SC Berkeley County Application Special Assessment 2012-2026 free printable template

Show details

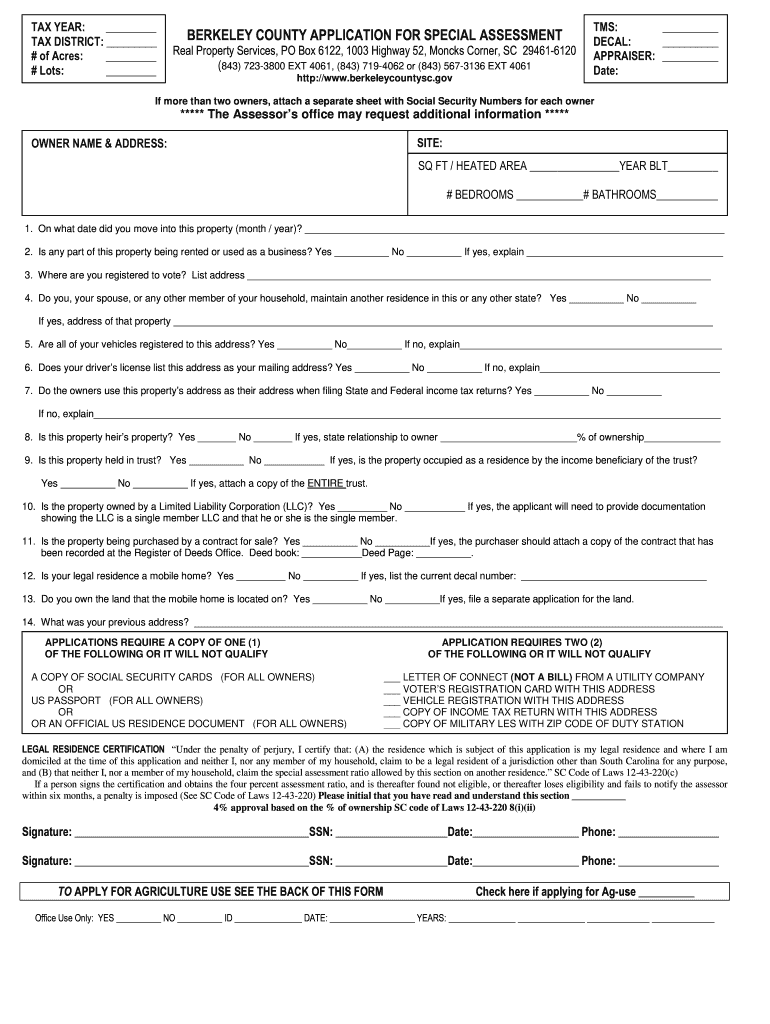

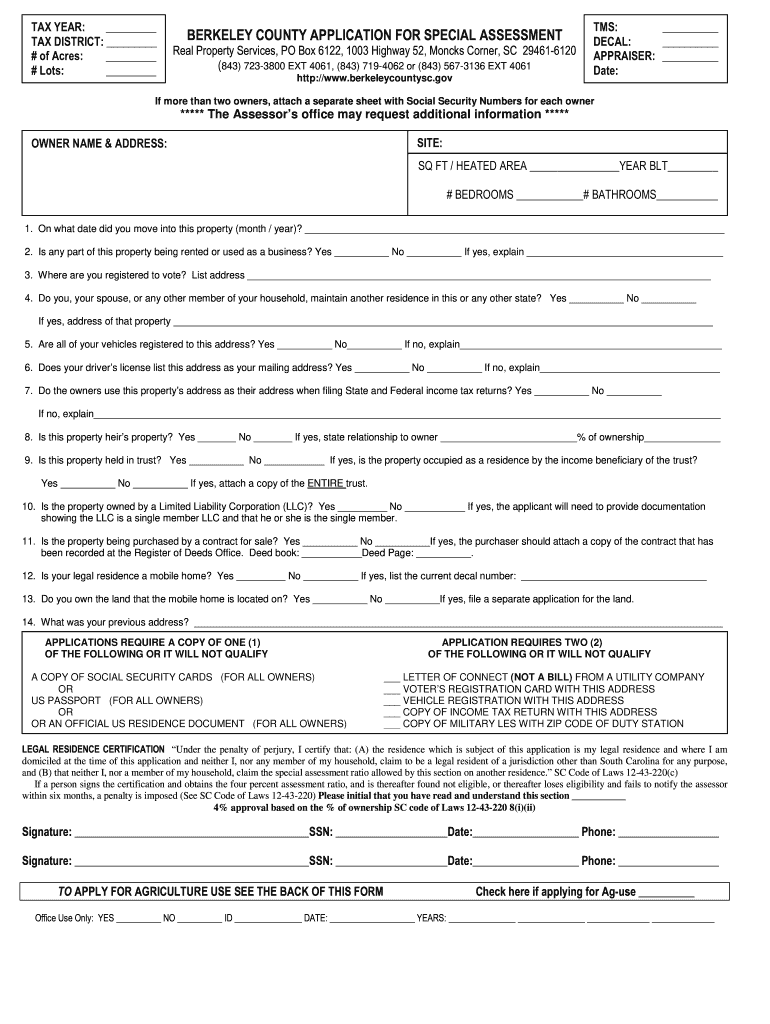

12-43-220 c 1 To qualify for the special property tax assessment ratio allowed by this item the owner-occupant must have actually owned and occupied the residence as application required by this term. 12-43-220 c 2 i. TAX YEAR TAX DISTRICT of Acres Lots BERKELEY COUNTY APPLICATION FOR SPECIAL ASSESSMENT Real Property Services PO Box 6122 1003 Highway 52 Moncks Corner SC 29461-6120 843 723-3800 EXT 4061 843 719-4062 or 843 567-3136 EXT 4061 http //www. South Carolina Code of Regulations...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC Berkeley County Application Special Assessment

