Instructions for Completing the BB&T Corporation 401(k) Savings Plan Voluntary Withdrawal Form 2012-2025 free printable template

Show details

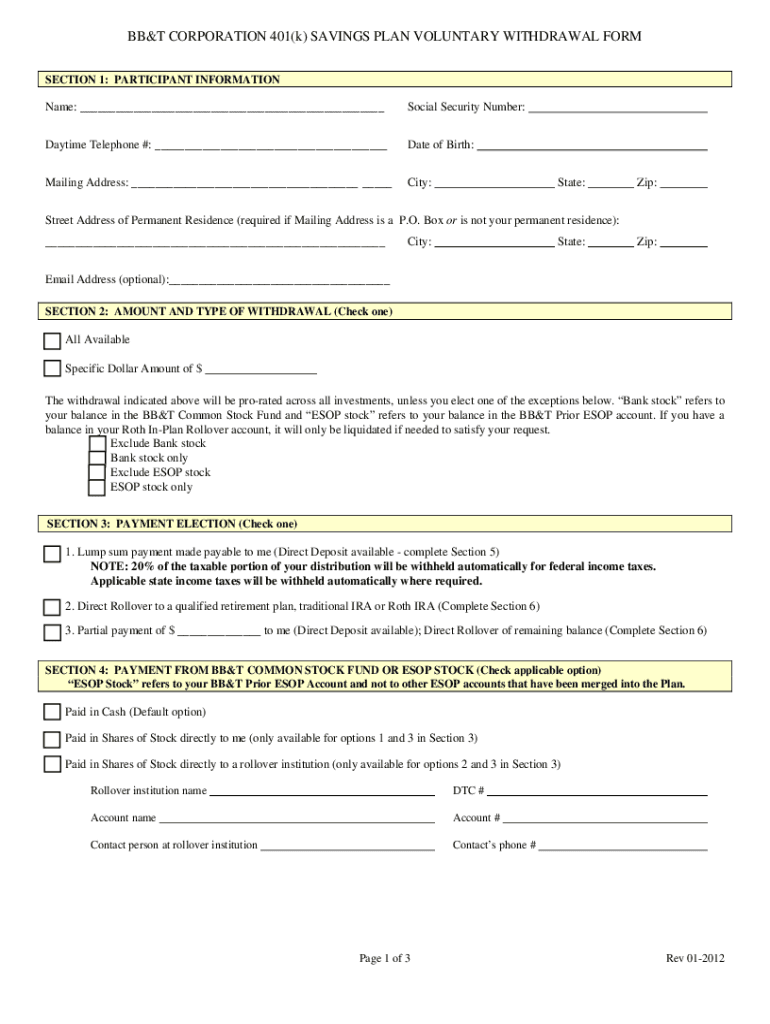

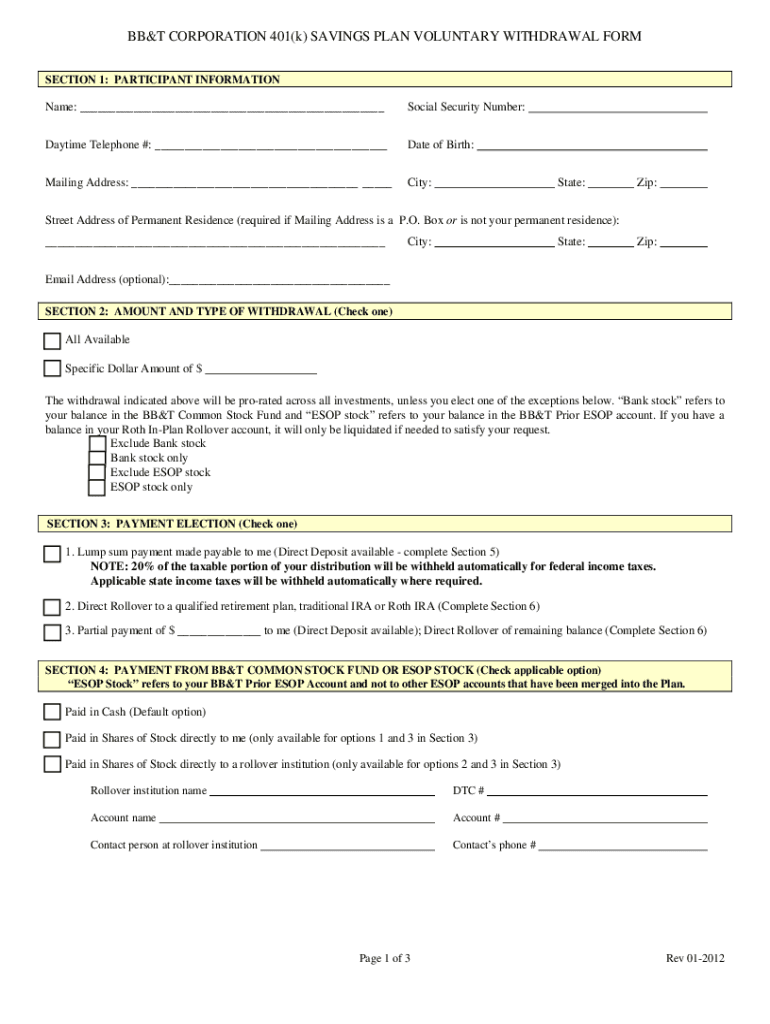

Instructions for Completing the BBT Corporation 401(k) Savings Plan Voluntary Withdrawal Form IMPORTANT: Please read the Special Tax Notices included in this distribution package before making any

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign plan month form

Edit your tax day form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax day form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax day form online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax day form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax day form

How to fill out Instructions for Completing the BB&T Corporation 401(k) Savings Plan

01

Begin by gathering your personal information such as name, Social Security number, and date of birth.

02

Review the 401(k) plan overview provided by BB&T Corporation to understand your investment options.

03

Complete the enrollment form by filling out your desired contribution percentage.

04

Select your investment options from the list provided in the plan documents.

05

Indicate your beneficiary information, ensuring to name someone you trust.

06

Double-check all information for accuracy before submission.

07

Submit the completed form to your HR representative or follow the submission guidelines outlined in the instructions.

Who needs Instructions for Completing the BB&T Corporation 401(k) Savings Plan?

01

Employees of BB&T Corporation who wish to participate in the 401(k) Savings Plan.

02

New hires who are eligible for the retirement benefits.

03

Current employees looking to adjust their contribution or investment choices.

Fill

form

: Try Risk Free

People Also Ask about

What is form 4868 used for?

A U.S. citizen or resident files this form to request an automatic extension of time to file a U.S. individual income tax return.

How do I get a copy of my form 4868?

From the Filing section: From within your TaxAct Online return, click Filing. Click File Extension. The program will proceed with the interview questions for you to review. On the screen titled Form 4868-Filing, you will have the option to print.

Can I file IRS form 4868 online?

You can file Form 4868 electronically by accessing IRS e-file using your tax software or by using a tax professional who uses e-file. 3.

Is tax day extended 2023?

The final day to file your federal income tax return was April 18, 2023. This was also the last day to request a six-month tax extension by filing Form 4868. If you haven't filed, the IRS says do it as soon as possible to limit the penalties and interest you may have to pay.

What happens if you miss tax deadline?

