Get the free Income Deferral 403(b) Contribution Agreement - benefits jhu

Show details

Este es un acuerdo de contribución para un plan 403(b) que permite a los empleados de Johns Hopkins University (JHU) hacer reducciones salariales voluntarias para la contribución de fondos de jubilación.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income deferral 403b contribution

Edit your income deferral 403b contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income deferral 403b contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income deferral 403b contribution online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit income deferral 403b contribution. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

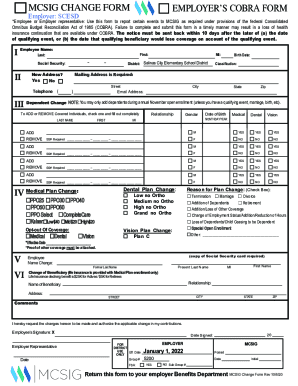

How to fill out income deferral 403b contribution

How to fill out Income Deferral 403(b) Contribution Agreement

01

Obtain the Income Deferral 403(b) Contribution Agreement form from your employer or plan administrator.

02

Fill in your personal information at the top of the form, including your name, address, and employee identification number.

03

Specify the percentage or dollar amount you wish to defer from your salary into your 403(b) plan.

04

Review the employer's matching contribution policies, if applicable, and note them on the form.

05

Sign and date the form to signify your agreement and understanding of the terms.

06

Submit the completed form to your HR department or plan administrator by the specified deadline.

Who needs Income Deferral 403(b) Contribution Agreement?

01

Employees of eligible non-profit organizations, schools, and other tax-exempt organizations who want to save for retirement.

02

Individuals looking to defer a portion of their income to reduce taxable income.

03

Participants in a 403(b) retirement savings plan offered by their employer.

Fill

form

: Try Risk Free

People Also Ask about

At what age can I withdraw from 403b without penalty?

But beware: While a terrific savings vehicle, 403(b)s have some drawbacks. 403(b)s have a narrower range of investments than 401(k)s, and many plans over-emphasize, or even prioritize, annuities as the primary investment option.

What's the difference between a 401k and a 403b?

403(b) Plans and Filing Federal Taxes You don't need to report your 403(b) plan contributions separately on your federal tax return. Your employer will report your contributions on your W-2. Because the funds are tax-deferred, your 403(b) plan contributions won't be taxed as part of your federal taxes.

What are the disadvantages of a 403b plan?

Investments: Deferred compensation is an agreement that your employer will distribute your deferred income to you, at a later date, along with any investment growth you would have earned.

What does 403 B deferral mean?

Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salary into individual accounts. The deferred salary is generally not subject to federal or state income tax until it's distributed.

What are the disadvantages of a 403b plan?

But beware: While a terrific savings vehicle, 403(b)s have some drawbacks. 403(b)s have a narrower range of investments than 401(k)s, and many plans over-emphasize, or even prioritize, annuities as the primary investment option.

What is a 403b deferral?

A 403(b) plan must generally allow all employees to make elective deferrals to the plan. Under the universal availability rule, if an employer permits one employee to defer salary by contributing it to a 403(b) plan, the employer must extend this offer to all employees of the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income Deferral 403(b) Contribution Agreement?

An Income Deferral 403(b) Contribution Agreement is a legal document that allows employees of certain tax-exempt organizations to defer a portion of their income into a retirement savings plan, thus reducing their taxable income for the year.

Who is required to file Income Deferral 403(b) Contribution Agreement?

Employees of eligible tax-exempt organizations, such as public schools and non-profit entities, who wish to participate in a 403(b) retirement plan must file an Income Deferral 403(b) Contribution Agreement.

How to fill out Income Deferral 403(b) Contribution Agreement?

To fill out the agreement, employees must provide personal information, such as their name and Social Security number, specify the amount or percentage of salary to defer, and sign the agreement to authorize the deferral payments.

What is the purpose of Income Deferral 403(b) Contribution Agreement?

The purpose of the agreement is to facilitate retirement savings for employees by allowing them to arrange for a portion of their salary to be withheld and contributed directly to a 403(b) retirement account, promoting long-term financial security.

What information must be reported on Income Deferral 403(b) Contribution Agreement?

The agreement must report the employee's identity, the amount or percentage of salary to be deferred, the effective date of deferral, and any employee or employer contributions specified.

Fill out your income deferral 403b contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Deferral 403b Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.