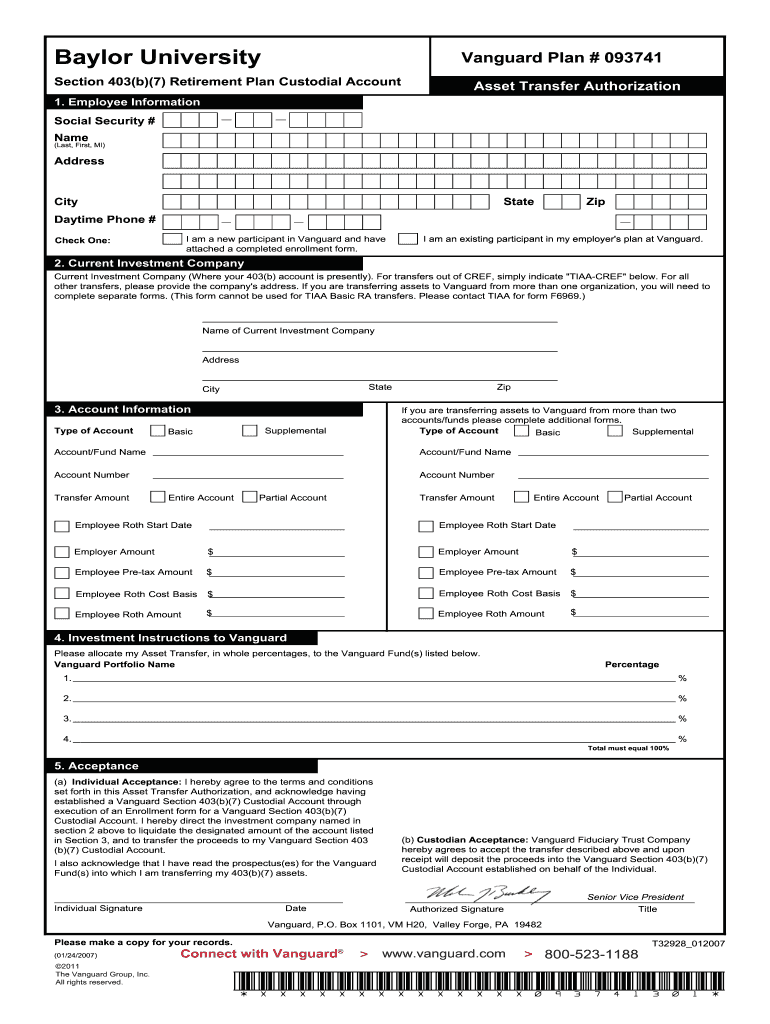

Get the free Asset Transfer Authorization

Show details

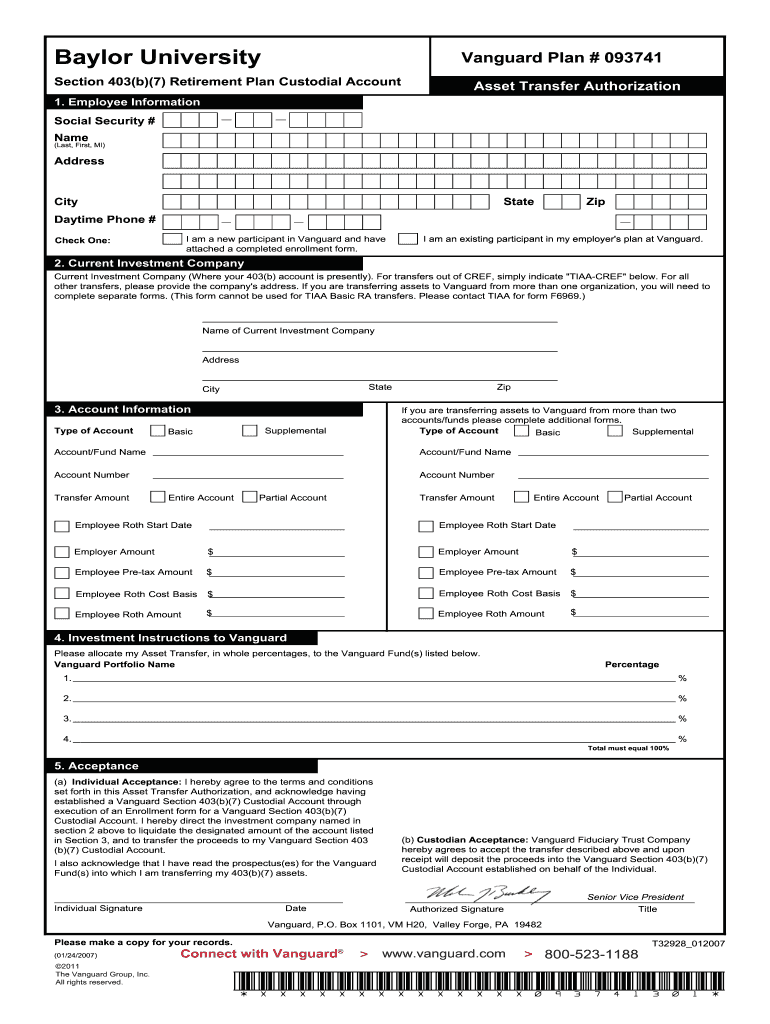

This form is used to authorize the transfer of assets from an existing 403(b) retirement account to a Vanguard Section 403(b)(7) Custodial Account. It includes sections for employee information, current

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign asset transfer authorization

Edit your asset transfer authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your asset transfer authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit asset transfer authorization online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit asset transfer authorization. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out asset transfer authorization

How to fill out Asset Transfer Authorization

01

Obtain the Asset Transfer Authorization form from the relevant institution.

02

Fill in the date at the top of the form.

03

Provide details of the current asset owner, including their name and contact information.

04

Enter the asset details, including type, description, and identification numbers if applicable.

05

Specify the recipient's information, including their name and contact details.

06

Include any conditions or restrictions on the transfer if necessary.

07

Sign and date the form to authorize the transfer.

08

Submit the completed form to the relevant authority or institution.

Who needs Asset Transfer Authorization?

01

Individuals or entities transferring assets.

02

Trustees overseeing asset transfers on behalf of beneficiaries.

03

Financial institutions handling transfers between accounts.

04

Estate executors managing asset distributions.

Fill

form

: Try Risk Free

People Also Ask about

What is a letter of transfer of assets?

Asset transfer letters typically include essential details such as the identities of both parties, specific descriptions of the assets being transferred, the effective date of the transfer, and any conditions or special terms governing the transaction.

What does transfer of assets out mean?

Transfer of an asset occurs when the interest in property is given to another individual, or disposed of in another way.

What is a transfer of assets as a going concern?

Transfer of a going concern (TOGC) is when a business, or part of a business, is sold and meets certain criteria which mean it is deemed to be a TOGC rather than a transfer of assets. In this scenario, no VAT applies to the value of the transaction, and it is 'outside the scope' of VAT (no output VAT1 is charged).

