Get the free Request to Add Loans to a Federal Consolidation Loan - floridastudentfinancialaid

Show details

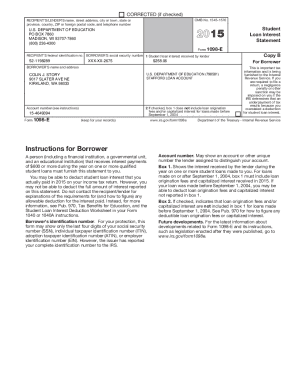

This form is used to request that a consolidating lender add eligible education loans that were not originally included in a Federal Consolidation Loan, within 180 days of loan disbursement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request to add loans

Edit your request to add loans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request to add loans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request to add loans online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit request to add loans. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request to add loans

How to fill out Request to Add Loans to a Federal Consolidation Loan

01

Obtain the Request to Add Loans to a Federal Consolidation Loan form from the Federal Student Aid website or your loan servicer.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Gather all necessary information about the loans you wish to add, including lender names, original loan amounts, and account numbers.

04

Fill out the form with your personal information, including your name, Social Security number, and contact details.

05

Complete the sections indicating the loans you want to consolidate, including the requested details.

06

Review the completed form for accuracy and ensure all necessary documentation is included.

07

Sign and date the form.

08

Submit the form to your loan servicer using their specified submission method (mail, fax, or online portal).

Who needs Request to Add Loans to a Federal Consolidation Loan?

01

Borrowers who have existing federal student loans and wish to consolidate them for easier management or to secure lower interest rates.

02

Individuals looking to defer payments or adjust the terms of their federal loans through consolidation.

Fill

form

: Try Risk Free

People Also Ask about

Can you get a second consolidation loan?

You can have more than one debt consolidation loan at a time, but you'll need to follow your lender's guidelines. Some lenders limit the number of loans you can have at one time, or how soon you can apply for a second loan after receiving the funds from the first.

Can you put 2 loans together?

A debt consolidation loan is a way to combine all your debts - credit card, personal loans, store card etc. - into one loan so you'll be making repayments in the one place. It means that you can take a breath and take back some control.

Can you add a loan to a consolidated loan?

If you want to add loans to your Direct Consolidation Loan application, you may do so within 180 days of when your new consolidation loan is made without having to submit a new Direct Consolidation Loan application. Contact your consolidation loan servicer for more information.

Can you combine federal loans?

A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan for the purpose of lowering your monthly payment amount or gaining access to federal forgiveness programs.

Does federal student loan consolidation hurt your credit?

Consolidating your federal loans has little direct effect on your score over the long term. Its effect on your age of credit accounts might temporarily lower your score. However, if consolidating means securing a lower, more manageable payment or unlocking federal benefits, the impact on your credit might be worth it.

Can I combine my federal student loans?

A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan for the purpose of lowering your monthly payment amount or gaining access to federal forgiveness programs.

Is there a downside to consolidating loans?

Consolidation has potential downsides, too: Because consolidation can lengthen your repayment period, you'll likely pay more in interest over the long run.

Can I combine all my loans into one?

Debt consolidation allows you to club all your smaller loans into one. Be it an outstanding bill of your credit card or a loan you take for your business, you can make repayment of all your debts into one by consolidating them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request to Add Loans to a Federal Consolidation Loan?

The Request to Add Loans to a Federal Consolidation Loan is a form that allows borrowers to include additional federal student loans into their existing federal consolidation loan.

Who is required to file Request to Add Loans to a Federal Consolidation Loan?

Borrowers who have an existing federal consolidation loan and wish to include newly eligible federal student loans must file the Request to Add Loans to a Federal Consolidation Loan.

How to fill out Request to Add Loans to a Federal Consolidation Loan?

To fill out the Request to Add Loans to a Federal Consolidation Loan, borrowers need to provide personal information, the loan numbers of the additional loans they wish to add, and other relevant details as specified in the form.

What is the purpose of Request to Add Loans to a Federal Consolidation Loan?

The purpose of the Request to Add Loans to a Federal Consolidation Loan is to streamline a borrower's repayment process by consolidating multiple federal loans into one single loan with a potentially lower interest rate.

What information must be reported on Request to Add Loans to a Federal Consolidation Loan?

The information that must be reported includes the borrower's name, address, loan numbers of the loans being added, and the names of the loan servicers for those loans.

Fill out your request to add loans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request To Add Loans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.