AL EX-A1 2020 free printable template

Show details

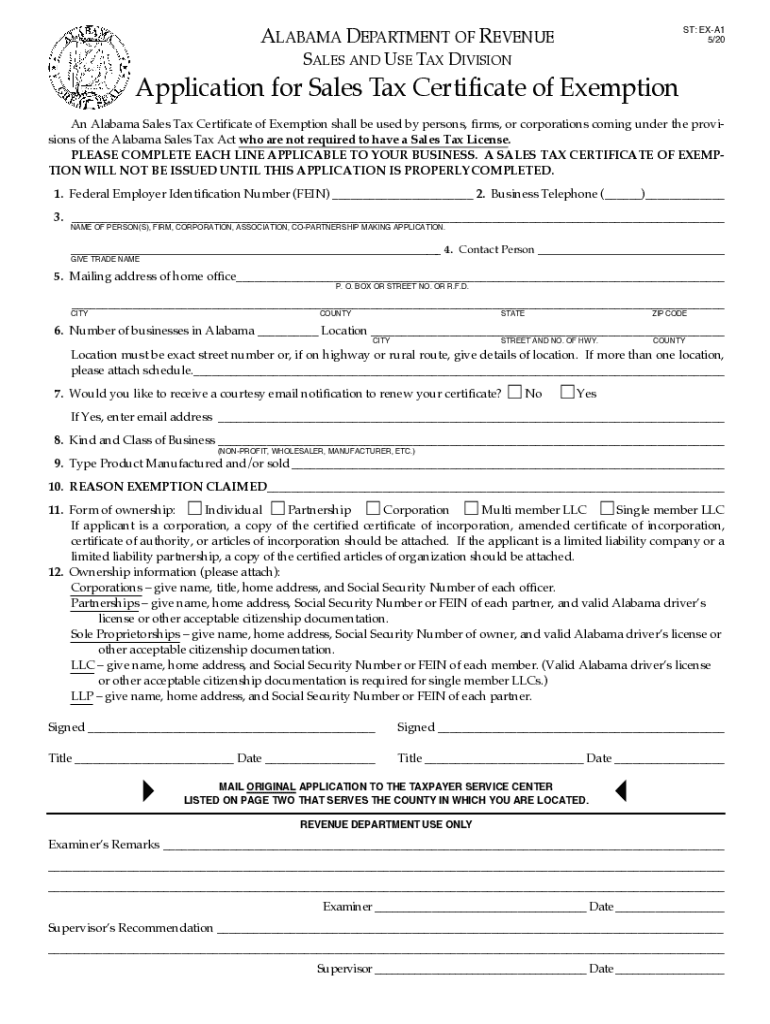

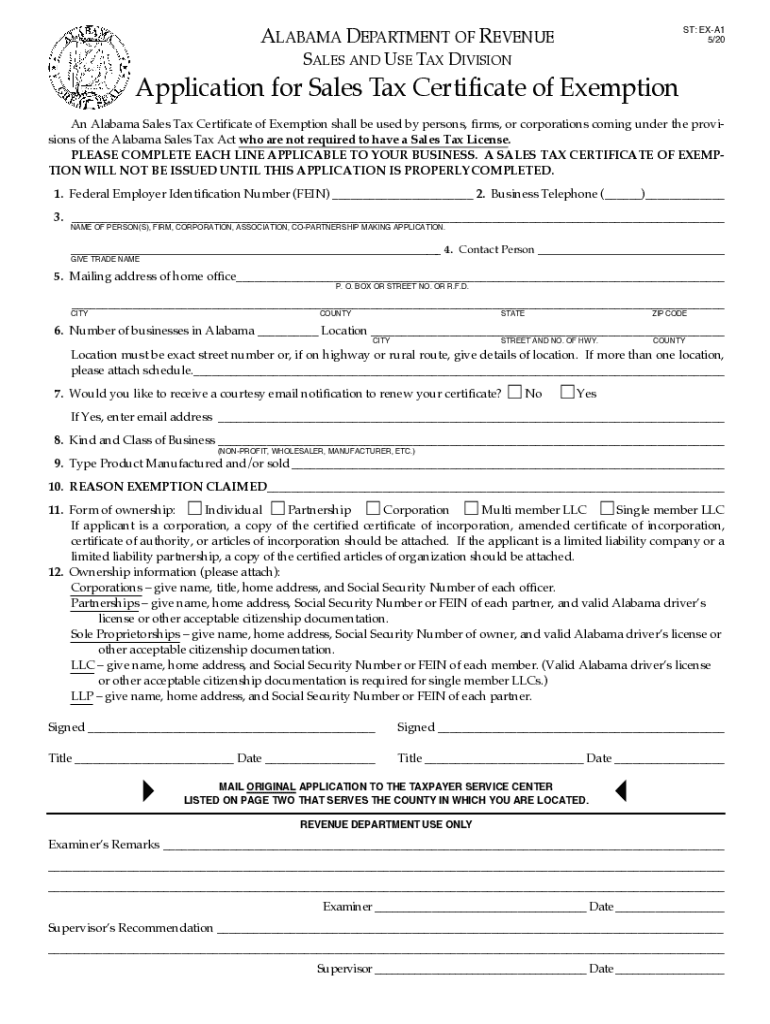

ResetALABAMA DEPARTMENT OF REVENUES: EXA1 5/20SALES AND USE TAX Divisionalization for Sales Tax Certificate of Exemption An Alabama Sales Tax Certificate of Exemption shall be used by persons, firms,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL EX-A1

Edit your AL EX-A1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL EX-A1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL EX-A1 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit AL EX-A1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL EX-A1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL EX-A1

How to fill out AL EX-A1

01

Start by obtaining the AL EX-A1 form from the relevant authority.

02

Read the instructions carefully to understand the requirements.

03

Fill out personal information such as your name, address, and contact details in the appropriate sections.

04

Provide any necessary identification numbers or references as specified.

05

Answer all questions truthfully and provide additional information as needed.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the form through the designated method, whether it is online or by mail.

Who needs AL EX-A1?

01

Individuals applying for a specific permit or certification.

02

Professionals seeking to demonstrate qualifications.

03

Participants in programs requiring proof of eligibility.

04

Anyone fulfilling legal or regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a resale certificate in Alabama?

The state of Alabama is one of the few states that don't have a resale certificate. When asked for one by a vendor, an Alabama business will give them a copy of their Alabama Sales Tax License.

What is a sales tax exemption certificate for resale in Alabama?

An Alabama resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without having to pay sales tax on them.

How do I get a US tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

How do I apply for over 65 property tax exemption in Alabama?