What is an example of a transfer of assets?

Selling the property, giving it as a gift, transferring the title willingly to a beneficiary, complying with a court order, or filing for bankruptcy can all result in the transfer of ownership. Loan Transfers are transfers as well.

How do I transfer assets to another person?

Naming beneficiaries on any of your accounts, assets and life insurance contracts is the easiest and most efficient way to transfer wealth. It enables the administrator of the estate to follow through on the wishes of the deceased immediately without the need to go through the probate process.

How do I transfer assets to another person?

Naming beneficiaries on any of your accounts, assets and life insurance contracts is the easiest and most efficient way to transfer wealth. It enables the administrator of the estate to follow through on the wishes of the deceased immediately without the need to go through the probate process.

What is a transfer of assets?

An asset transfer is the process of legally shifting ownership of assets from one entity to another, which can occur in various contexts such as personal finance, business transactions, or investment management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Asset Transfer Authorization?

Asset Transfer Authorization is a formal document that allows the transfer of assets from one entity to another, ensuring that the transfer is documented and approved.

Who is required to file Asset Transfer Authorization?

Entities that are transferring assets, such as companies or organizations, are required to file Asset Transfer Authorization to comply with legal and regulatory requirements.

How to fill out Asset Transfer Authorization?

To fill out Asset Transfer Authorization, provide details such as the names of the transferring and receiving parties, descriptions of the assets being transferred, the reason for the transfer, and signatures from authorized representatives.

What is the purpose of Asset Transfer Authorization?

The purpose of Asset Transfer Authorization is to ensure that asset transfers are carried out legally and transparently, protecting the rights of both the transferring and receiving parties.

What information must be reported on Asset Transfer Authorization?

Information that must be reported includes details about the transferring and receiving parties, descriptions of the assets, the value of the assets, the purpose of the transfer, and any relevant dates.

Fill out your asset transfer authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Asset Transfer Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.