An extension to file provides an additional six months with a new filing deadline of Oct. 16. Penalties and interest apply to taxes owed after April 18 and interest is charged on tax and penalties until the balance is paid in full.

Is tax day a deadline to file or pay taxes?

The deadline to file 2022 income tax returns is Tuesday - but not for everyone in California. For most of the country, April 18 is the filing deadline. However, filing and payment deadlines have been automatically extended to Oct. 16 if you have an address in a federally declared disaster area.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax day form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax day form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute tax day form online?

pdfFiller has made it easy to fill out and sign tax day form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my tax day form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax day form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is Instructions for Completing the BB&T Corporation 401(k) Savings Plan?

The Instructions for Completing the BB&T Corporation 401(k) Savings Plan provide detailed guidelines on how employees can participate in and manage their 401(k) retirement savings accounts, including information on contributions, investment options, and withdrawal procedures.

Who is required to file Instructions for Completing the BB&T Corporation 401(k) Savings Plan?

Employees of BB&T Corporation who wish to enroll or make changes to their participation in the 401(k) Savings Plan are required to complete the instructions as part of the process.

How to fill out Instructions for Completing the BB&T Corporation 401(k) Savings Plan?

To fill out the Instructions for Completing the BB&T Corporation 401(k) Savings Plan, employees should carefully follow the step-by-step directions provided in the document, ensuring that all required information is accurately entered and submitted within the specified deadlines.

What is the purpose of Instructions for Completing the BB&T Corporation 401(k) Savings Plan?

The purpose of the instructions is to guide employees in effectively managing their contributions to the 401(k) plan, to ensure compliance with regulations, and to maximize retirement savings through informed investment decisions.

What information must be reported on Instructions for Completing the BB&T Corporation 401(k) Savings Plan?

The information that must be reported includes personal details such as the employee's name, Social Security number, contribution rates, selected investment options, and any other relevant data required for account setup and maintenance.

Fill out your tax day form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Day Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.