KS K-BEN 3117 2022-2025 free printable template

Show details

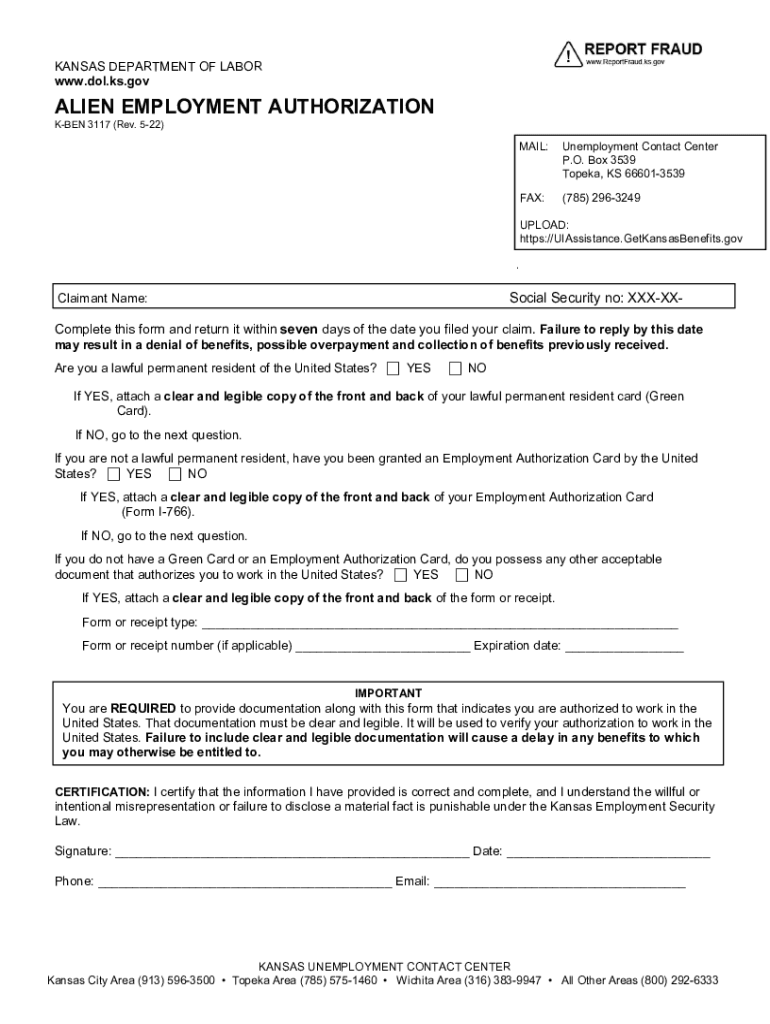

KANSAS DEPARTMENT OF LABOR

www.dol.ks.govALIEN EMPLOYMENT AUTHORIZATIONKBEN 3117 (Rev. 522)MAIL:Unemployment Contact Center

P.O. Box 3539

Topeka, KS 666013539FAX:(785) 2963249UPLOAD:

https://UIAssistance.GetKansasBenefits.gov.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS K-BEN 3117

Edit your KS K-BEN 3117 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS K-BEN 3117 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS K-BEN 3117 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KS K-BEN 3117. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-BEN 3117 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS K-BEN 3117

How to fill out KS K-BEN 3117

01

Obtain the KS K-BEN 3117 form from the official website or your local tax office.

02

Start by filling in your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide information about your income sources relevant to the form.

04

Fill out any sections that apply to your tax situation, such as deductions or credits.

05

Review the instructions for each section to ensure all required information is provided.

06

Double-check all entered values for accuracy and completeness.

07

Sign and date the form at the indicated section.

08

Submit the completed form according to the instructions (online or by mail).

Who needs KS K-BEN 3117?

01

Individuals and businesses in Kansas who need to report specific income or claim tax benefits.

02

Taxpayers who are required to disclose certain financial information for state tax purposes.

03

Professionals and consultants offering services in fields that demand compliance with Kansas economic regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of form 8840?

Use Form 8840 to claim the closer connection to a foreign country(ies) exception to the substantial presence test. The exception is described later and in Regulations section 301.7701(b)-2.

When should you file a closer connection?

If your TOTAL DAYS is 183 days or more you should file the IRS Form 8840. The filing deadline for IRS Form 8840 - also known as the Closer Connection Exemption - is June 15 for the previous calendar year.

What is Form 8840 for Canadian snowbirds?

For tax purposes, any Canadian who spends roughly four months or more in the U.S. each calendar year should annually file the IRS Form 8840 Closer Connection Form. It is the only simple way to be treated as a non-resident and avoid needing to file a US tax return.

Who should fill out form 8840?

Who Should File Form 8840? Canadian snowbirds and those who spend a fair amount of time in the U.S. should assess whether they should be filing Form 8840. Even those who spend less than 122 days in a given year should consider filing Form 8840 as a safeguard measure.

What form do I need to file as a resident alien?

Resident aliens must follow the same tax laws as U.S. citizens. If you're a resident alien, you must report your worldwide income from all sources, that is, income from both within and outside the United States. You'll file a Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

What is a 8840 used for?

Use Form 8840 to claim the closer connection to a foreign country(ies) exception to the substantial presence test.

Do I need form 8840?

Form 8840: The Form 8840 is an International Tax Form that is used as an IRS exception to the substantial presence test. When a person is neither a U.S. citizen nor legal permanent resident, they are typically not subject to tax and reporting on their worldwide income — because they are not a U.S. Person.

Can a Form 8840 be filed late?

If you do not timely file Form 8840, Closer Connection Exception Statement for Aliens, you cannot claim the closer connection exception to the substantial presence test, unless you can show by clear and convincing evidence that you took reasonable actions to become aware of the filing requirements and significant steps

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS K-BEN 3117 directly from Gmail?

KS K-BEN 3117 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the KS K-BEN 3117 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your KS K-BEN 3117 in seconds.

How can I edit KS K-BEN 3117 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit KS K-BEN 3117.

What is KS K-BEN 3117?

KS K-BEN 3117 is a form used by the Kansas Department of Revenue to report certain information related to taxes or business entities in the state of Kansas.

Who is required to file KS K-BEN 3117?

Businesses and individuals who are registered in Kansas and meet specific criteria related to tax obligations or business activities may be required to file KS K-BEN 3117.

How to fill out KS K-BEN 3117?

To fill out KS K-BEN 3117, provide accurate and complete information as requested in the form, including personal or business details, financial information, and any required signatures.

What is the purpose of KS K-BEN 3117?

The purpose of KS K-BEN 3117 is to ensure compliance with state tax regulations and to collect necessary information for tax administration and reporting.

What information must be reported on KS K-BEN 3117?

The information that must be reported on KS K-BEN 3117 typically includes identification details of the filer, financial information relevant to tax calculation, and any additional documentation as specified by the form instructions.

Fill out your KS K-BEN 3117 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS K-BEN 3117 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.