Edit your SC Berkeley County Application Special Assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC Berkeley County Application Special Assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC Berkeley County Application Special Assessment online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SC Berkeley County Application Special Assessment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out SC Berkeley County Application Special Assessment

To fill out the SC Berkeley County assessment, follow these steps:

01

Start by gathering all the necessary documents and information related to your property. This may include property deeds, recent tax statements, and any other relevant paperwork.

02

Access the online portal provided by Berkeley County or visit the nearest county office to obtain a physical copy of the assessment form.

03

Begin filling out the assessment form by providing your personal details such as name, address, and contact information. Make sure all the information is accurate and up-to-date.

04

Proceed to the property information section where you will need to provide specific details about your property. This may include details such as the size of the property, any improvements made, and its current condition.

05

Next, you may need to answer questions regarding the property's usage, such as whether it is used for residential or commercial purposes.

06

If there have been any changes or updates to your property since the previous assessment, make sure to include them in the appropriate sections. This may include renovations, additions, or changes in ownership.

07

As you complete each section of the assessment, double-check all the information for accuracy and completeness. Providing precise information is crucial to ensure a fair assessment.

08

Once you have filled out all the necessary sections of the assessment form, review it one final time to make sure there are no errors or omissions.

09

If you are filling out a physical copy of the form, make a photocopy of the completed assessment for your records.

10

Finally, submit the completed assessment form through the designated method specified by Berkeley County. This may include mailing it, submitting it online, or delivering it in person.

Who needs the SC Berkeley County assessment?

01

Property owners in Berkeley County, South Carolina are required to complete the SC Berkeley County assessment.

02

Those who have made changes or improvements to their property since the last assessment need to update the information through the assessment form.

03

Anyone who has recently acquired a property within Berkeley County will also need to fill out the assessment to ensure accurate property valuation for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Is Berkeley County Real Property 4%?

Berkeley County Launches Online Applications for 4% Property Tax Assessment. MONCKS CORNER, S.C. – (Monday, May 4, 2020) — Berkeley County Government's Real Property Services Department will start accepting 4% Legal Residence and 4% Agricultural Use applications online starting today, Monday, May 4, 2020.

What is the property tax rate in Berkeley County SC?

The average effective property tax rate in Berkeley County is 0.68%, which is slightly lower than the state average and about half of the national average. The largest recipient of property tax revenues in the county is local school districts. The Berkeley School District mill rate is about 225 mills.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

What is an assessment notice SC?

Assessment notices must be sent to the person listed as property owner as of December 31 of the prior year. The assessment notice includes the market value, the new assessment value, the assessment ratio, number of acres or lots, location of property, tax map number and the appeals procedure.

Is Berkeley County real property 4%?

Berkeley County Launches Online Applications for 4% Property Tax Assessment. MONCKS CORNER, S.C. – (Monday, May 4, 2020) — Berkeley County Government's Real Property Services Department will start accepting 4% Legal Residence and 4% Agricultural Use applications online starting today, Monday, May 4, 2020.

What is the tax assessment rate in Berkeley County?

Assessment Ratio Home (legal residence) 4% Second Home (for any residential property where you do not live) 6% Agriculture real property (private owned) 4%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send SC Berkeley County Application Special Assessment to be eSigned by others?

Once your SC Berkeley County Application Special Assessment is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit SC Berkeley County Application Special Assessment online?

With pdfFiller, it's easy to make changes. Open your SC Berkeley County Application Special Assessment in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit SC Berkeley County Application Special Assessment on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing SC Berkeley County Application Special Assessment.

What is sc berkeley county assessment?

The sc berkeley county assessment is a process conducted in Berkeley County, South Carolina to determine the value of properties for tax purposes.

Who is required to file sc berkeley county assessment?

Property owners in Berkeley County, South Carolina are required to file the sc berkeley county assessment.

How to fill out sc berkeley county assessment?

To fill out the sc berkeley county assessment, property owners must provide information about their property, including its characteristics, value, and any relevant exemptions.

What is the purpose of sc berkeley county assessment?

The purpose of the sc berkeley county assessment is to fairly and accurately determine the value of properties for tax assessment purposes in Berkeley County, South Carolina.

What information must be reported on sc berkeley county assessment?

On the sc berkeley county assessment, property owners must report information about their property's characteristics, such as size, location, improvements, and any relevant exemptions.

Fill out your SC Berkeley County Application Special Assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC Berkeley County Application Special Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.