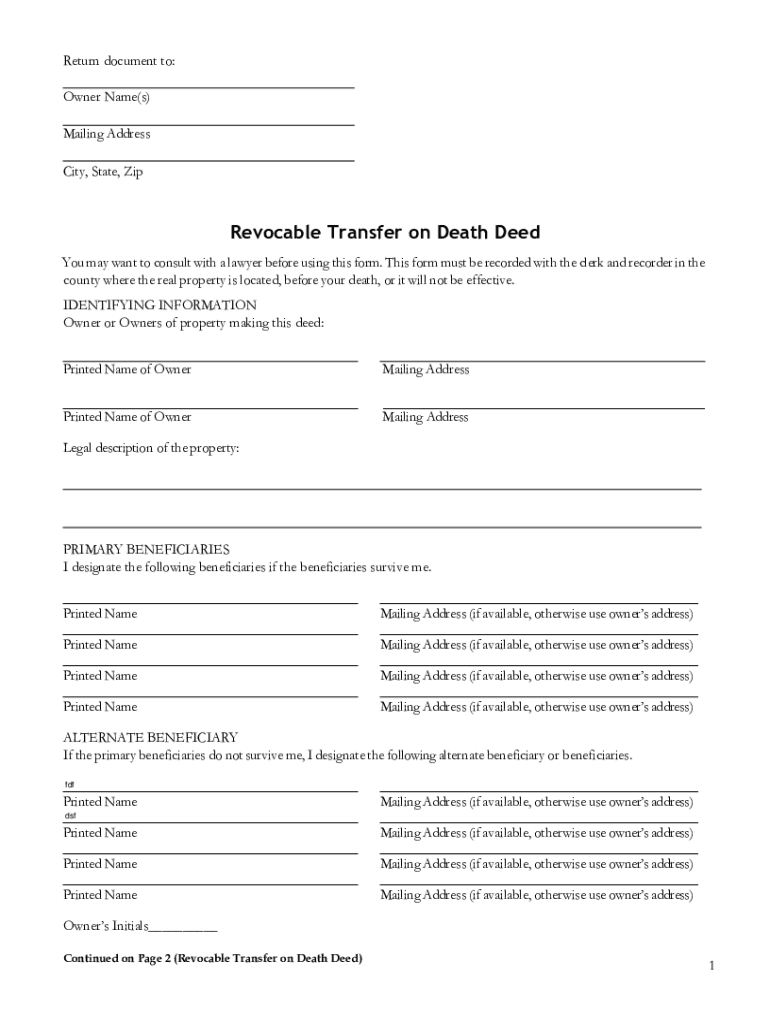

Return document to:

Owner Name(s)

Mailing Address

City, State, Irrevocable Transfer on Death Deed

You may want to consult with a lawyer before using this form. This form must be recorded with the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revocable transfer on death

Edit your revocable transfer on death form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revocable transfer on death form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revocable transfer on death online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit revocable transfer on death. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revocable transfer on death

How to fill out revocable transfer on death

01

To fill out a revocable transfer on death, follow these steps:

1. Obtain the necessary form or template for the revocable transfer on death. This can usually be found from your state's department of motor vehicles or a reputable legal document service provider.

02

Read the instructions and the form carefully. Make sure you understand all the requirements and terms.

03

Begin by providing your personal information, such as your full name, address, and contact details, in the designated fields.

04

Identify the beneficiary or beneficiaries who will receive the transfer on death. Provide their full names, addresses, and any other required details.

05

Specify the assets or property that you wish to transfer on death. This could include financial accounts, real estate, vehicles, or any other assets that can be legally transferred in this manner.

06

Clearly state your intentions regarding the transfer on death. Ensure that your language is clear and unambiguous to avoid any potential conflicts or misunderstandings.

07

Review the completed form to ensure accuracy and completeness. Make any necessary corrections before finalizing it.

08

Sign and date the form in the presence of a notary public or another authorized witness, as required by your state's laws.

09

Make copies of the completed form for your own records and provide a copy to the beneficiary or beneficiaries, if necessary.

10

Store the original form in a safe and secure location, such as a locked filing cabinet or a safe deposit box at a bank.

11

Note: It is always recommended to consult with an attorney or legal professional for guidance during the process of filling out a revocable transfer on death. They can provide you with personalized advice based on your specific circumstances.

Who needs revocable transfer on death?

01

Revocable transfer on death is generally recommended for individuals who want to ensure a smooth transfer of their assets to specific beneficiaries upon their death. It can be particularly useful for individuals with significant assets, such as real estate properties, valuable financial accounts, or sentimental items that they want to pass on without going through the probate process.

02

Some common scenarios where revocable transfer on death can be beneficial include:

1. Married couples who want to transfer assets to their spouse without the need for probate.

03

Individuals with dependents who want to provide for their children or other family members after their death.

04

Elderly individuals who want to simplify the transfer of assets and reduce the potential for disputes among heirs.

05

Individuals who want to maintain privacy and confidentiality in the distribution of their assets after death.

06

Individuals who want to ensure a specific person or organization receives their assets, such as a favorite charity or nonprofit organization.

07

It is important to note that the requirements and regulations for revocable transfer on death may vary by state or jurisdiction. It is advisable to consult with an attorney or legal professional to understand the specific laws and guidelines that apply to your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify revocable transfer on death without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your revocable transfer on death into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in revocable transfer on death?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your revocable transfer on death to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit revocable transfer on death on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign revocable transfer on death. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is revocable transfer on death?

Revocable transfer on death is a legal arrangement that allows an individual to transfer assets to beneficiaries upon their death, while retaining the ability to change or revoke the designation during their lifetime.

Who is required to file revocable transfer on death?

The person who created the revocable transfer on death is typically required to file the necessary paperwork with the appropriate authorities.

How to fill out revocable transfer on death?

To fill out a revocable transfer on death, you will need to provide information about the assets being transferred, the designated beneficiaries, and any specific instructions or conditions for the transfer.

What is the purpose of revocable transfer on death?

The purpose of a revocable transfer on death is to ensure that assets are transferred to specified beneficiaries upon the individual's death without having to go through the probate process.

What information must be reported on revocable transfer on death?

The information that must be reported on a revocable transfer on death typically includes details about the assets being transferred, the beneficiaries, and any conditions or restrictions on the transfer.

Fill out your revocable transfer on death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revocable Transfer On Death is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.