Get the free Independent Contractor vs. Employee Classification Check List

Show details

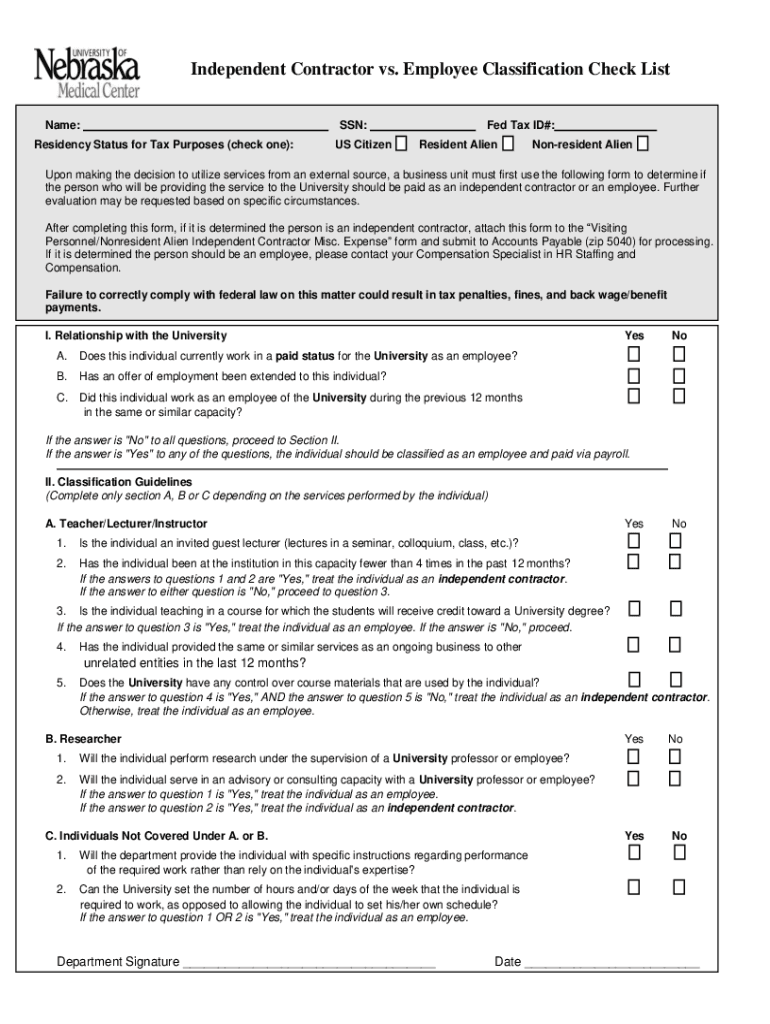

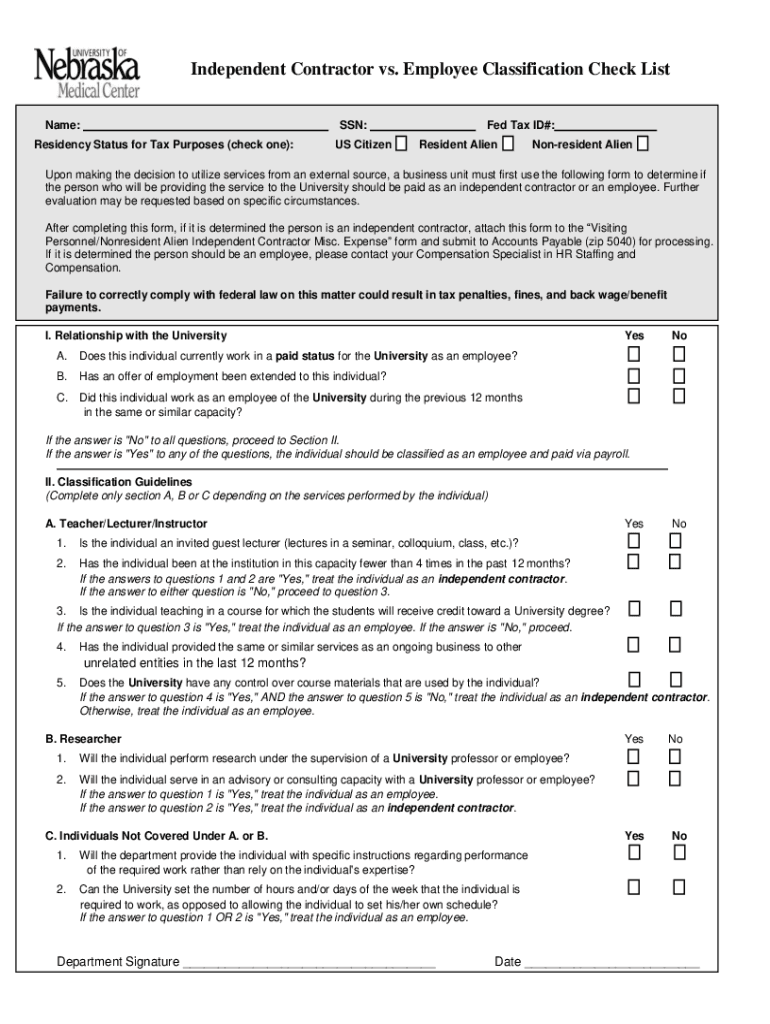

Independent Contractor vs. Employee Classification Check List Name:SSN:Residency Status for Tax Purposes (check one):US Citizen Fed Tax ID#: Resident AlienNonresident Alienation making the decision

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor vs employee

Edit your independent contractor vs employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor vs employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contractor vs employee online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit independent contractor vs employee. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor vs employee

How to fill out independent contractor vs employee

01

Determine the nature of the work: Analyze the tasks that need to be performed and decide if the worker will be providing services as an independent contractor or as an employee.

02

Review legal requirements: Familiarize yourself with the laws and regulations related to independent contractors and employees in your country or state. This will help ensure you are abiding by the correct classification.

03

Draft a contract: If hiring an independent contractor, create a legally binding contract that outlines the terms of the engagement. Specify the scope of work, payment terms, and any other relevant details.

04

Collect necessary documentation: Obtain any required documents or forms from the independent contractor or employee, such as tax forms or proof of eligibility to work.

05

Maintain proper records: Keep thorough records of the services performed and payments made to the independent contractor or employee. This will be important for tax purposes and legal compliance.

06

Regularly review the classification: Revisit the classification periodically to ensure it is still accurate. Work dynamics may change, so it's crucial to stay updated on the worker's status.

Who needs independent contractor vs employee?

01

Businesses or individuals that require specialized skills for short-term projects may choose to hire independent contractors. This includes companies in industries like IT, graphic design, consulting, and construction. Independent contractors offer flexibility and specific expertise without the need for long-term employment.

02

On the other hand, businesses with consistent, ongoing needs may opt to hire employees. Employees provide a longer commitment and can be managed more directly. Industries such as retail, hospitality, healthcare, and manufacturing often rely heavily on employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit independent contractor vs employee from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your independent contractor vs employee into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get independent contractor vs employee?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the independent contractor vs employee in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I fill out independent contractor vs employee on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your independent contractor vs employee. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is independent contractor vs employee?

Independent contractors are typically self-employed individuals who work on a project basis and are not considered employees of a company, while employees are individuals who work directly for a company and are subject to its rules and regulations.

Who is required to file independent contractor vs employee?

Employers are required to classify workers as either independent contractors or employees and file the appropriate tax forms.

How to fill out independent contractor vs employee?

To fill out independent contractor vs employee, employers must gather information about the worker's relationship with the company, including factors such as control over work and financial arrangements.

What is the purpose of independent contractor vs employee?

The purpose of independent contractor vs employee classification is to determine how a worker should be treated for tax and legal purposes, including eligibility for benefits and protection under labor laws.

What information must be reported on independent contractor vs employee?

Information reported on independent contractor vs employee includes worker's name, Social Security number, earnings, and tax deductions.

Fill out your independent contractor vs employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Vs Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.