Get the free Mel Brown Family Loan Repayment Assistance Program - law wustl

Show details

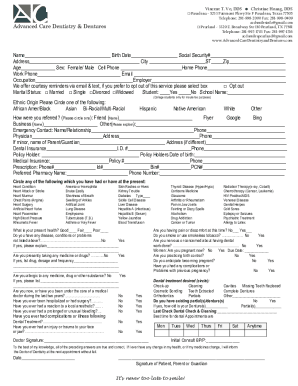

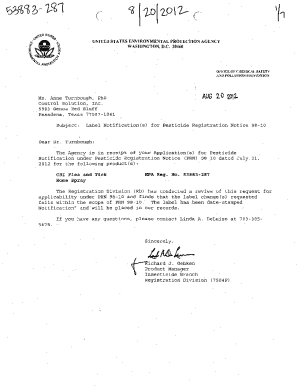

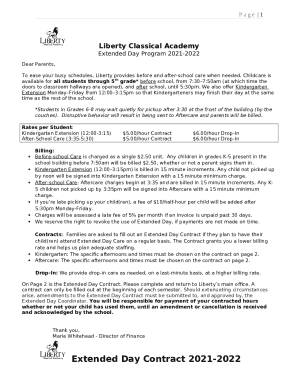

This application form is intended for individuals seeking assistance through the Mel Brown Family Loan Repayment Assistance Program at Washington University School of Law. It collects personal, employment,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mel brown family loan

Edit your mel brown family loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mel brown family loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mel brown family loan online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mel brown family loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mel brown family loan

How to fill out Mel Brown Family Loan Repayment Assistance Program

01

Obtain the application form for the Mel Brown Family Loan Repayment Assistance Program from the official website or designated office.

02

Read the program guidelines thoroughly to ensure eligibility.

03

Gather all necessary documents, including proof of income, loan details, and any additional required paperwork.

04

Complete the application form carefully, providing accurate and truthful information.

05

Attach all required documents to your application form.

06

Submit the completed application form and accompanying documents either online or by mail, as instructed.

07

Keep a copy of your application and documents for your records.

Who needs Mel Brown Family Loan Repayment Assistance Program?

01

Individuals or families struggling to meet their loan repayment obligations due to financial hardship.

02

Recent graduates who have taken out loans for education and are facing difficulties in repayment.

03

Low-income households that require assistance in managing their debt and improving their financial stability.

Fill

form

: Try Risk Free

People Also Ask about

Why am I getting a student loan refund check?

If the amount you borrow for your education exceeds your expenses, you'll receive a student loan refund check. If you spend this money, you'll have to pay it back with interest, so typically, the best thing you can do is return it.

Who qualifies for the NHSC loan repayment program?

The NHSC LRP is open to licensed primary care medical, dental, and mental and behavioral health providers who are employed or seeking employment at approved sites. You must work in a Health Professional Shortage Area (HPSA) to qualify for this program.

What is loan repayment assistance program?

If your income after graduation is modest, the Loan Repayment Assistance Program (“LRAP”) can help you pay back your federal, private alternative, and parent PLUS loans – at no cost to you or your family. LRAP is a financial safety-net.

What is the Maryland loan assistance repayment program?

What is the Maryland Loan Assistance Repayment Program (MLARP)? The MLARP offers primary care physicians and physician assistants an opportunity to practice their profession in a community that lacks adequate health care services while also receiving funds to pay their educational loans.

How do loan repayment assistance programs work?

LRAPs provide loan repayment or lower loan payments to graduates entering specific types of employment, usually law-related public interest jobs. Most LRAPs and loan forgiveness programs contain limits on the amount of income a recipient can earn while participating in such a program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mel Brown Family Loan Repayment Assistance Program?

The Mel Brown Family Loan Repayment Assistance Program is a financial assistance initiative designed to help eligible individuals repay their student loans or other educational debt. It aims to alleviate the burden of loan repayments for families and individuals pursuing higher education.

Who is required to file Mel Brown Family Loan Repayment Assistance Program?

Individuals who are seeking assistance to repay their educational loans and meet the eligibility criteria set by the program are required to file for the Mel Brown Family Loan Repayment Assistance Program.

How to fill out Mel Brown Family Loan Repayment Assistance Program?

To fill out the Mel Brown Family Loan Repayment Assistance Program application, individuals must complete the required forms accurately, provide necessary documentation regarding their educational loans, and submit the application by the specified deadline.

What is the purpose of Mel Brown Family Loan Repayment Assistance Program?

The purpose of the Mel Brown Family Loan Repayment Assistance Program is to provide financial relief to individuals and families struggling with educational loans, ultimately promoting higher education access and reducing financial burdens related to student debt.

What information must be reported on Mel Brown Family Loan Repayment Assistance Program?

Applicants must report personal information such as their name, contact details, educational background, loan details, income information, and any other relevant financial data required by the program to assess eligibility for assistance.

Fill out your mel brown family loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mel Brown Family Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.