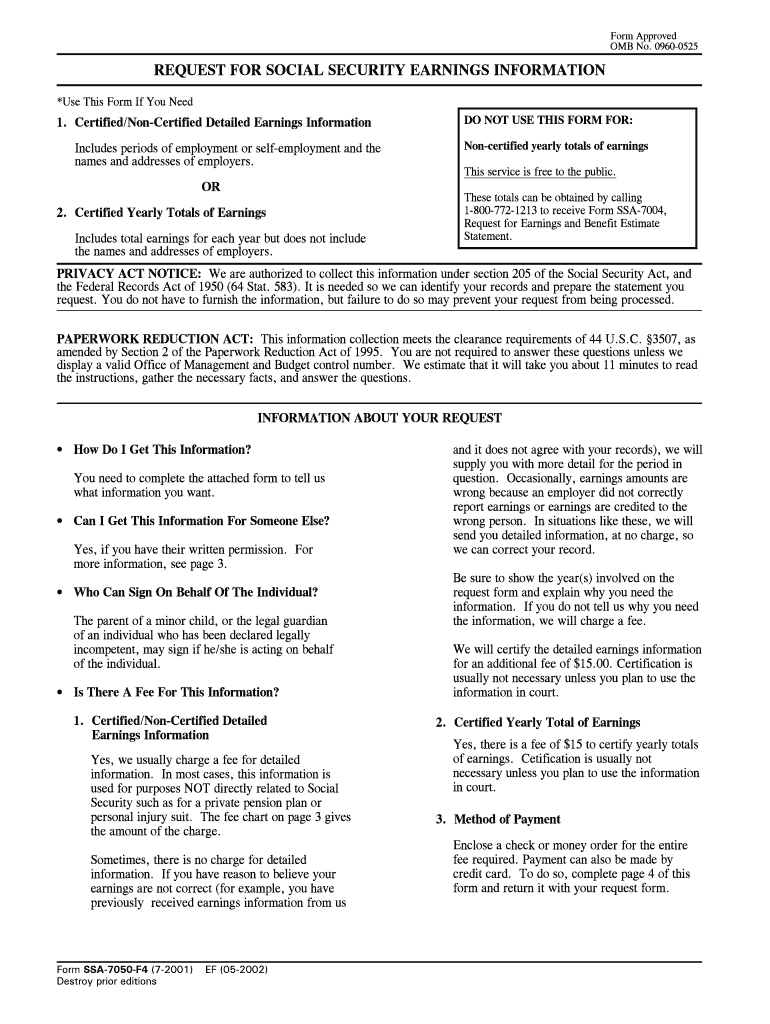

Who needs an SSA Form 7050-F4?

An individual taxpayer should file Form SSA-7050-F4 in case they want to obtain an itemized earnings statement (either certified or noncertified, including the names of employers) or certified yearly earnings totals, providing no employment details, only the earnings.

The full name of Form SSA-7050-F4 is Request for Social Security Earnings Information.

What is Form SSA-7050-F4 for?

The Request for Social Security Earnings Information is obligatory to be filled out to inform the Social Security Administration of a taxpayer’s desire to obtain an in-depth statement of their employment records. This form is also to be filed if an individual is willing to receive other person's earning statement (in case they are entitled to do so).

The information requested can be helpful in terms of allowing the taxpayer to estimate their future retirement or disability benefits, or to estimate their Social Security and Medicare taxes that were paid.

Is Request for Social Security Earnings Information accompanied by other forms?

There is no need to support the Request for Social Security Earnings Information by any other documents unless the filer of the form is not requesting their earnings statement or yearly earnings totals.

The filer should not forget that there is a fee that must be paid for the request, the details can be seen here1.

When is Form SSA-7050-F4 due?

The submission of the SSA-7050-F4 does not imply following any strict deadlines, yet the applicant should be aware of the timeframe within which the SSA can accomplish gathering all the requested information. Typically, a filer should expect the SSA to be preparing the response for up to four months.

How do I fill out Request for Social Security Earnings Information?

The properly completed SSA Form 7050-F4 implies indicating the following information:

- The full name of the person whose earnings information is being requested

- Social Security Number

- Date of Birth

- Type of information needed

- The recipient (if different from the applicant)

- Authorization by the applicant or their legal guardian

- Payment details

Where do I send Form SSA-7050-F4?

The completed form must be filed with the SSA; the address depends on whether the applicant turned to a private contractor for help. Both of the relevant addresses are indicated in the text of the form on Page 4.

1check the link — https://www.ssa.gov/forms/ssa-7050.html