A. To apply for senior citizens or disability exemption you must bring proof of age (birth certificate or drivers license) and most recent Federal and State income tax returns to the Tax Assessor's office between October 1 and December 31 to be eligible for exemption on the next years tax.

What is the utility tax exemption in Alabama?

Alabama allows an exemption on the furnishing of electricity to a manufacturer or compounder for use in an electrolytic or electrothermal manufacturing or compounding process, natural gas which becomes a component of tangible personal property manufactured or compounded (but not used as fuel or energy), and natural gas

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit AL EX-A1 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like AL EX-A1, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make edits in AL EX-A1 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit AL EX-A1 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I edit AL EX-A1 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute AL EX-A1 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is AL EX-A1?

AL EX-A1 is a form used in Alabama for individuals and businesses to report certain tax-exempt transactions.

Who is required to file AL EX-A1?

Entities or individuals who engage in tax-exempt purchases or sales and need to document these transactions must file AL EX-A1.

How to fill out AL EX-A1?

To fill out AL EX-A1, provide the required identification information, specify the nature of the transaction, and list the details of the items or services being reported.

What is the purpose of AL EX-A1?

The purpose of AL EX-A1 is to ensure proper documentation of tax-exempt transactions for regulatory compliance and to prevent tax evasion.

What information must be reported on AL EX-A1?

Information that must be reported on AL EX-A1 includes the tax-exempt status of the purchaser, the type of transaction, and specific details regarding the items or services involved.

Fill out your AL EX-A1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL EX-a1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.