Get the free mc 219

Show details

This document provides essential information regarding the rights, responsibilities, and confidentiality of individuals applying for Medi-Cal benefits in California.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mc 219 form

Edit your mc 219 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mc 219 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mc 219 form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mc 219 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mc 219 form

How to fill out mc 219?

01

Obtain the mc 219 form from the relevant authority or website.

02

Read the instructions and guidelines provided with the form carefully.

03

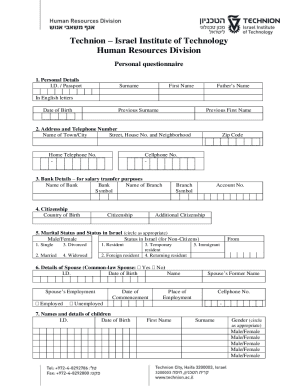

Fill in your personal information accurately, including your name, address, and contact details.

04

Provide any necessary details about your occupation or employment.

05

Indicate the purpose or reason for filling out the mc 219 form.

06

Answer all the questions or provide the requested information clearly and concisely.

07

Review the completed form to ensure all fields are filled out correctly.

08

Sign and date the form as required.

09

Submit the filled-out mc 219 form to the appropriate authority or designated location.

10

Keep a copy of the completed form for your records.

Who needs mc 219?

01

Individuals or businesses involved in particular legal procedures that require the submission of mc 219.

02

Employers who need to document certain information about their employees.

03

Organizations or entities that require an individual's personal and contact details for record-keeping purposes.

04

Government agencies or regulatory bodies that mandate the use of mc 219 for specific processes or documentation.

Video instructions and help with filling out and completing mc 219

Instructions and Help about mc 219 form

Fill

form

: Try Risk Free

People Also Ask about

How much money can you have in the bank and still qualify for Medi-Cal?

Household sizeAsset limits1 person$130,0002 people$195,0003 people$260,0004 people$325,0006 more rows • Feb 15, 2023

What is MC 219?

MC 219 (11/15) ENG2. • To verify immigration status with the Department of Homeland Security (DHS), if required. Information shared with DHS cannot be used for immigration enforcement unless you are committing fraud.

Can I get Medi-Cal if I have money in the bank?

4. How to Qualify. To find out if you qualify for one of Medi-Cal's programs, look at your countable asset levels. As of July 1, 2022, you may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member.

What is the maximum income to qualify for Medi-Cal 2023?

ing to Covered California income guidelines and salary restrictions, if an individual makes less than $47,520 per year or if a family of four earns wages less than $97,200 per year, then they qualify for government assistance based on their income.

Is Medi-Cal based on income or assets?

Note: Medi-Cal disregards property for individuals whose eligibility is determined utilizing your Modified Adjusted Gross Income (MAGI).

How much money can I have in the bank and get Medi-Cal?

Q: What is the Asset Limit Elimination? Te Medi-Cal program applies an asset limit of $2,000 for an individual and $3,000 for a couple for adults over age 65, persons under age 65 with a disability, and residents of long-term care facilities enrolled in Medi-Cal.

What are the two types of Medi-Cal?

You should keep this guide and use it when you have questions about Medi-Cal. California offers two ways to get health coverage. They are “Medi-Cal” and “Covered California.” Both programs use the same application.

What happens if you don't report a change to Medi-Cal?

Additionally, if you don't report your income change within the required time frame, it may affect what you're eligible for in terms of savings and coverage. Essentially, the amount you earn directly impacts the amount you pay for your health insurance plan.

How much money is too much for Medi-Cal?

Countable Assets Limits: Up to $2,000 for an individual, $3,000 for couples. Note: These are SSI's limits. If your assets are too high for SSI, you may still qualify for other Medi-Cal categories.

Who is eligible for Medi-Cal in California 2023?

Note: Most consumers up to 138% FPL will be eligible for Medi-Cal. If ineligible for Medi-Cal, consumers may qualify for a Covered California health plan with financial help including: federal premium tax credit, Silver (94, 87, 73) plans and Zero Cost Sharing and Limited Cost Sharing AIAN plans.

What happens if you don't report changes to Medi-Cal?

Additionally, if you don't report your income change within the required time frame, it may affect what you're eligible for in terms of savings and coverage. Essentially, the amount you earn directly impacts the amount you pay for your health insurance plan.

Do I need to report income change to Medi-Cal?

You must report changes to Covered California within 30 days. For Medi-Cal, you must report it within 10 days. To report changes, call Covered California at (800) 300-1506 or sign in to your online account.

What do you have to report to Medi-Cal?

You must give income and tax filing status information for everyone who is in your family and is on your tax return. You also may need to give information about your property. You do not have to file taxes to qualify for Medi-Cal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mc 219 form to be eSigned by others?

Once your mc 219 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get mc 219 form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mc 219 form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit mc 219 form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share mc 219 form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is mc 219?

MC 219 is a form used for reporting miscellaneous information related to certain tax filings, often associated with the Internal Revenue Service.

Who is required to file mc 219?

Individuals or entities that meet specific reporting criteria set by the IRS are required to file MC 219.

How to fill out mc 219?

To fill out MC 219, you need to provide the required personal and financial information as outlined in the instructions provided by the IRS, ensuring all sections are completed accurately.

What is the purpose of mc 219?

The purpose of MC 219 is to collect necessary information for tax reporting, ensuring compliance with IRS regulations.

What information must be reported on mc 219?

Information reported on MC 219 typically includes details such as taxpayer identification numbers, income figures, and other relevant financial data required for tax reporting.

Fill out your mc 219 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mc 219 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.