Get the free Application to Enter into a Factoring Agreement

Show details

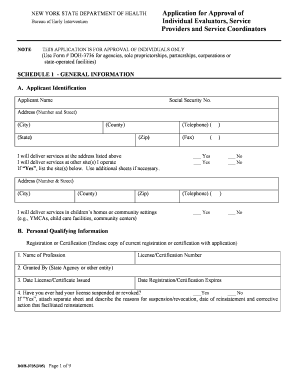

This document serves as an application for businesses seeking to enter into a factoring agreement, requiring various pertinent information regarding the business, its officers, financial statements,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application to enter into

Edit your application to enter into form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application to enter into form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application to enter into online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application to enter into. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application to enter into

How to fill out Application to Enter into a Factoring Agreement

01

Begin by downloading the Application to Enter into a Factoring Agreement from the provider's website.

02

Fill out your business information, including the name, address, and contact details.

03

Provide your tax identification number and any relevant business registration details.

04

Describe your business, including the nature of operations and industry type.

05

List your accounts receivable details, including major clients and estimated receivables to be factored.

06

Include financial statements such as balance sheets and income statements, if required by the factoring company.

07

Sign and date the application to verify the accuracy of the information provided.

08

Submit the application along with any requested documents via the specified method (email, fax, or mail).

Who needs Application to Enter into a Factoring Agreement?

01

Businesses looking for immediate cash flow by selling their receivables.

02

Companies that are struggling with cash flow issues and need quick financing.

03

Startups that do not have access to traditional bank financing.

04

Businesses that want to outsource their credit management process.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of factoring agreement?

A factoring agreement is a crucial contract between a factoring company and a business, enabling the sale of accounts receivable for immediate cash. They outline terms like fees, payment schedules, and responsibilities. However, accuracy is paramount to uphold mutual trust and compliance.

What is a factoring letter?

Invoice factoring is an agreement to assign your accounts receivable (A/R) to a factoring company. So the letter communicates that a third party (factoring company) is managing and collecting your A/R.

What is factoring agreement?

Factoring is a type of financing agreement where a creditor buys the rights to or the credit risk of a company's accounts receivable . Instead of getting a loan from a bank, a company may sell their accounts receivable to a creditor for a fee instead to shore up immediate cash or improve their balance sheets .

How do I get out of a factoring agreement?

A factoring contract is an agreement where a small business sells outstanding invoices to third parties — known as factors — in exchange for upfront cash. When these invoices, or accounts receivable, are paid by clients, the money will go to the factor, rather than the small business itself.

What is factoring in simple words?

Factoring is the process of selling these outstanding invoices to a financier or 'factor'. You sell the invoice at a discounted rate, lower than the money owed on the invoice. The factoring firm makes a profit by then chasing up the client to whom the unpaid invoice is addressed and charging them the full amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application to Enter into a Factoring Agreement?

The Application to Enter into a Factoring Agreement is a formal document that businesses submit to initiate a partnership with a factoring company, seeking to sell their receivables for immediate cash.

Who is required to file Application to Enter into a Factoring Agreement?

Any business that wishes to engage in factoring services must file the Application to Enter into a Factoring Agreement, typically including those with outstanding invoices needing immediate liquidity.

How to fill out Application to Enter into a Factoring Agreement?

To fill out the Application to Enter into a Factoring Agreement, businesses need to provide details including their business structure, financial information, accounts receivable details, and terms of the proposed factoring arrangement.

What is the purpose of Application to Enter into a Factoring Agreement?

The purpose of the Application is to assess the business's eligibility for factoring services and to outline the terms and conditions under which the factoring company agrees to purchase receivables from the business.

What information must be reported on Application to Enter into a Factoring Agreement?

The Application should report information such as the business's legal name, contact details, financial statements, current accounts receivable, and a description of the goods or services provided.

Fill out your application to enter into online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application To Enter Into is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.