Get the free Coverdell Education Savings Account Application

Show details

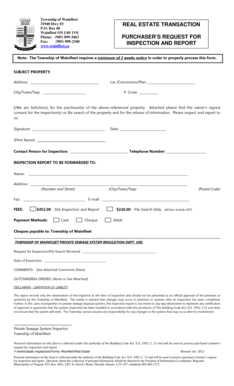

Coverdell Education Savings Account Application Overnight Express Mail To PRIMECAP Odyssey Funds c/o U.S. Bancorp Fund Services LLC 615 E. Michigan St. FL3 Milwaukee WI 53202-5207 Mail to PRIMECAP Odyssey Funds PO Box 701 In compliance with the USA PATRIOT Act all mutual funds are required to obtain the following information for all registered owners and all authorized individuals full name date of birth Social Security number and permanent street address. The responsible party does not wish...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coverdell education savings account

Edit your coverdell education savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coverdell education savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit coverdell education savings account online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit coverdell education savings account. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coverdell education savings account

How to fill out Coverdell Education Savings Account Application

01

Obtain the Coverdell Education Savings Account Application form from a financial institution or their website.

02

Read the instructions carefully to understand the requirements and information needed.

03

Provide personal information for the account beneficiary, including their name, Social Security number, and date of birth.

04

Fill out your personal information as the account owner, including your name, contact information, and Social Security number.

05

Select an initial contribution amount that you intend to deposit into the Coverdell account.

06

Choose your investment options based on what the financial institution offers for your account.

07

Review the terms and conditions associated with the Coverdell account, ensuring you understand the fees and limitations.

08

Sign and date the application to certify that all information provided is accurate.

09

Submit the application to the financial institution along with any required documentation and your initial contribution.

Who needs Coverdell Education Savings Account Application?

01

Parents or guardians who want to save for their child's future education expenses.

02

Students who are looking for a way to fund their education-related costs.

03

Families seeking tax-advantaged savings options for educational purposes.

04

Individuals interested in covering qualified education expenses, including K-12 education and higher education.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a 529 plan and a Coverdell?

The primary difference between a Coverdell ESA and a 529 savings plan is the expenses that qualify for tax-free withdrawals. A Coverdell allows for a wider range of education-related expenses, especially pertaining to K-12 students.

What are the disadvantages of a Coverdell?

Cons: Contribution Limits: Annual contributions are capped at $2,000 per beneficiary. Income Restrictions: There are income limits for contributors, which may exclude higher-income families. Age Limits: Contributions can only be made until the beneficiary turns 18, and the funds must be used by age 30.

How to open a Coverdell Education Savings Account?

Cons: Contribution Limits: Annual contributions are capped at $2,000 per beneficiary. Income Restrictions: There are income limits for contributors, which may exclude higher-income families. Age Limits: Contributions can only be made until the beneficiary turns 18, and the funds must be used by age 30.

Is a Coverdell worth it?

Benefits of a Coverdell: Tax-free asset growth within the account. Greater flexibility related to qualified education expenses, especially for pre-college education. May be rolled over into a 529 plan or to another qualifying family member. Potentially more investment options through the sponsoring bank's platform.

What are the disadvantages of a Coverdell Education Savings Account?

If your MAGI is between $95,000 and $110,000 (between $190,000 and $220,000 if filing a joint return), the $2,000 limit for each designated beneficiary is gradually reduced. If your MAGI is $110,000 or more ($220,000 or more if filing a joint return), you can't contribute to anyone's Coverdell ESA.

What is ESA in education pros and cons?

The Main Features of the ESA: An ESA can be used for primary and secondary school, not just college expenses. An ESA has income restrictions. You can't contribute to an ESA if you make more than $110,000 (single) or $220,000 (married filing jointly). You can't contribute more than $2,000 to an ESA per child, per year.

What are the income requirements for Coverdell ESA?

The trust or custodian is the party that establishes and controls the funds in the ESA for the student beneficiary, who must be under the age of 18 at the time of designation. Funds within the account are not considered to be owned by the custodian nor by the beneficiary unless they are the same individual.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Coverdell Education Savings Account Application?

The Coverdell Education Savings Account Application is a form used to establish a Coverdell ESA, which is a savings account designed to help families save for education expenses.

Who is required to file Coverdell Education Savings Account Application?

Any individual who wants to set up a Coverdell Education Savings Account for their child or a beneficiary is required to file this application.

How to fill out Coverdell Education Savings Account Application?

To fill out the Coverdell Education Savings Account Application, individuals need to provide personal information about the account owner and the beneficiary, including names, Social Security numbers, and details about contributions.

What is the purpose of Coverdell Education Savings Account Application?

The purpose of the Coverdell Education Savings Account Application is to formally request the establishment of a Coverdell ESA, allowing funds to be set aside for qualified education expenses tax-free.

What information must be reported on Coverdell Education Savings Account Application?

The application must include the account owner's and beneficiary's personal information, contribution amounts, investment choices, and selection of a custodian or trustee.

Fill out your coverdell education savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coverdell Education Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.