Get the free K-40H - ksrevenue

Show details

This document provides information about the Kansas Homestead Refund program available for low income seniors, detailing eligibility requirements, filing instructions, and refund calculations. The

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign k-40h - ksrevenue

Edit your k-40h - ksrevenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your k-40h - ksrevenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

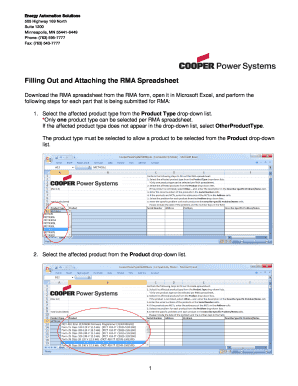

Editing k-40h - ksrevenue online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit k-40h - ksrevenue. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

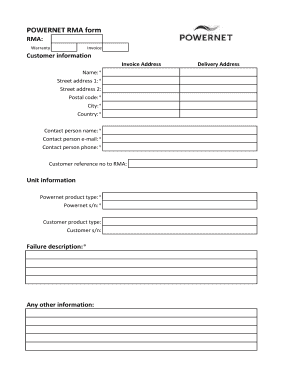

How to fill out k-40h - ksrevenue

How to fill out K-40H

01

Obtain the K-40H form from the official taxation website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Report your income sources accurately in the designated sections of the form.

04

Fill out the section for any applicable tax credits or deductions.

05

Calculate your total tax liability based on the provided instructions.

06

Review the completed form for any errors or omissions.

07

Sign and date the form before submitting it.

08

Keep a copy of the completed form for your records.

Who needs K-40H?

01

Individuals who are residents of Kansas and wish to claim a tax refund.

02

Taxpayers who qualify for specific tax credits offered in the state of Kansas.

03

Anyone filing taxes in Kansas who has the need to report additional income or claim deductions.

Fill

form

: Try Risk Free

People Also Ask about

Do seniors get a property tax break in Kansas?

Safe Senior is also referred to as, “Kansas Property Tax Relief for Low Income Seniors”. The refund is up to 75% of the 2024 general property tax paid or to be paid on the 2024 real estate tax statement for the residence in which the claimant lived in 2024.

What is the property tax credit in Kansas?

The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident's homestead. Your refund percentage is based on your total household income and the refund is a percentage of your general property tax paid. The maximum refund is $700.

How much is the Kansas homestead exemption?

IF eligible you may receive a refund of up to $700. To Qualify: Must be a Kansas resident for the entire year who owned AND occupied a homestead AND total household income is $42,600 or less (this amount is subject to change yearly). You must also meet ONE of the following requirements.

Who is eligible for the Kansas Homestead refund?

To Qualify: Must be a Kansas resident for the entire year who owned AND occupied a homestead AND total household income is $42,600 or less (this amount is subject to change yearly).

What qualifies as a homestead in Kansas?

you must have household income of $42,600 or less; you must have owned and occupied a home in Kansas during 2024; and. your house cannot be valued at more than $350,000.

Who is exempt from paying property taxes in Kansas?

Government Exemptions Property used exclusively for state, municipal or political subdivision purposes, including leased vehicles if leased for a period of at least one year and property leased for medical services and certain property funded by industrial revenue bonds, up to 10 years.

How do you qualify for the Homestead Credit?

One of the key requirements is occupancy status — homestead exemptions are typically only available for primary residences. Some other factors that may impact eligibility include your age and income, as well as your marital, veteran or disability status.

What is the income limit for a homestead in Kansas?

Qualifications for the Homestead Claim (K-40H): Owner of your home; Total household income is $42,600 or less; AND. Over age 55, or blind, or disabled, OR has dependent child who lived with you and was under age 18, for the entire tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is K-40H?

K-40H is a Kansas state tax form used to report income tax for homeowners based on property taxes paid.

Who is required to file K-40H?

Homeowners who claim a property tax refund are required to file the K-40H form.

How to fill out K-40H?

To fill out K-40H, gather your property tax information, complete the designated sections with your details, and submit it alongside your income tax return.

What is the purpose of K-40H?

The purpose of K-40H is to allow qualifying homeowners to receive a property tax refund based on their property taxes.

What information must be reported on K-40H?

Information such as the property address, amount of property tax paid, and the homeowner's personal identification details must be reported on K-40H.

Fill out your k-40h - ksrevenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

K-40h - Ksrevenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.